Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have the following information from the Garry Electrical company about its buildings acquired on January 1, 2018: Buildings acquisition cost Useful life $

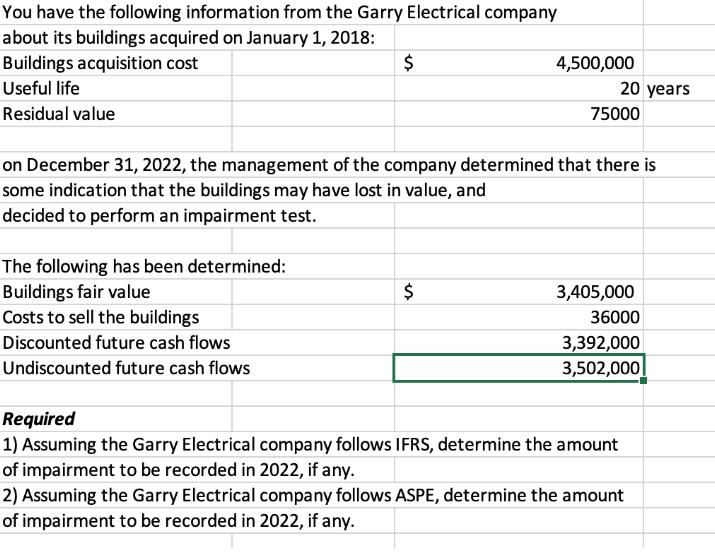

You have the following information from the Garry Electrical company about its buildings acquired on January 1, 2018: Buildings acquisition cost Useful life $ 4,500,000 20 years 75000 Residual value on December 31, 2022, the management of the company determined that there is some indication that the buildings may have lost in value, and decided to perform an impairment test. The following has been determined: Buildings fair value Costs to sell the buildings Discounted future cash flows Undiscounted future cash flows es $ 3,405,000 36000 3,392,000 3,502,000 Required 1) Assuming the Garry Electrical company follows IFRS, determine the amount of impairment to be recorded in 2022, if any. 2) Assuming the Garry Electrical company follows ASPE, determine the amount of impairment to be recorded in 2022, if any.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started