Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have the opportunity to invest in a riskfree asset and stocks A and B. The riskfree rate is 2%; you can earn 2%

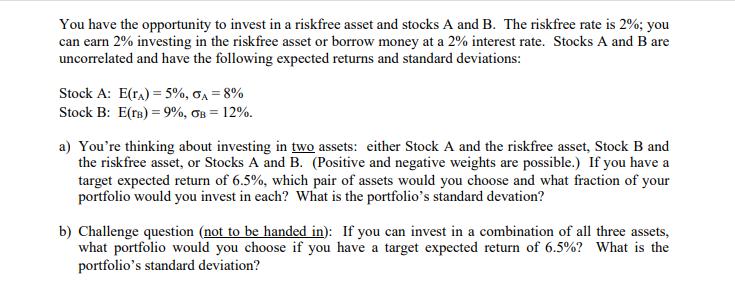

You have the opportunity to invest in a riskfree asset and stocks A and B. The riskfree rate is 2%; you can earn 2% investing in the riskfree asset or borrow money at a 2% interest rate. Stocks A and B are uncorrelated and have the following expected returns and standard deviations: Stock A: E(TA) = 5%, GA = 8% Stock B: E(rs) = 9%, OB = 12%. a) You're thinking about investing in two assets: either Stock A and the riskfree asset, Stock B and the riskfree asset, or Stocks A and B. (Positive and negative weights are possible.) If you have a target expected return of 6.5%, which pair of assets would you choose and what fraction of your portfolio would you invest in each? What is the portfolio's standard devation? b) Challenge question (not to be handed in): If you can invest in a combination of all three assets, what portfolio would you choose if you have a target expected return of 6.5%? What is the portfolio's standard deviation? You have the opportunity to invest in a riskfree asset and stocks A and B. The riskfree rate is 2%; you can earn 2% investing in the riskfree asset or borrow money at a 2% interest rate. Stocks A and B are uncorrelated and have the following expected returns and standard deviations: Stock A: E(TA) = 5%, GA = 8% Stock B: E(rs) = 9%, OB = 12%. a) You're thinking about investing in two assets: either Stock A and the riskfree asset, Stock B and the riskfree asset, or Stocks A and B. (Positive and negative weights are possible.) If you have a target expected return of 6.5%, which pair of assets would you choose and what fraction of your portfolio would you invest in each? What is the portfolio's standard devation? b) Challenge question (not to be handed in): If you can invest in a combination of all three assets, what portfolio would you choose if you have a target expected return of 6.5%? What is the portfolio's standard deviation? You have the opportunity to invest in a riskfree asset and stocks A and B. The riskfree rate is 2%; you can earn 2% investing in the riskfree asset or borrow money at a 2% interest rate. Stocks A and B are uncorrelated and have the following expected returns and standard deviations: Stock A: E(TA) = 5%, GA = 8% Stock B: E(rs) = 9%, OB = 12%. a) You're thinking about investing in two assets: either Stock A and the riskfree asset, Stock B and the riskfree asset, or Stocks A and B. (Positive and negative weights are possible.) If you have a target expected return of 6.5%, which pair of assets would you choose and what fraction of your portfolio would you invest in each? What is the portfolio's standard devation? b) Challenge question (not to be handed in): If you can invest in a combination of all three assets, what portfolio would you choose if you have a target expected return of 6.5%? What is the portfolio's standard deviation?

Step by Step Solution

★★★★★

3.53 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

a To achieve an expected return of 65 with the lowest risk ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started