Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have recently joined a boutique advisory firm in Perth. You are tasked to complete a valuation for a small company, the ABC. A

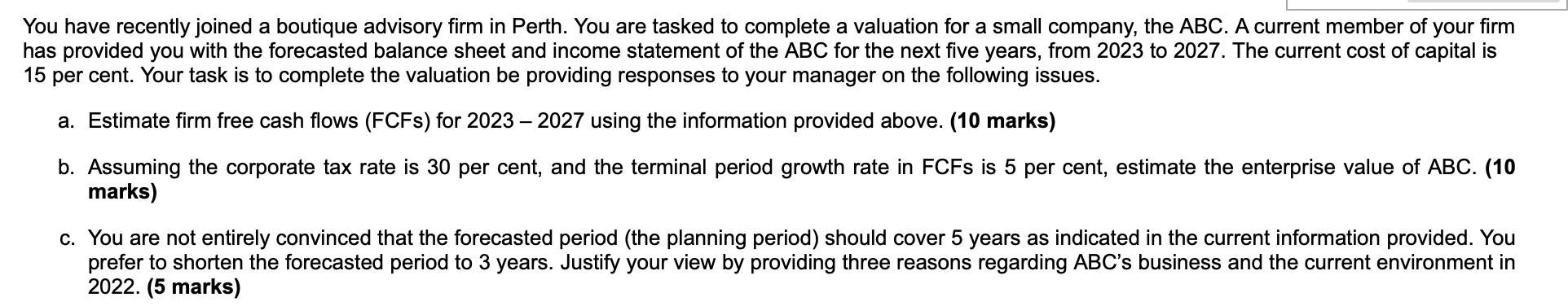

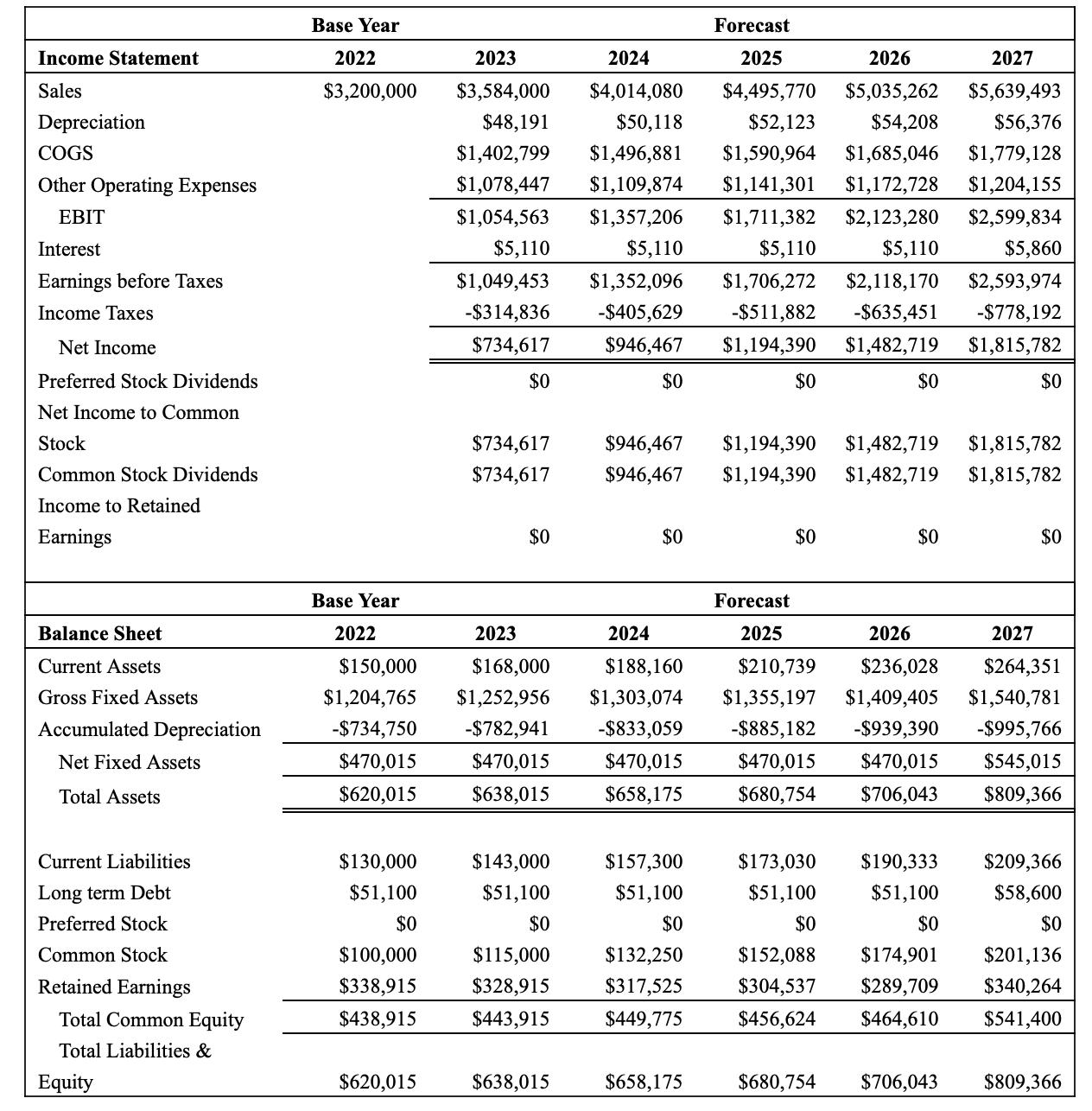

You have recently joined a boutique advisory firm in Perth. You are tasked to complete a valuation for a small company, the ABC. A current member of your firm has provided you with the forecasted balance sheet and income statement of the ABC for the next five years, from 2023 to 2027. The current cost of capital is 15 per cent. Your task is to complete the valuation be providing responses to your manager on the following issues. a. Estimate firm free cash flows (FCFS) for 2023 2027 using the information provided above. (10 marks) b. Assuming the corporate tax rate is 30 per cent, and the terminal period growth rate in FCFs is 5 per cent, estimate the enterprise value of ABC. (10 marks) c. You are not entirely convinced that the forecasted period (the planning period) should cover 5 years as indicated in the current information provided. You prefer to shorten the forecasted period to 3 years. Justify your view by providing three reasons regarding ABC's business and the current environment in 2022. (5 marks) Income Statement Sales Depreciation COGS Other Operating Expenses EBIT Interest Earnings before Taxes Income Taxes Net Income Preferred Stock Dividends Net Income to Common Stock Common Stock Dividends Income to Retained Earnings Balance Sheet Current Assets Gross Fixed Assets Accumulated Depreciation Net Fixed Assets Total Assets Current Liabilities Long term Debt Preferred Stock Common Stock Retained Earnings Total Common Equity Total Liabilities & Equity Base Year 2022 $3,200,000 Base Year 2022 $150,000 $1,204,765 -$734,750 $470,015 $620,015 $130,000 $51,100 $0 $100,000 $338,915 $438,915 $620,015 2023 2024 $3,584,000 $4,014,080 $48,191 $50,118 $1,402,799 $1,496,881 $1,078,447 $1,109,874 $1,054,563 $1,357,206 $5,110 $5,110 $1,049,453 $1,352,096 -$314,836 -$405,629 $734,617 $946,467 $0 $0 $734,617 $734,617 $0 $143,000 $51,100 $0 2023 2024 $168,000 $188,160 $1,252,956 $1,303,074 -$782,941 -$833,059 $470,015 $470,015 $638,015 $658,175 $115,000 $328,915 $443,915 $946,467 $946,467 $638,015 $0 $157,300 $51,100 $0 $132,250 $317,525 $449,775 $658,175 Forecast 2025 2026 2027 $4,495,770 $5,035,262 $5,639,493 $54,208 $56,376 $52,123 $1,590,964 $1,685,046 $1,779,128 $1,141,301 $1,172,728 $1,204,155 $1,711,382 $2,123,280 $2,599,834 $5,110 $5,110 $5,860 $1,706,272 $2,118,170 $2,593,974 -$511,882 -$635,451 -$778,192 $1,194,390 $1,482,719 $1,815,782 $0 Forecast 2025 $1,194,390 $1,482,719 $1,194,390 $1,482,719 $0 $0 $173,030 $51,100 $0 $0 $190,333 $51,100 $0 2026 2027 $210,739 $236,028 $264,351 $1,355,197 $1,409,405 $1,540,781 -$885,182 -$939,390 -$995,766 $470,015 $470,015 $545,015 $680,754 $706,043 $809,366 $152,088 $174,901 $304,537 $289,709 $456,624 $464,610 $0 $680,754 $706,043 $1,815,782 $1,815,782 $0 $209,366 $58,600 $0 $201,136 $340,264 $541,400 $809,366

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started