Answered step by step

Verified Expert Solution

Question

1 Approved Answer

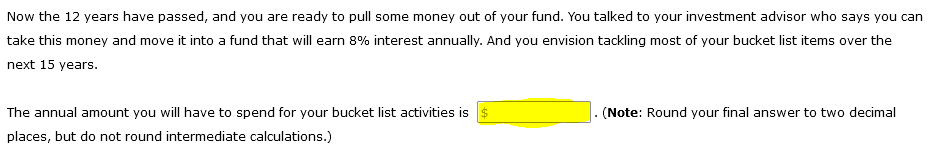

You just found out that you had a very eccentric uncle who lived quietly in Brooklyn. He left you $65,000. You just saw the movie

You just found out that you had a very eccentric uncle who lived quietly in Brooklyn. He left you $65,000. You just saw the movie The Bucket List and have decided that you want to put some money away so that in 12 years, you can start fulfilling items on that list.

With whatever money you have left, youll pay off some bills. You have found an investment instrument that will pay 7% interest annually.

Use the scenarios along with the following factor table data to answer each of the questions

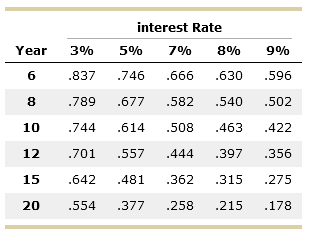

Present Value Factors:

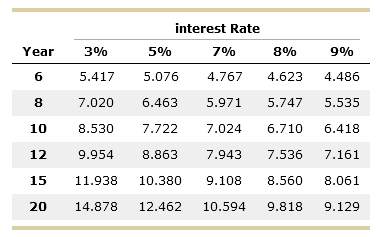

Present Value Annuity Factors:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started