Question

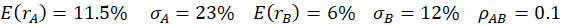

You have the following information for stock portfolio A and bond portfolio B. The risk-free rate is 4.5%. THE optimal risky portfolio, P, has weights

- You have the following information for stock portfolio A and bond portfolio B. The risk-free rate is 4.5%.

THE optimal risky portfolio, P, has weights of 61.69% in A and 38.31% in B and has a standard deviation of 15.35%. What is the expected return of the optimal complete portfolio for an investor with a risk aversion parameter of A = 1.8?

- A producer wants to set up a hedge on its expected November purchase of 60,000 bushels of soybeans using the November soybean futures contract. The current spot price for soybeans is 1105 and the current November soybean futures price is 1176. At delivery in November the soybean spot price is 1130. The producer buys the soybeans in the spot market and closes the soybeans futures position. What is the effective price per bushel the producer pays for the soybeans?

The expected return on the market is 12.0% and the risk-free rate is 4.0%. A stock with a beta of 1.3 has an expected return of 14.4%. Analysts expect the stock to pay a dividend in one year of $5.15 and that the stock price at that time will be $62.20. The current stock price is $59.20. What is the stocks alpha?

E(rA)=11.5%A=23%E(rB)=6%B=12%AB=0.1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started