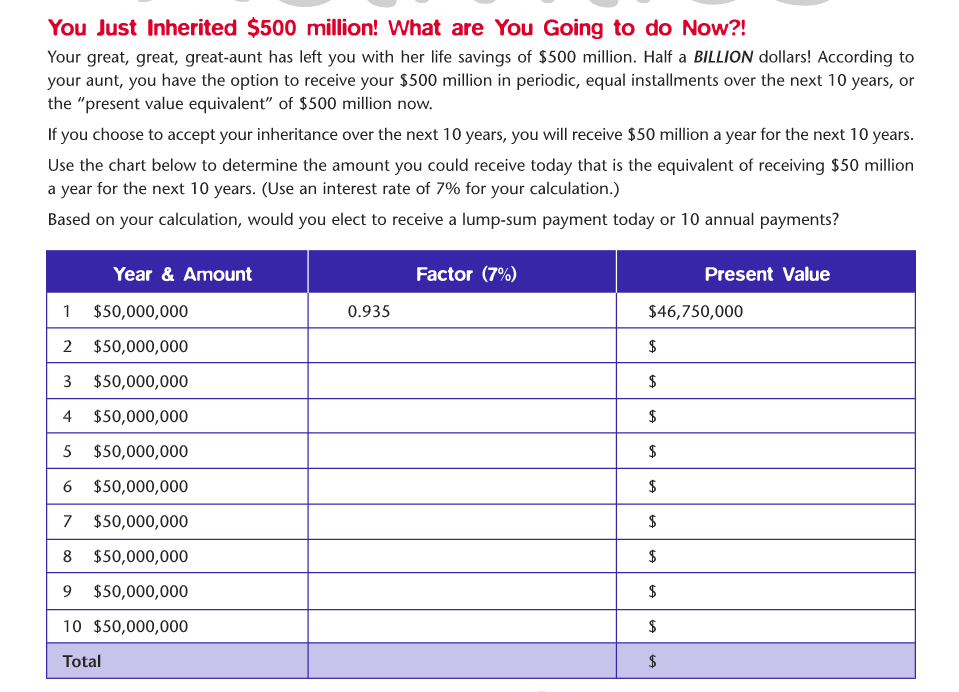

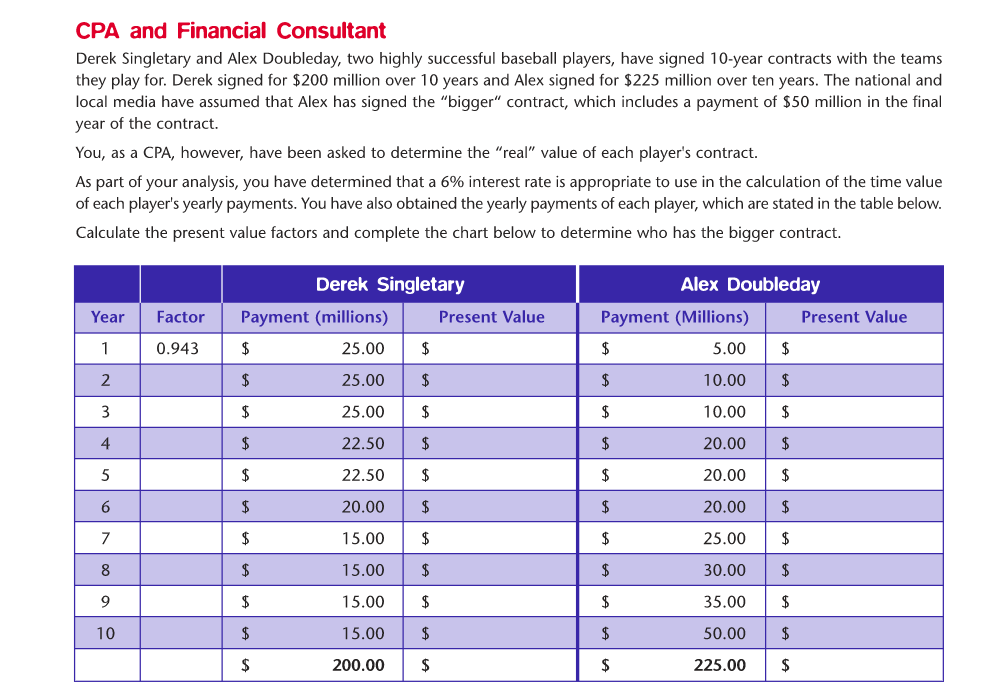

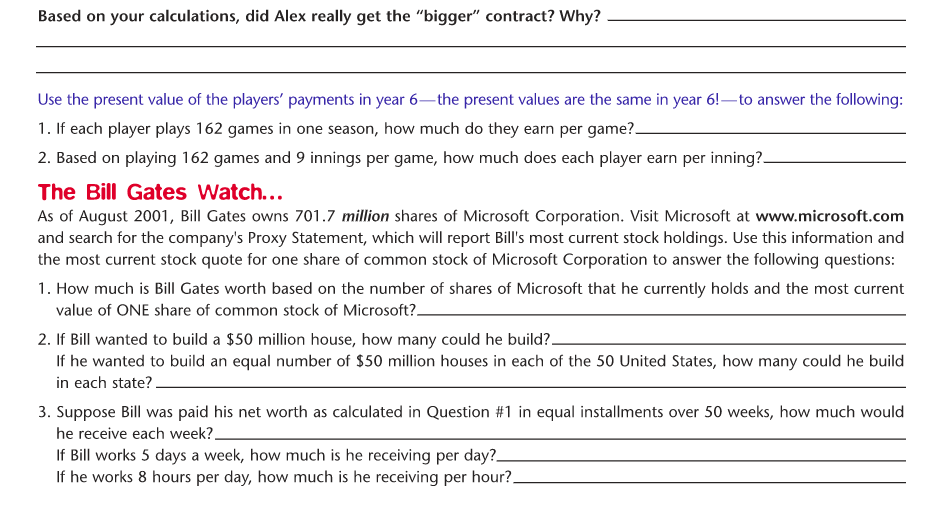

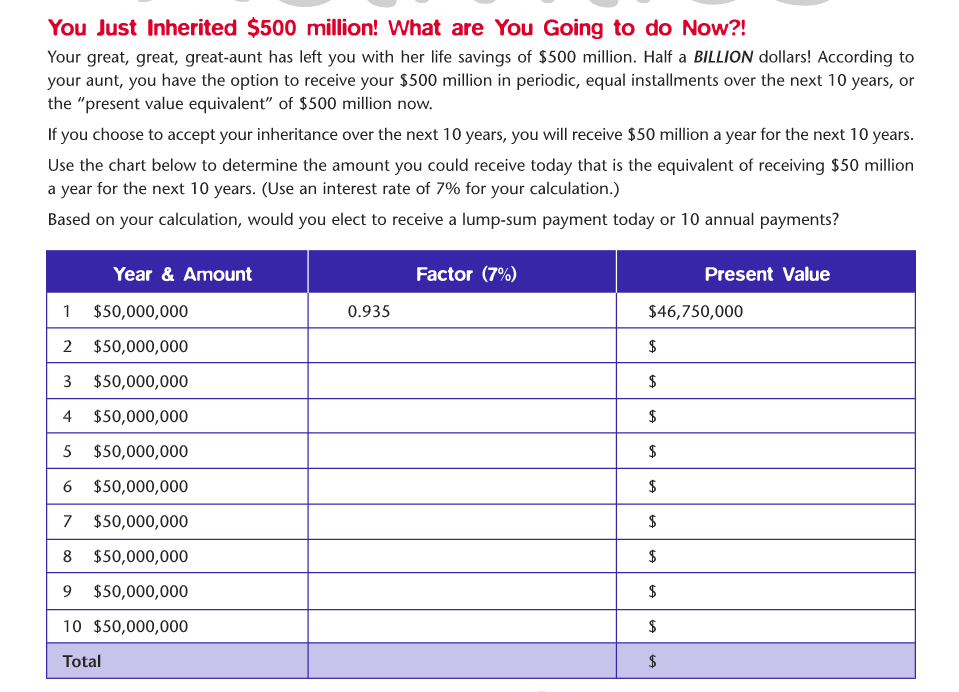

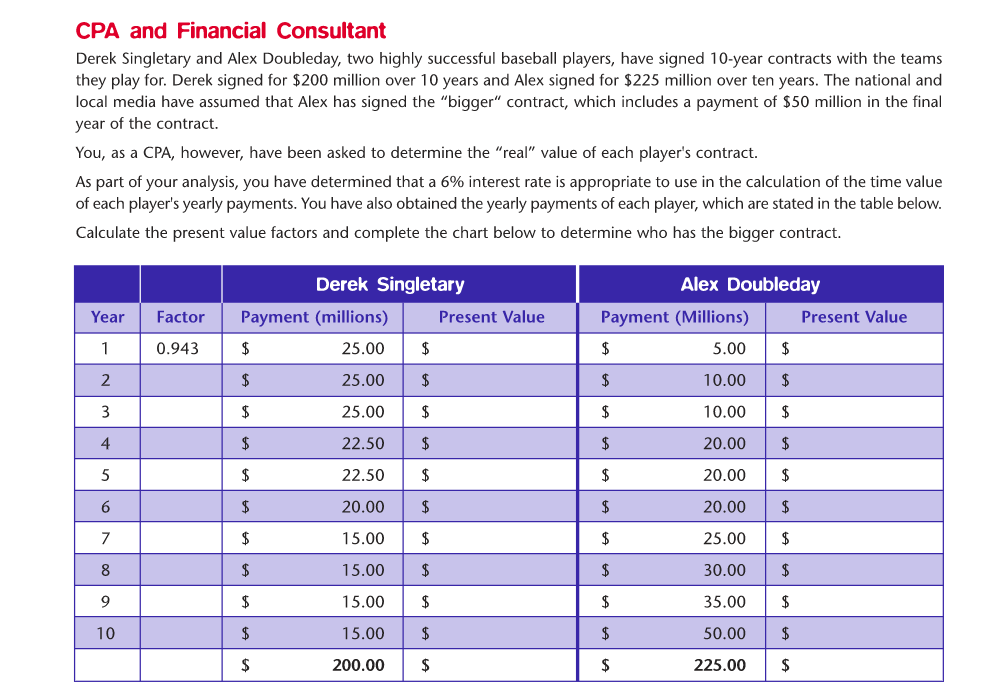

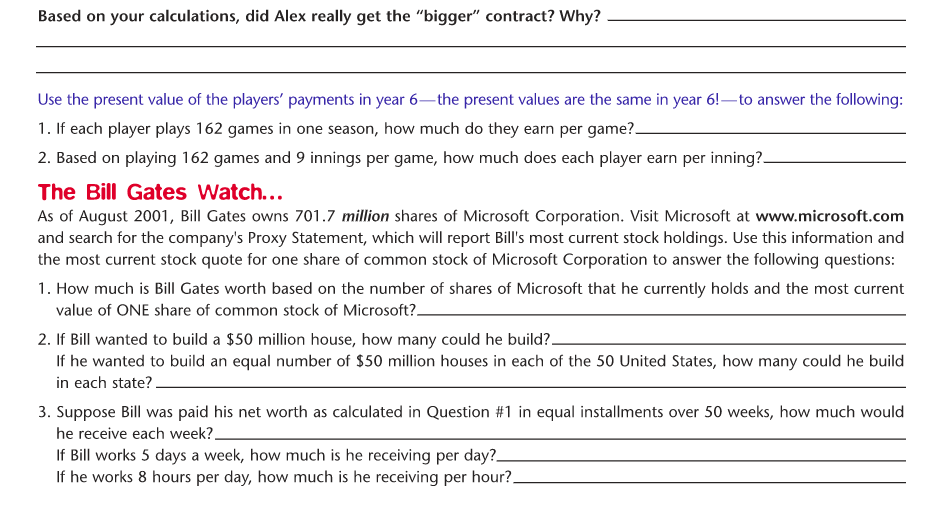

You Just Inherited $500 million! What are You Going to do Now?! Your great, great, great-aunt has left you with her life savings of $500 million. Half a BILLION dollars! According to your aunt, you have the option to receive your $500 million in periodic, equal installments over the next 10 years, or the "present value equivalent of $500 million now. If you choose to accept your inheritance over the next 10 years, you will receive $50 million a year for the next 10 years. Use the chart below to determine the amount you could receive today that is the equivalent of receiving $50 million a year for the next 10 years. (Use an interest rate of 7% for your calculation.) Based on your calculation, would you elect to receive a lump-sum payment today or 10 annual payments? Year & Amount Factor (7%) Present Value 0.935 $46,750,000 1 $50,000,000 2 $50,000,000 $ 3 $50,000,000 $ 4 $50,000,000 $ 5 $50,000,000 $ 6 $50,000,000 $ 7 $50,000,000 $ $ 8 $50,000,000 9 $50,000,000 $ 10 $50,000,000 $ Total $ CPA and Financial Consultant Derek Singletary and Alex Doubleday, two highly successful baseball players, have signed 10-year contracts with the teams they play for. Derek signed for $200 million over 10 years and Alex signed for $225 million over ten years. The national and local media have assumed that Alex has signed the "bigger" contract, which includes a payment of $50 million in the final year of the contract. You, as a CPA, however, have been asked to determine the "real" value of each player's contract. As part of your analysis, you have determined that a 6% interest rate is appropriate to use in the calculation of the time value of each player's yearly payments. You have also obtained the yearly payments of each player, which are stated in the table below. Calculate the present value factors and complete the chart below to determine who has the bigger contract. Derek Singletary Payment (millions) Present Value Alex Doubleday Payment (Millions) Present Value Year Factor 1 0.943 $ 25.00 $ $ 5.00 $ 2 $ 25.00 $ $ 10.00 $ 3 $ 25.00 $ $ 10.00 $ 4 $ 22.50 $ 20.00 $ 5 $ 22.50 $ $ 20.00 $ 6 $ 20.00 $ $ 20.00 $ 7 $ 15.00 $ $ 25.00 $ 8 $ 15.00 $ $ 30.00 $ 9 $ 15.00 $ $ 35.00 $ 10 $ 15.00 $ $ 50.00 $ $ 200.00 $ $ 225.00 $ Based on your calculations, did Alex really get the "bigger" contract? Why? Use the present value of the players' payments in year 6the present values are the same in year 6!to answer the following: 1. If each player plays 162 games in one season, how much do they earn per game? 2. Based on playing 162 games and 9 innings per game, how much does each player earn per inning? The Bill Gates Watch... As of August 2001, Bill Gates owns 701.7 million shares of Microsoft Corporation. Visit Microsoft at www.microsoft.com and search for the company's Proxy Statement, which will report Bill's most current stock holdings. Use this information and the most current stock quote for one share of common stock of Microsoft Corporation to answer the following questions: 1. How much is Bill Gates worth based on the number of shares of Microsoft that he currently holds and the most current value of ONE share of common stock of Microsoft? 2. If Bill wanted to build a $50 million house, how many could he build? If he wanted to build an equal number of $50 million houses in each of the 50 United States, how many could he build in each state? 3. Suppose Bill was paid his net worth as calculated in Question #1 in equal installments over 50 weeks, how much would he receive each week?_ If Bill works 5 days a week, how much is he receiving per day? If he works 8 hours per day, how much is he receiving per hour