Answered step by step

Verified Expert Solution

Question

1 Approved Answer

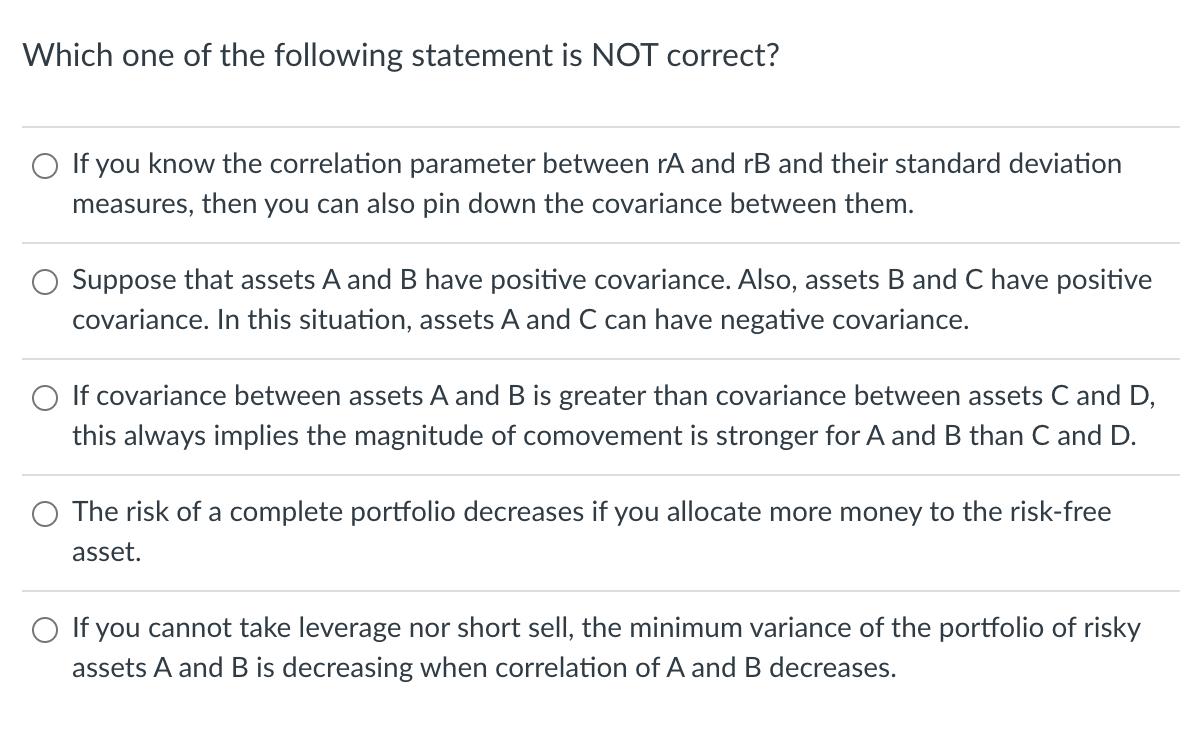

Which one of the following statement is NOT correct? O If you know the correlation parameter between rA and rB and their standard deviation

Which one of the following statement is NOT correct? O If you know the correlation parameter between rA and rB and their standard deviation measures, then you can also pin down the covariance between them. Suppose that assets A and B have positive covariance. Also, assets B and C have positive covariance. In this situation, assets A and C can have negative covariance. If covariance between assets A and B is greater than covariance between assets C and D, this always implies the magnitude of comovement is stronger for A and B than C and D. O The risk of a complete portfolio decreases if you allocate more money to the risk-free asset. If you cannot take leverage nor short sell, the minimum variance of the portfolio of risky assets A and B is decreasing when correlation of A and B decreases.

Step by Step Solution

★★★★★

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below The statement that is NOT correct ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started