Question

You have the option to buy points on the loan. This means that you can pay an extra 1% of the initial principal along with

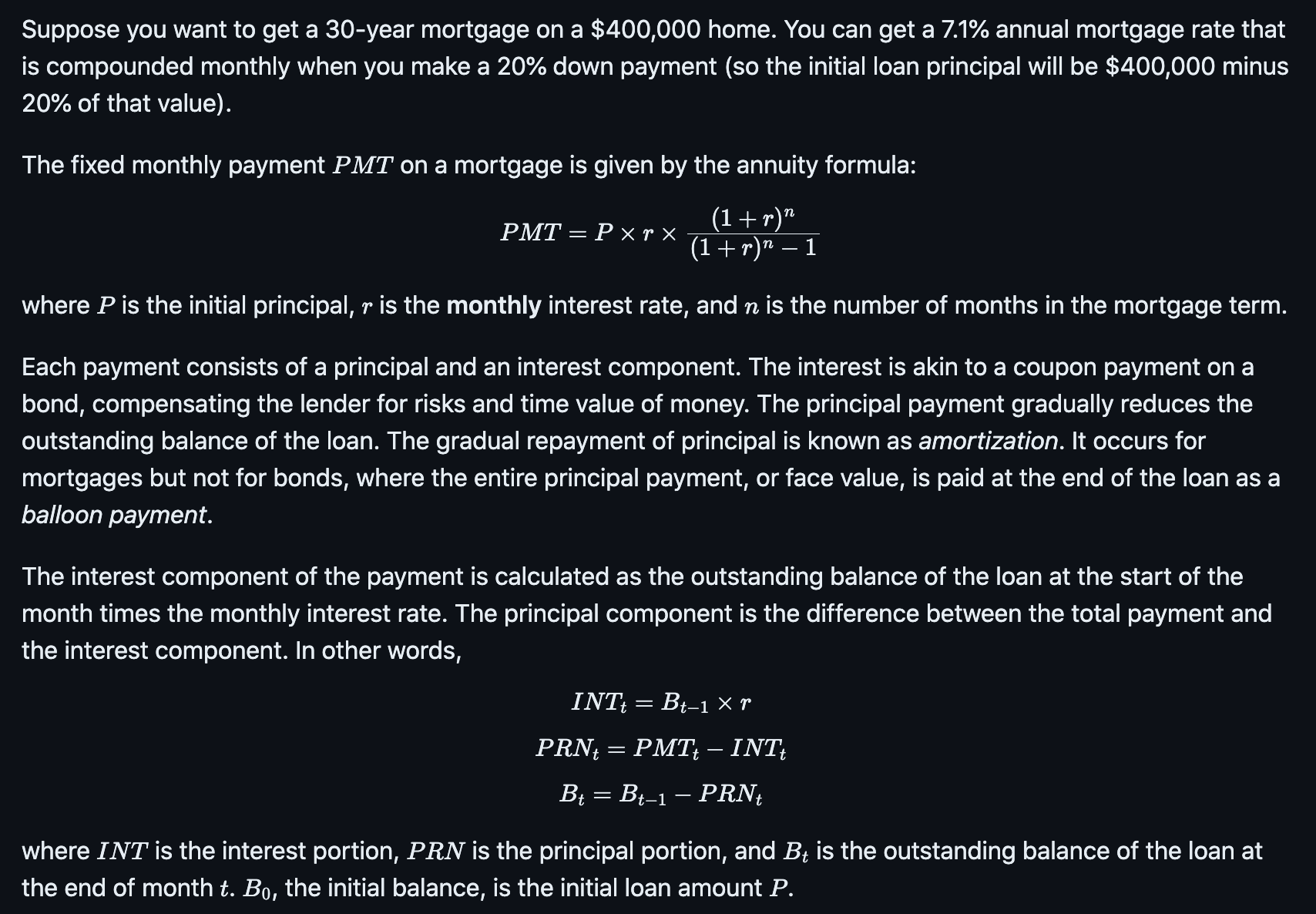

You have the option to buy "points" on the loan. This means that you can pay an extra 1% of the initial principal along with your down payment, and doing so will lower the annual interest rate by 0.25% (thereby lowering the monthly payment). Importantly, the points you pay -- the extra 1% -- do NOT count towards the principal of the loan. They are just a fee paid to the bank. In exchange, you get a lower interest rate. Lenders will often advertise the lower rate, to get which you need to pay the points. But is it worth it? You will figure this out in this question.\ \ If you own the home for the entire 30-year loan period, buying points usually lowers the total cost of the loan. But most people dont do that they often move before then. When you sell the house, you use (some of) the proceeds from the sale to repay the remaining mortgage balance, after which you no longer need to make any payments.\ \ Suppose you decide to sell the house after living in it for \ months (and making \ monthly payments). The total cost of the mortgage is the cost of points paid today, plus \ months of monthly payments \ , plus the final balance at the end of the \ 'th month \ .\ \ The total cost of the mortgage is then:\ \ \ Of course, as an experienced finance student, you know about time value of money, which means that you shouldn't make decisions based on discounted total costs of many payments over time. So given a monthly discount rate \ , you compute the present value of mortgage payments as:\ \ \ \ \ What discount rate should you use? This is the age-old question in finance. One way to approach it is to discount cash flows at your opportunity cost, i.e. at the rate you can earn on an alternative investment of similar risk. Intuitively, the reason why money 10 years from now is worth less to you than money today is because, if you got money today, you could invest it and have more in 10 years. Let's assume an annual discount rate of 4%.\ \ In a new part of your notebook, rearrange ("refactor") your code from Part A into a function that takes points, interest rate, and the months until you sell the house as inputs and returns the present value of the mortgage as an output.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started