Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have secured a loan from PNC Bank for two years to build a new business location. The terms of the loan are that

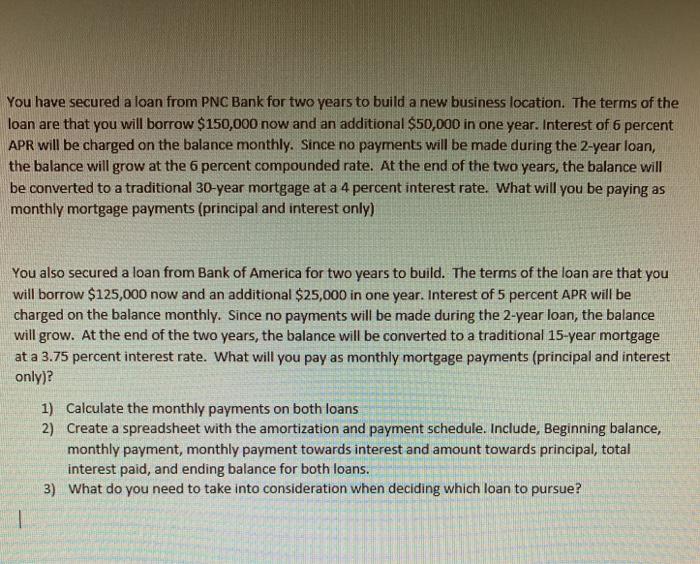

You have secured a loan from PNC Bank for two years to build a new business location. The terms of the loan are that you will borrow $150,000 now and an additional $50,000 in one year. Interest of 6 percent APR will be charged on the balance monthly. Since no payments will be made during the 2-year loan, the balance will grow at the 6 percent compounded rate. At the end of the two years, the balance will be converted to a traditional 30-year mortgage at a 4 percent interest rate. What will you be paying as monthly mortgage payments (principal and interest only) You also secured a loan from Bank of America for two years to build. The terms of the loan are that you will borrow $125,000 now and an additional $25,000 in one year. Interest of 5 percent APR will be charged on the balance monthly. Since no payments will be made during the 2-year loan, the balance will grow. At the end of the two years, the balance will be converted to a traditional 15-year mortgage at a 3.75 percent interest rate. What will you pay as monthly mortgage payments (principal and interest only)? 1) Calculate the monthly payments on both loans 2) Create a spreadsheet with the amortization and payment schedule. Include, Beginning balance, monthly payment, monthly payment towards interest and amount towards principal, total interest paid, and ending balance for both loans. 3) What do you need to take into consideration when deciding which loan to pursue?

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the monthly payments on the loan from PNC Bank we will use the formula for compound interest A P1 rnnt A the future value of the loan P ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started