Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same prospects for sales and

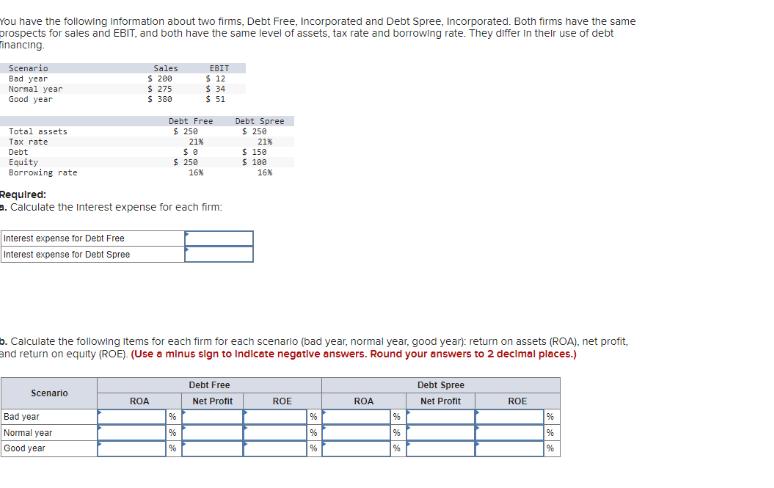

You have the following information about two firms, Debt Free, Incorporated and Debt Spree, Incorporated. Both firms have the same prospects for sales and EBIT, and both have the same level of assets, tax rate and borrowing rate. They differ in their use of debt inancing. Scenario Bad year Normal year Good year Total assets Tax rate Debt Equity Borrowing rate Interest expense for Debt Free Interest expense for Debt Spree Scenario Sales $ 200 $ 275 $ 380 Bad year Normal year Good year ROA Debt Free $ 250 21% se $ 250 Required: a. Calculate the Interest expense for each firm: EBIT $ 12 16% % % % $ 34 $ 51 b. Calculate the following items for each firm for each scenario (bad year, normal year, good year); return on assets (ROA), net profit, and return on equity (ROE). (Use a minus sign to Indicate negative answers. Round your answers to 2 decimal places.) Debt Spree $ 250 Debt Free Net Profit 21% $ 150 $ 100 16% ROE 96 96 % ROA % % % Debt Spree Net Profit ROE 96 96 %

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the interest expense for each firm we need to multiply the debt amount by the borrowing rate Interest expense for Debt Free Interest expe...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started