Answered step by step

Verified Expert Solution

Question

1 Approved Answer

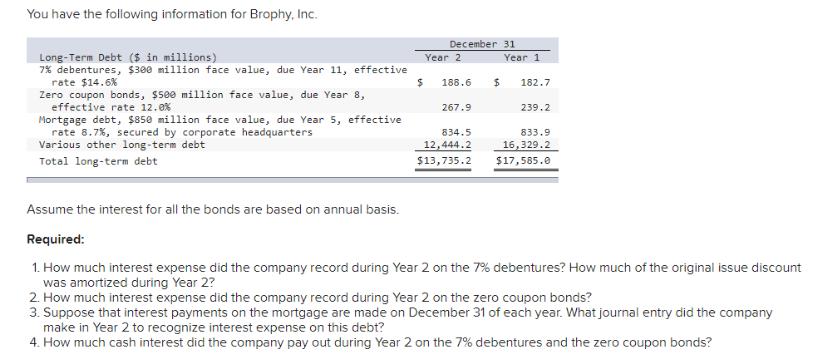

You have the following information for Brophy, Inc. December 31 Long-Term Debt ($ in millions) 7% debentures, $300 million face value, due Year 11,

You have the following information for Brophy, Inc. December 31 Long-Term Debt ($ in millions) 7% debentures, $300 million face value, due Year 11, effective rate $14.6% Zero coupon bonds, $500 million face value, due Year 8, effective rate 12.0% Mortgage debt, $850 million face value, due Year 5, effective rate 8.7%, secured by corporate headquarters Various other long-term debt Year 2 Year 1 186.6 182.7 267.9 239.2 834.5 833.9 12,444.2 16,329.2 Total long-term debt $13,735.2 $17,585.0 Assume the interest for all the bonds are based on annual basis. Required: 1. How much interest expense did the company record during Year 2 on the 7% debentures? How much of the original issue discount was amortized during Year 2? 2. How much interest expense did the company record during Year 2 on the zero coupon bonds? 3. Suppose that interest payments on the mortgage are made on December 31 of each year. What journal entry did the company make in Year 2 to recognize interest expense on this debt? 4. How much cash interest did the company pay out during Year 2 on the 7% debentures and the zero coupon bonds?

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

636140f71039f_234745.pdf

180 KBs PDF File

636140f71039f_234745.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started