You have to clearly state and justify your assumptions regarding the estimated sales growth rate that you will be using to calculate the EFN. ( Agthia)

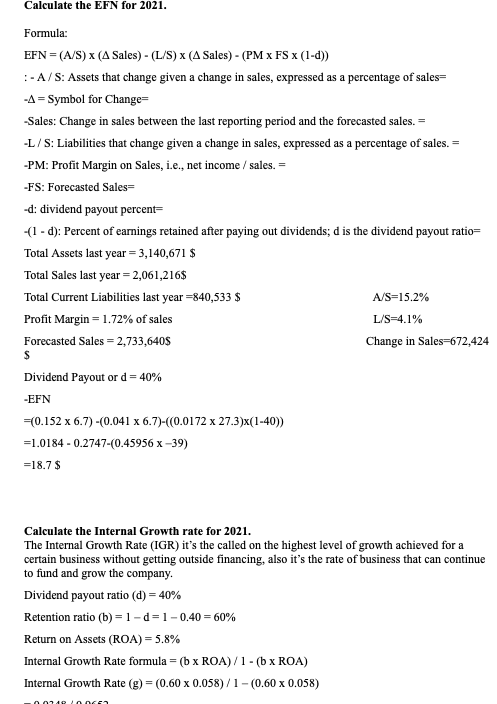

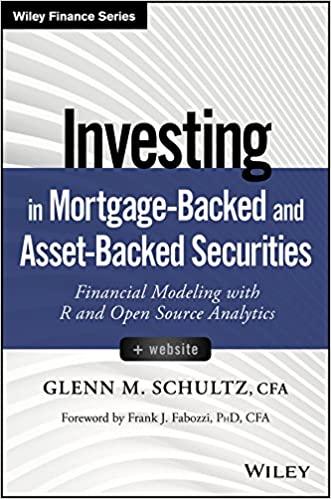

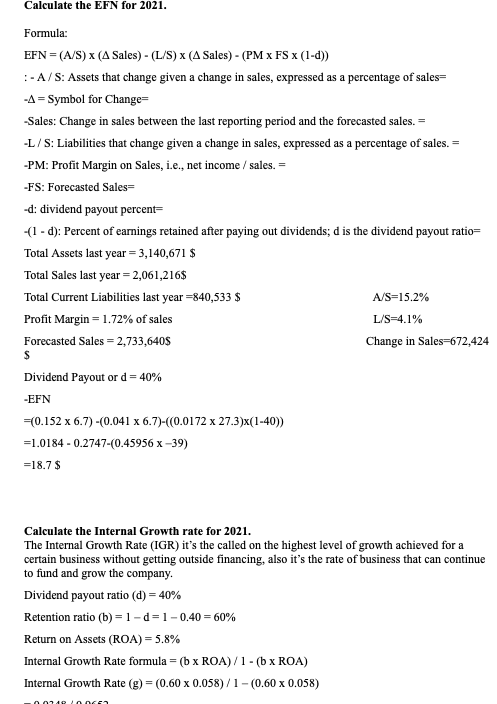

Calculate the EFN for 2021. Formula: EFN = (A/S) X (A Sales) - (L/S) x (4 Sales) - (PMx FS X (1-d)) :-A/S: Assets that change given a change in sales, expressed as a percentage of sales -A = Symbol for Change -Sales: Change in sales between the last reporting period and the forecasted sales. = -L/S: Liabilities that change given a change in sales, expressed as a percentage of sales. = -PM: Profit Margin on Sales, i.e., net income / sales. = -FS: Forecasted Sales -d: dividend payout percent- -(1 - d): Percent of earnings retained after paying out dividends; d is the dividend payout ratio= Total Assets last year = 3,140,671 $ Total Sales last year = r= 2,061,216$ Total Current Liabilities last year =840,533 $ A/S=15.2% Profit Margin = 1.72% of sales L/S=4.1% Forecasted Sales = 2,733,640$ Change in Sales=672,424 $ Dividend Payout or d = 40% EFN =(0.152 x 6.7) -(0.041 x 6.7)-((0.0172 x 27.3)x(1-40)) =1.0184 -0.2747-(0.45956 x -39) =18.7 $ Calculate the Internal Growth rate for 2021. The Internal Growth Rate (IGR) it's the called on the highest level of growth achieved for a certain business without getting outside financing, also it's the rate of business that can continue to fund and grow the company. Dividend payout ratio (d) = 40% Retention ratio (b) = 1 - d = 1 -0.40 = 60% Return on Assets (ROA) = 5.8% Internal Growth Rate formula = = (b x ROA)/1 - (B x ROA) Internal Growth Rate (g) = (0.60 x 0.058)/1-(0.60 x 0.058) 000 e = 0.0348/0.9652 = 3.605% or 3.61% Alternatively, if the formula used is: b x ROA Internal Growth Rate(g) = 0.60 x 5.8 = 3.48% Calculate the Sustainable growth rate for 2021. The SGR is the maximum growth rate a company can sustain without being financed by equity or dept. Dividend Payout Ratio = Dividends Paid / Net Income Dividend Payout Ratio = 118,800,00 / 110,254,000 Dividend Payout Ratio = 1.077 SGR = Return On Equity x (1 - Dividend Payout Ratio) SGR= x(1 - 1.077) SGR = 0.732 0.68 Calculate the EFN for 2021. Formula: EFN = (A/S) X (A Sales) - (L/S) x (4 Sales) - (PMx FS X (1-d)) :-A/S: Assets that change given a change in sales, expressed as a percentage of sales -A = Symbol for Change -Sales: Change in sales between the last reporting period and the forecasted sales. = -L/S: Liabilities that change given a change in sales, expressed as a percentage of sales. = -PM: Profit Margin on Sales, i.e., net income / sales. = -FS: Forecasted Sales -d: dividend payout percent- -(1 - d): Percent of earnings retained after paying out dividends; d is the dividend payout ratio= Total Assets last year = 3,140,671 $ Total Sales last year = r= 2,061,216$ Total Current Liabilities last year =840,533 $ A/S=15.2% Profit Margin = 1.72% of sales L/S=4.1% Forecasted Sales = 2,733,640$ Change in Sales=672,424 $ Dividend Payout or d = 40% EFN =(0.152 x 6.7) -(0.041 x 6.7)-((0.0172 x 27.3)x(1-40)) =1.0184 -0.2747-(0.45956 x -39) =18.7 $ Calculate the Internal Growth rate for 2021. The Internal Growth Rate (IGR) it's the called on the highest level of growth achieved for a certain business without getting outside financing, also it's the rate of business that can continue to fund and grow the company. Dividend payout ratio (d) = 40% Retention ratio (b) = 1 - d = 1 -0.40 = 60% Return on Assets (ROA) = 5.8% Internal Growth Rate formula = = (b x ROA)/1 - (B x ROA) Internal Growth Rate (g) = (0.60 x 0.058)/1-(0.60 x 0.058) 000 e = 0.0348/0.9652 = 3.605% or 3.61% Alternatively, if the formula used is: b x ROA Internal Growth Rate(g) = 0.60 x 5.8 = 3.48% Calculate the Sustainable growth rate for 2021. The SGR is the maximum growth rate a company can sustain without being financed by equity or dept. Dividend Payout Ratio = Dividends Paid / Net Income Dividend Payout Ratio = 118,800,00 / 110,254,000 Dividend Payout Ratio = 1.077 SGR = Return On Equity x (1 - Dividend Payout Ratio) SGR= x(1 - 1.077) SGR = 0.732 0.68