Question

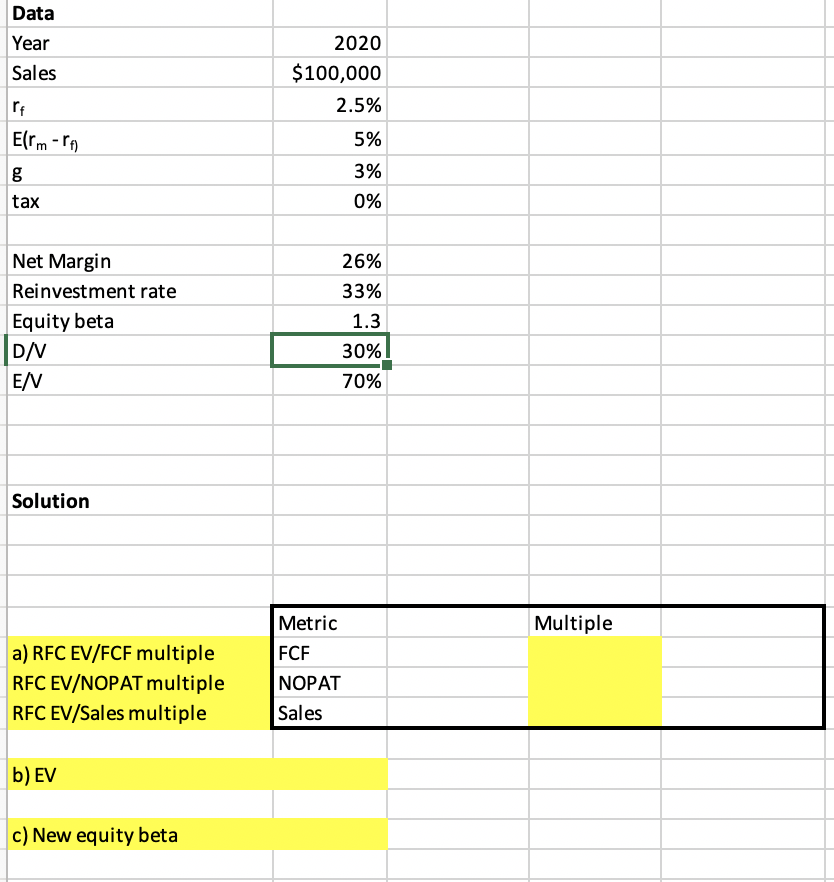

You have the following information about the Kellogg Furniture Company (KFC). Annual sales in 2020 are $100,000. Sales are expected to grow at 3% a

You have the following information about the Kellogg Furniture Company (KFC).

-

Annual sales in 2020 are $100,000. Sales are expected to grow at 3% a year.

-

The cash flows in 2020 have been distributed. The firms enterprise value is evaluated as a claim to its cash

flows starting from 2021.

-

KFCs profit margin is expected to be 26%.

-

Tax rate is 0%.

-

KFC is expected to reinvest 33% of its NOPAT in fixed assets and net working capital.

-

KFC has an equity beta of 1.3.

KFC is financed with 30% debt and 70% equity.

The risk free rate of return is 2.5%, and the expected market risk premium is (m f ) = 5%.

KFCs debt is risk free, with a beta of 0.

Hint: Use asset beta if you are analyzing the cost of capital for the firm.

-

a) (15 points) Calculate KFCs enterprise value (EV) to FCF ratio, EV to NOPAT ratio, and EV to Sales ratio in 2020.

-

b) (5 points) Estimate the current enterprise value of KFC in 2020.

-

c) (10 points) Suppose now (in 2020) the firm adjusts its capital structure. Without changing the underlying cash flows, the firm issues some debt and buys back some equity. Now debt is 50% and equity is 50%. Suppose debt is still risk free and has a beta of 0. What is the beta of new equity?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started