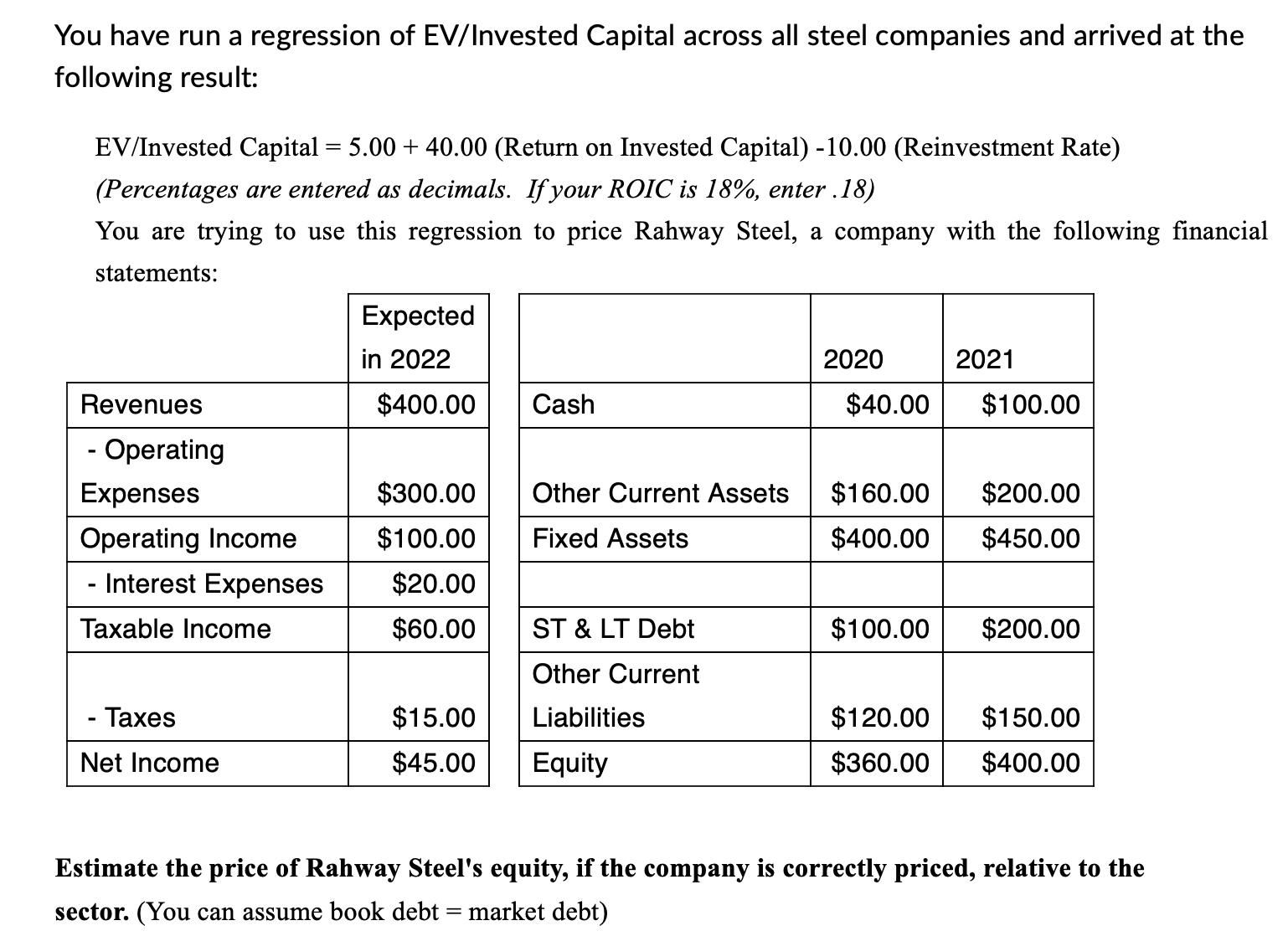

You have run a regression of EV/Invested Capital across all steel companies and arrived at the following result: EV/Invested Capital = 5.00 + 40.00

You have run a regression of EV/Invested Capital across all steel companies and arrived at the following result: EV/Invested Capital = 5.00 + 40.00 (Return on Invested Capital) -10.00 (Reinvestment Rate) (Percentages are entered as decimals. If your ROIC is 18%, enter .18) You are trying to use this regression to price Rahway Steel, a company with the following financial statements: Expected in 2022 $400.00 Cash 2020 2021 $40.00 $100.00 Revenues - Operating Expenses $300.00 Other Current Assets $160.00 $200.00 Operating Income $100.00 Fixed Assets $400.00 $450.00 - Interest Expenses $20.00 Taxable Income $60.00 ST & LT Debt $100.00 $200.00 Other Current - Taxes $15.00 Liabilities $120.00 $150.00 Net Income $45.00 Equity $360.00 $400.00 Estimate the price of Rahway Steel's equity, if the company is correctly priced, relative to the sector. (You can assume book debt = market debt)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To estimate the price of Rahway Steels equity using the regression model provided we first ne...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started