Question

You have the option to open a store today at a cost of 30, which would generate a present value of profits of 50.

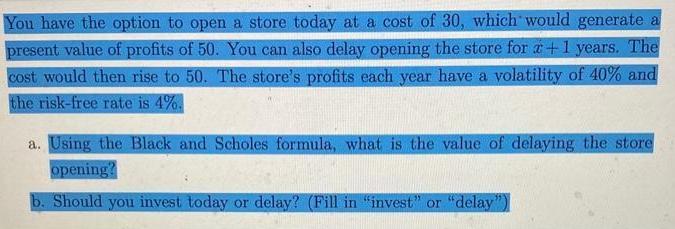

You have the option to open a store today at a cost of 30, which would generate a present value of profits of 50. You can also delay opening the store for a +1 years. The cost would then rise to 50. The store's profits each year have a volatility of 40% and the risk-free rate is 4%. a. Using the Black and Scholes formula, what is the value of delaying the store opening? b. Should you invest today or delay? (Fill in "invest" or "delay")

Step by Step Solution

3.56 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To determine the value of delaying the store opening and whether you should invest today or delay we ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App