Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You have your savings invested in a portfolio with the following details: Number of Shares Price Per Share Beta Share A 10,000 $4.50 1.95

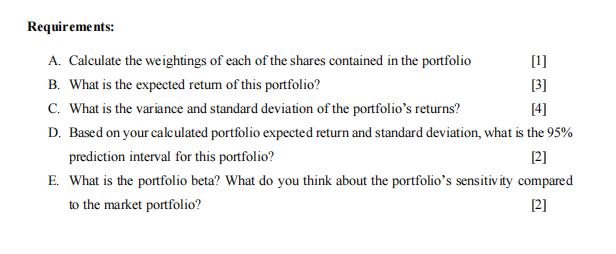

You have your savings invested in a portfolio with the following details: Number of Shares Price Per Share Beta Share A 10,000 $4.50 1.95 Share B 20,000 $3.50 0.55 Based on analyst reports, she has estimated the following retums for each of these shares in three different economic states: State Economy Boom Normal Recession of Probability State 35% 50% 15% Economic Expected Return Expected Share A Share B 8% 3.5% -5% 14% 6% 2% Return Requirements: A. Calculate the weightings of each of the shares contained in the portfolio [1] B. What is the expected return of this portfolio? [3] C. What is the variance and standard deviation of the portfolio's returns? [4] D. Based on your calculated portfolio expected return and standard deviation, what is the 95% prediction interval for this portfolio? [2] E. What is the portfolio beta? What do you think about the portfolio's sensitivity compared to the market portfolio? [2]

Step by Step Solution

★★★★★

3.31 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below A Calcul ate the weight ings of each of the shares contained in the portfolio 1 ANS WER Share A 10 000 10 000 20 000 0 33 Share B 20 000 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started