Question: You have slaved away for four years as an Associate in the real estate group of the prestigious investment banking group Gold in Stacks (

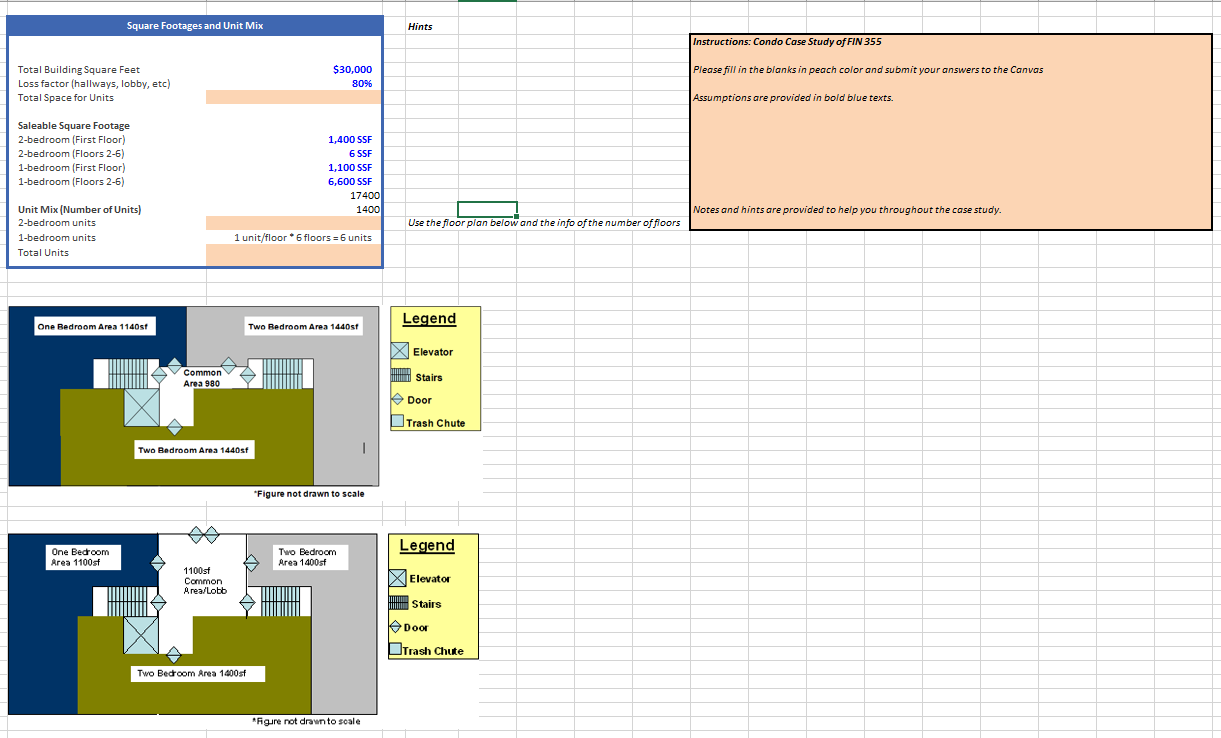

You have slaved away for four years as an Associate in the real estate group of the prestigious investment banking group Gold in Stacks GIS You have been able to accumulate savings of $ and your current lifestyle requires you to make a pretax gross income of $ You have a twoyearold child and a working spouse. Secretly you have always wanted to be your own boss and to build equity with your sweat. One day while walking home you notice an old, abandoned, sixstory office building that is about gross square feet. Intrigued by the building, you do a little homework and conclude: The neighborhood is solid, and is largely owneroccupied high and midrise residential condominiums. A typical condo in the neighborhood is about square feet and sells for $$ You can purchase the property inclusive of transaction costs for $ million. You estimate that if all goes smoothly, you can renovate the property into condos for about $ million in hard and soft costs including interest expense The property is unlikely to support any groundlevel retail. Construction will probably take about one year. Based upon your knowledge of financial markets and equity joint venture deal structures, you believe that: You can get a combined purchase and construction loan secured by the property of LoantoCost, drawn down over the purchase and construction period, subject to all equity going in first. The loan would carry an annual interest rate of payable monthly, accruing until cash coverage exists. The lender will sweep all cash inflows not required for construction and sale of units. The loan would be for a term of three years with no amortization. A private equity fund would be willing to provide the necessary equity; however, they will require you to personally invest of the cash equity, which will be given a subordinated equity position. They will give you a carried equity position on any profits the project earns in excess of an annual projectlevel equity IRR. They will allow you to take a development fee of $ with half paid on a pro rata basis to construction outlays, and the other half retained in a subordinated equity position. Even though half will in fact be paid out during construction, the entire $ amount will be credited to you as carried equity. Though you hate to admit it if you undertake this project, you will have to essentially put all of your savings at risk, and also work on it full time. If youre going to take all of this risk and disrupt your predictable and stable lifestyle, you would require that the project hit a gross development profit margin sale value total development cost This high a margin is also required to get the investor on board, as they typically do not write checks for anything less than $ million in size. Calculating Required Sales Amounts for Achieving a Targeted Profit MarginUnits

SSF SplitSum of above lines

Profit

Total Profits to Parties Total ProjectLevel Profit:

TRUE

Split "Cash Left for Split"

in dollar term

Find the Equity above to derive the dollar term

Find the Equity above to derive the dollar term in dollar term

Dollars from Split

Dollars from Split

Check whether the sum of investorDeveloper splits is equal to projectlevel profit Value should be TRUE if the table is filled in correctly

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock