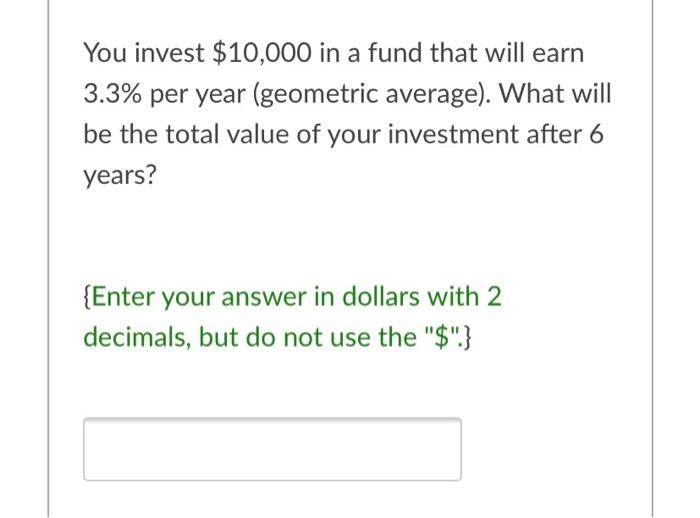

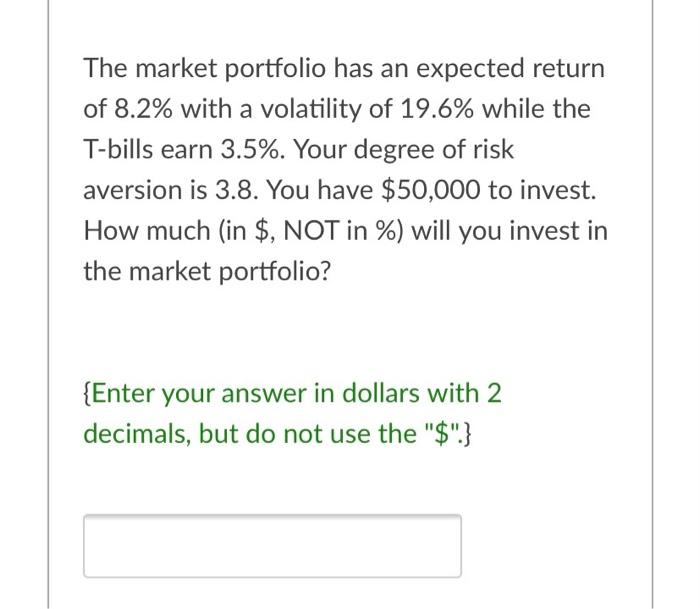

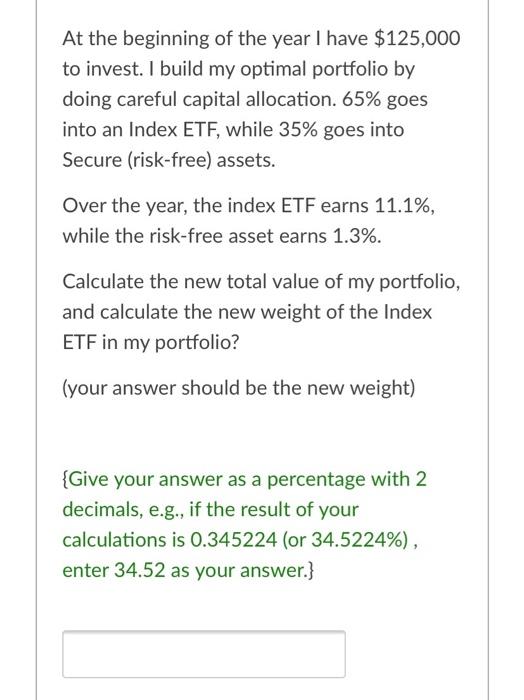

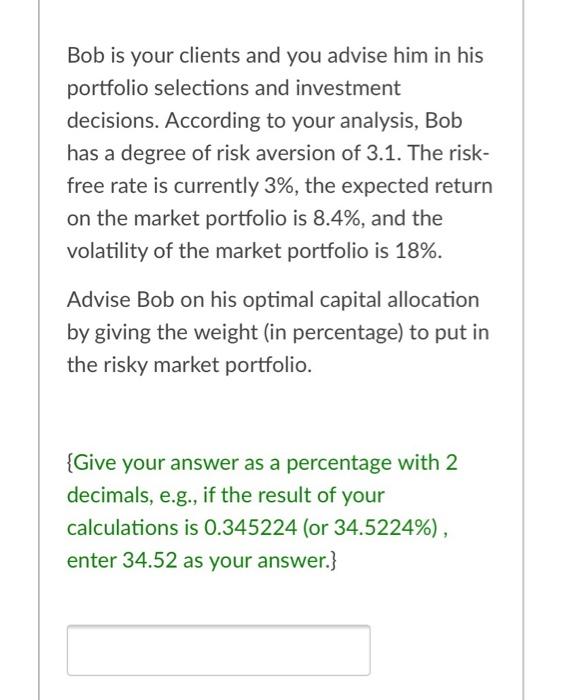

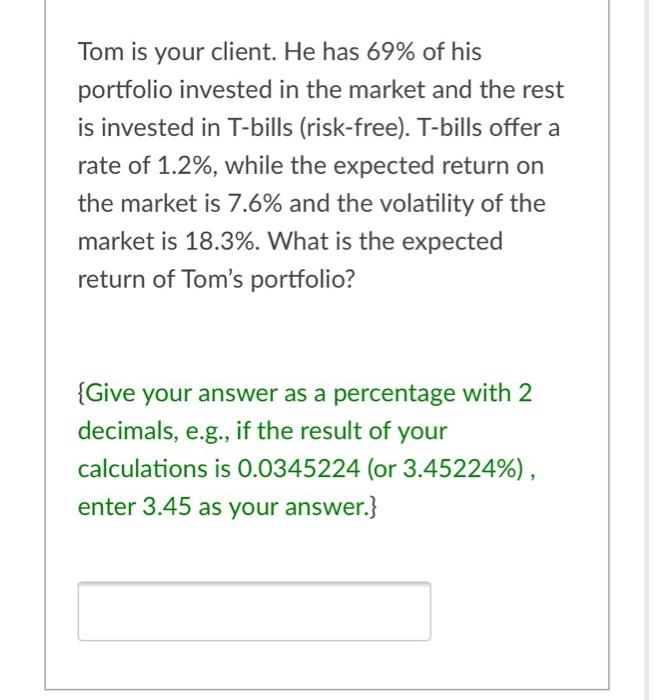

You invest $10,000 in a fund that will earn 3.3% per year (geometric average). What will be the total value of your investment after 6 years? {Enter your answer in dollars with 2 decimals, but do not use the "$"} The market portfolio has an expected return of 8.2% with a volatility of 19.6% while the T-bills earn 3.5%. Your degree of risk aversion is 3.8. You have $50,000 to invest. How much (in $, NOT in %) will you invest in the market portfolio? {Enter your answer in dollars with 2 decimals, but do not use the "$"} At the beginning of the year I have $125,000 to invest. I build my optimal portfolio by doing careful capital allocation. 65% goes into an Index ETF, while 35% goes into Secure (risk-free) assets. Over the year, the index ETF earns 11.1%, while the risk-free asset earns 1.3%. Calculate the new total value of my portfolio, and calculate the new weight of the Index ETF in my portfolio? (your answer should be the new weight) {Give your answer as a percentage with 2 decimals, e.g., if the result of your calculations is 0.345224 (or 34.5224%), enter 34.52 as your answer.} Bob is your clients and you advise him in his portfolio selections and investment decisions. According to your analysis, Bob has a degree of risk aversion of 3.1. The risk- free rate is currently 3%, the expected return on the market portfolio is 8.4%, and the volatility of the market portfolio is 18%. Advise Bob on his optimal capital allocation by giving the weight (in percentage) to put in the risky market portfolio. {Give your answer as a percentage with 2 decimals, e.g., if the result of your calculations is 0.345224 (or 34.5224%), enter 34.52 as your answer.} Tom is your client. He has 69% of his portfolio invested in the market and the rest is invested in T-bills (risk-free). T-bills offer a rate of 1.2%, while the expected return on the market is 7.6% and the volatility of the market is 18.3%. What is the expected return of Tom's portfolio? {Give your answer as a percentage with 2 decimals, e.g., if the result of your calculations is 0.0345224 (or 3.45224%), enter 3.45 as your answer.}