Question

You hold four stocks in your portfolio: A, B, C, and D. The portfolio beta is 1.134. Stock A comprises 25% of the dollar

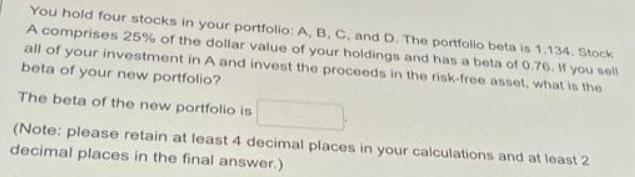

You hold four stocks in your portfolio: A, B, C, and D. The portfolio beta is 1.134. Stock A comprises 25% of the dollar value of your holdings and has a beta of 0.76. If you sell all of your investment in A and invest the proceeds in the risk-free asset, what is the beta of your new portfolio? The beta of the new portfolio is (Note: please retain at least 4 decimal places in your calculations and at least 2 decimal places in the final answer.)

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

calculation of the beta of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Vector Mechanics for Engineers Statics and Dynamics

Authors: Ferdinand Beer, E. Russell Johnston, Jr., Elliot Eisenberg, William Clausen, David Mazurek, Phillip Cornwell

8th Edition

73212229, 978-0073212227

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App