Answered step by step

Verified Expert Solution

Question

1 Approved Answer

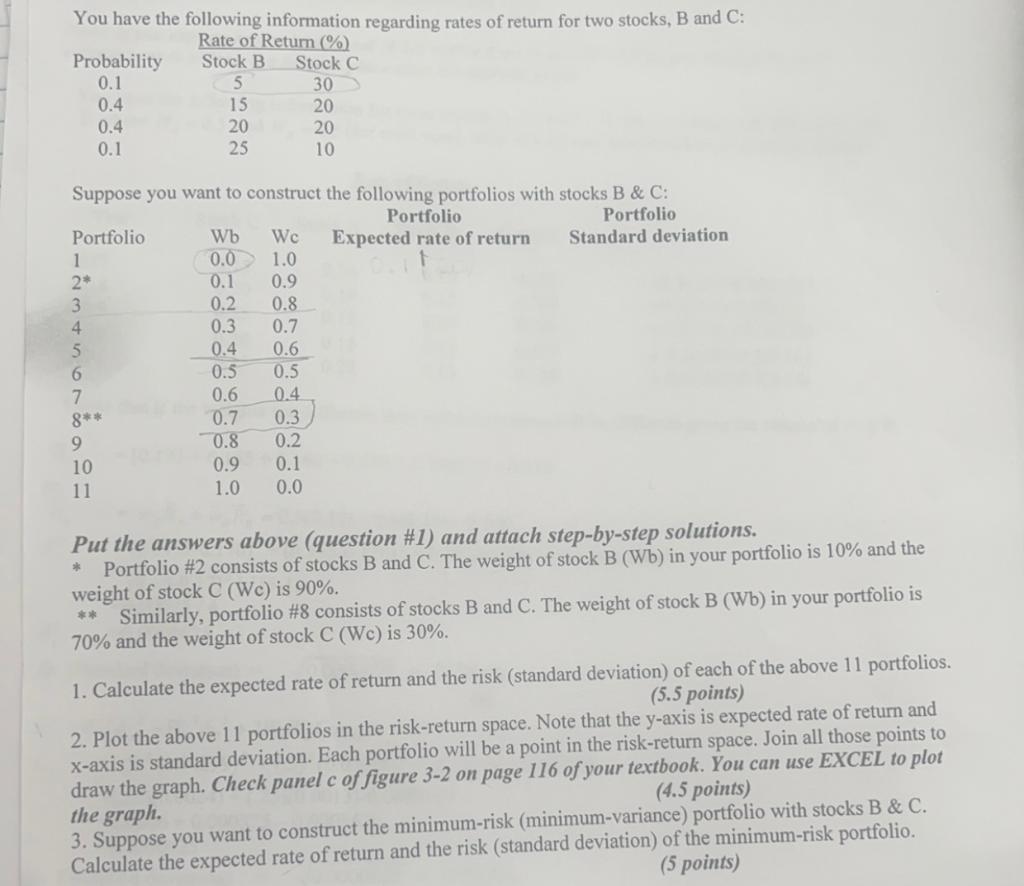

You have the following information regarding rates of return for two stocks, B and C: Rate of Return (%) Stock B Stock C 30

You have the following information regarding rates of return for two stocks, B and C: Rate of Return (%) Stock B Stock C 30 20 20 10 Probability 0.1 0.4 0.4 0.1 5 15 20 25 Suppose you want to construct the following portfolios with stocks B & C: Portfolio Portfolio 1 2* 3 4 5 6 7 8** 9 10 11 Portfolio Wb We Expected rate of return 1.0 0.9 0.0 0.1 0.2 oo 23456789 0.3 0.4 0.5 0.6 0.7 0.8 0.9 1.0 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 Standard deviation Put the answers above (question #1) and attach step-by-step solutions. * Portfolio #2 consists of stocks B and C. The weight of stock B (Wb) in your portfolio is 10% and the weight of stock C (WC) is 90%. ** Similarly, portfolio #8 consists of stocks B and C. The weight of stock B (Wb) in your portfolio is 70% and the weight of stock C (WC) is 30%. 1. Calculate the expected rate of return and the risk (standard deviation) of each of the above 11 portfolios. (5.5 points) 2. Plot the above 11 portfolios in the risk-return space. Note that the y-axis is expected rate of return and x-axis is standard deviation. Each portfolio will be a point in the risk-return space. Join all those points to draw the graph. Check panel c of figure 3-2 on page 116 of your textbook. You can use EXCEL to plot (4.5 points) the graph. 3. Suppose you want to construct the minimum-risk (minimum-variance) portfolio with stocks B & C. Calculate the expected rate of return and the risk (standard deviation) of the minimum-risk portfolio. (5 points)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the expected rate of return and the risk standard deviation of each portfolio we will use the given information on the rates of return fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started