Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You just bought a motorcycle for $12,000. You plan to ride the motorcycle for two years, and then sell it for $6,000. During this

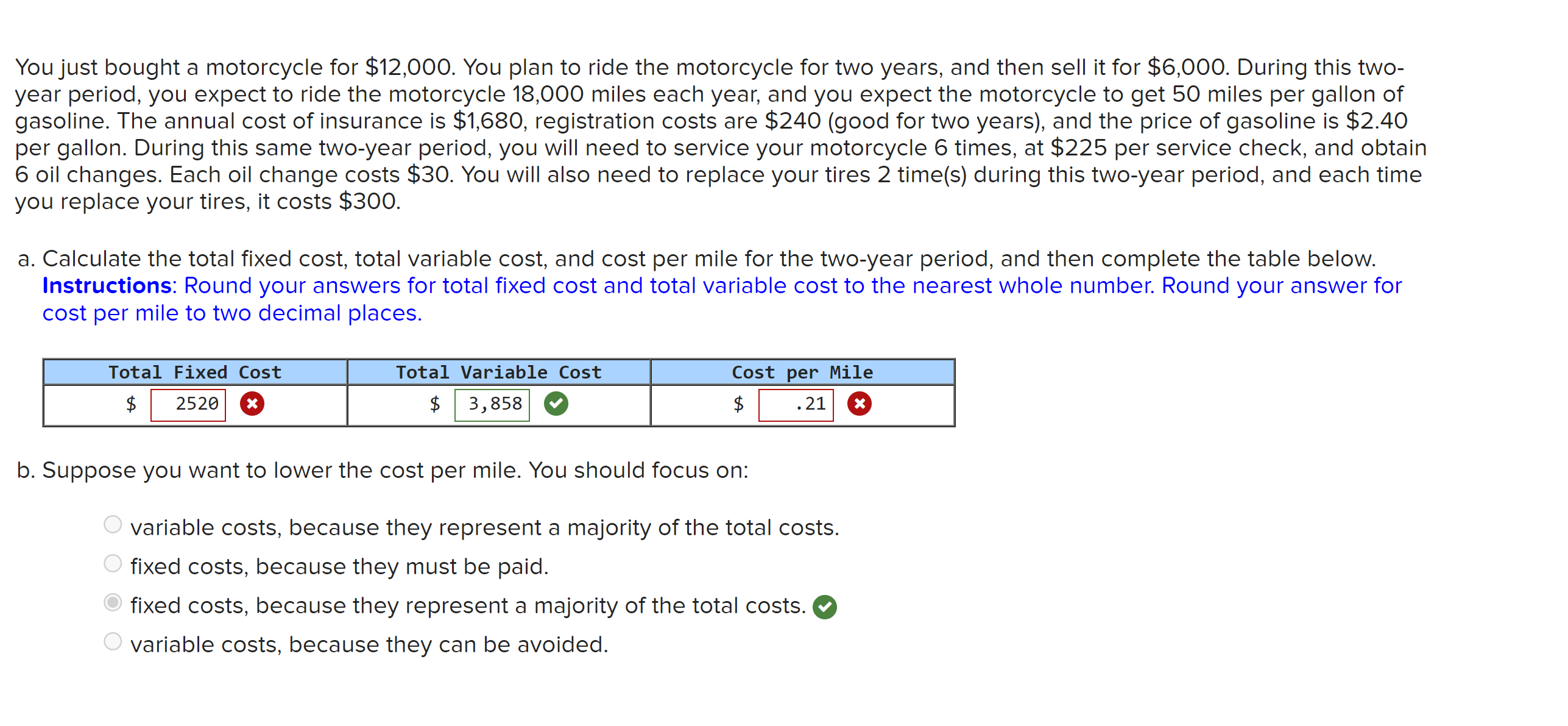

You just bought a motorcycle for $12,000. You plan to ride the motorcycle for two years, and then sell it for $6,000. During this two- year period, you expect to ride the motorcycle 18,000 miles each year, and you expect the motorcycle to get 50 miles per gallon of gasoline. The annual cost of insurance is $1,680, registration costs are $240 (good for two years), and the price of gasoline is $2.40 per gallon. During this same two-year period, you will need to service your motorcycle 6 times, at $225 per service check, and obtain 6 oil changes. Each oil change costs $30. You will also need to replace your tires 2 time(s) during this two-year period, and each time you replace your tires, it costs $300. a. Calculate the total fixed cost, total variable cost, and cost per mile for the two-year period, and then complete the table below. Instructions: Round your answers for total fixed cost and total variable cost to the nearest whole number. Round your answer for cost per mile to two decimal places. Total Fixed Cost 2520 Total Variable Cost Cost per Mile $ 3,858 $ .21 b. Suppose you want to lower the cost per mile. You should focus on: variable costs, because they represent a majority of the total costs. fixed costs, because they must be paid. fixed costs, because they represent a majority of the total costs. variable costs, because they can be avoided.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started