Answered step by step

Verified Expert Solution

Question

1 Approved Answer

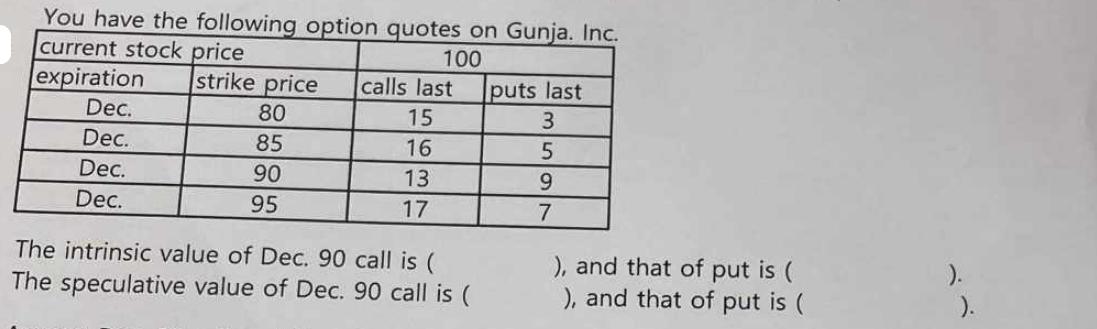

You have the following option quotes on Gunja. Inc. current stock price 100 expiration Dec. Dec. Dec. Dec. strike price calls last 80 15

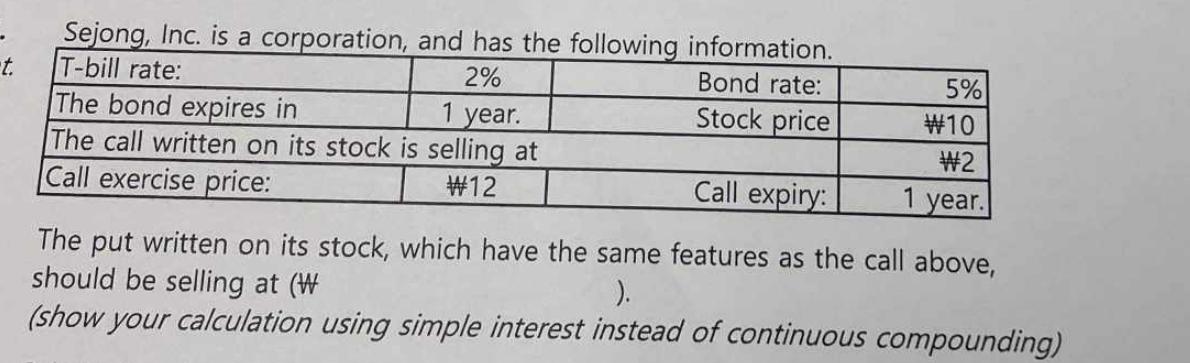

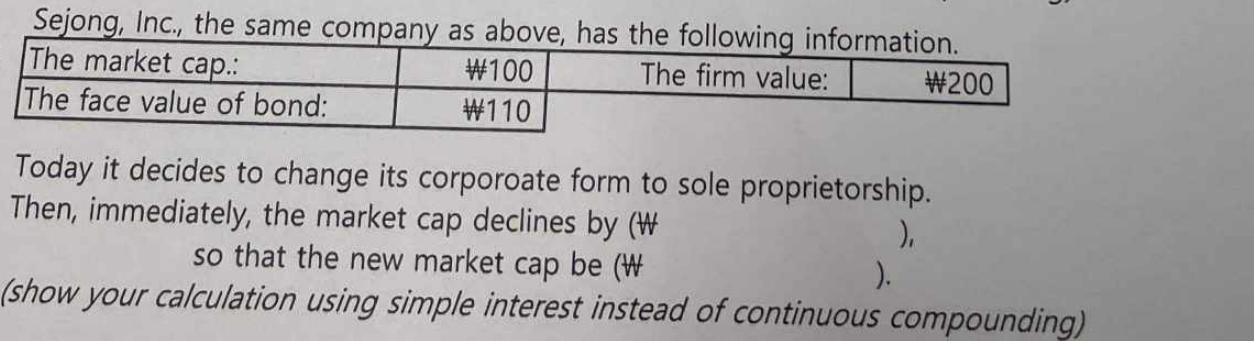

You have the following option quotes on Gunja. Inc. current stock price 100 expiration Dec. Dec. Dec. Dec. strike price calls last 80 15 85 16 90 13 95 17 The intrinsic value of Dec. 90 call is ( The speculative value of Dec. 90 call is ( puts last 3 5 9 7 ), and that of put is ( ), and that of put is ( ). t. Sejong, Inc. is a corporation, and has the following information. T-bill rate: 2% The bond expires in 1 year. The call written on its stock is selling at Call exercise price: #12 Bond rate: Stock price 5% #10 #2 1 year. Call expiry: The put written on its stock, which have the same features as the call above, should be selling at (W ). (show your calculation using simple interest instead of continuous compounding) Sejong, Inc., the same company as above, has the following information. The market cap.: The firm value: #100 The face value of bond: #110 Today it decides to change its corporoate form to sole proprietorship. Then, immediately, the market cap declines by (W so that the new market cap be (W (show your calculation using simple interest instead of continuous compounding) ). #200 ),

Step by Step Solution

★★★★★

3.52 Rating (142 Votes )

There are 3 Steps involved in it

Step: 1

1 Lets calculate the intrinsic and speculative values for the given option quotes on Gunja Inc Given Current stock price 100 For the Dec 90 call optio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started