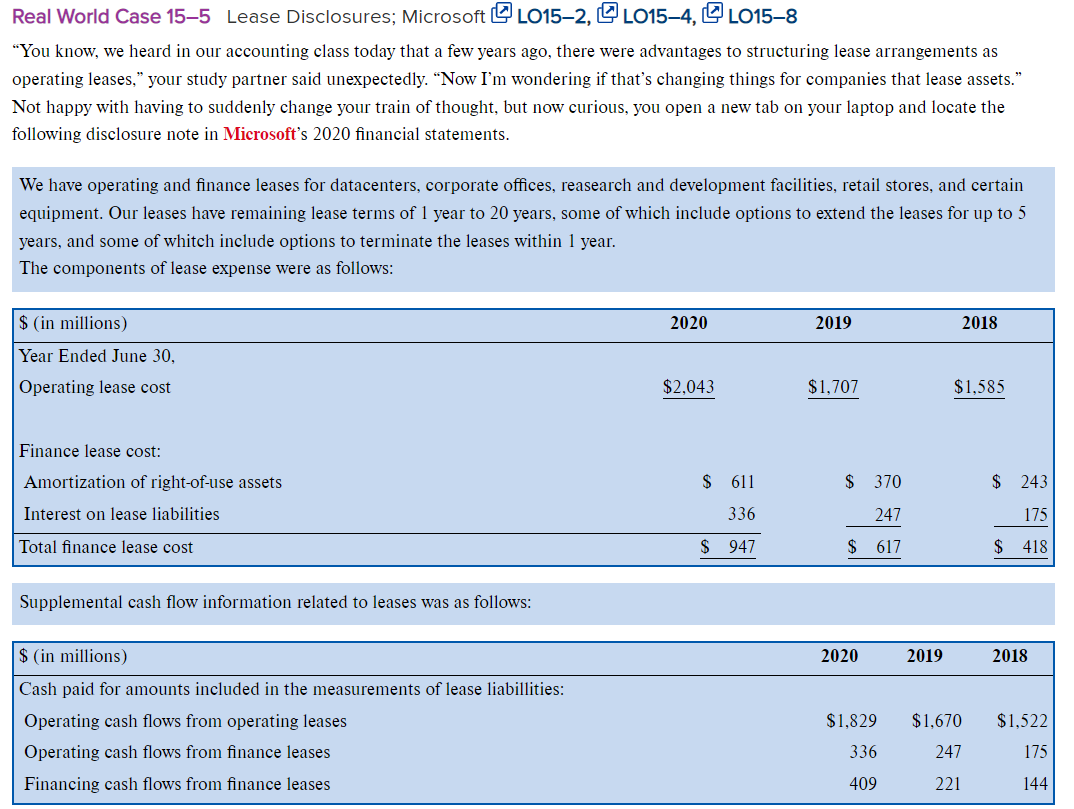

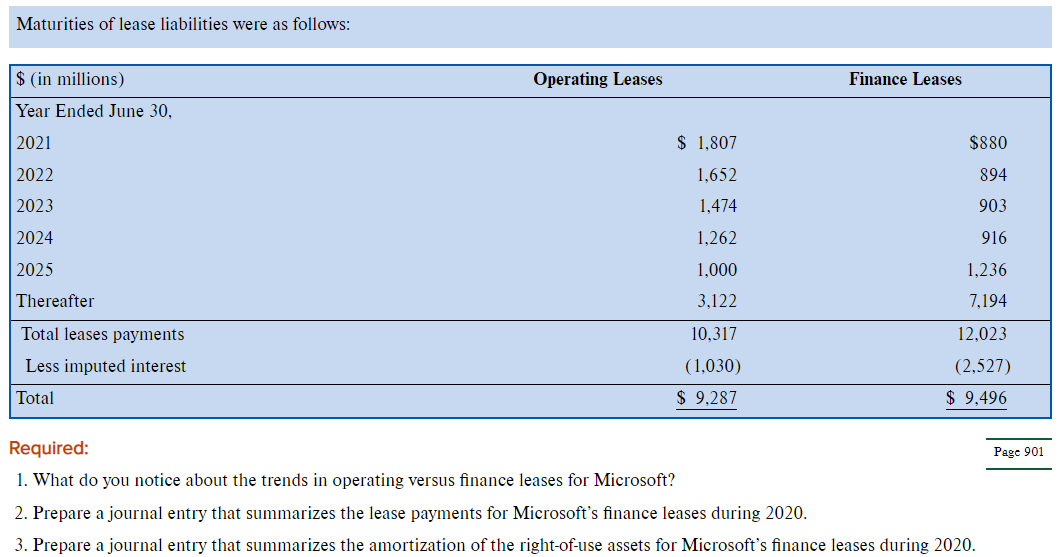

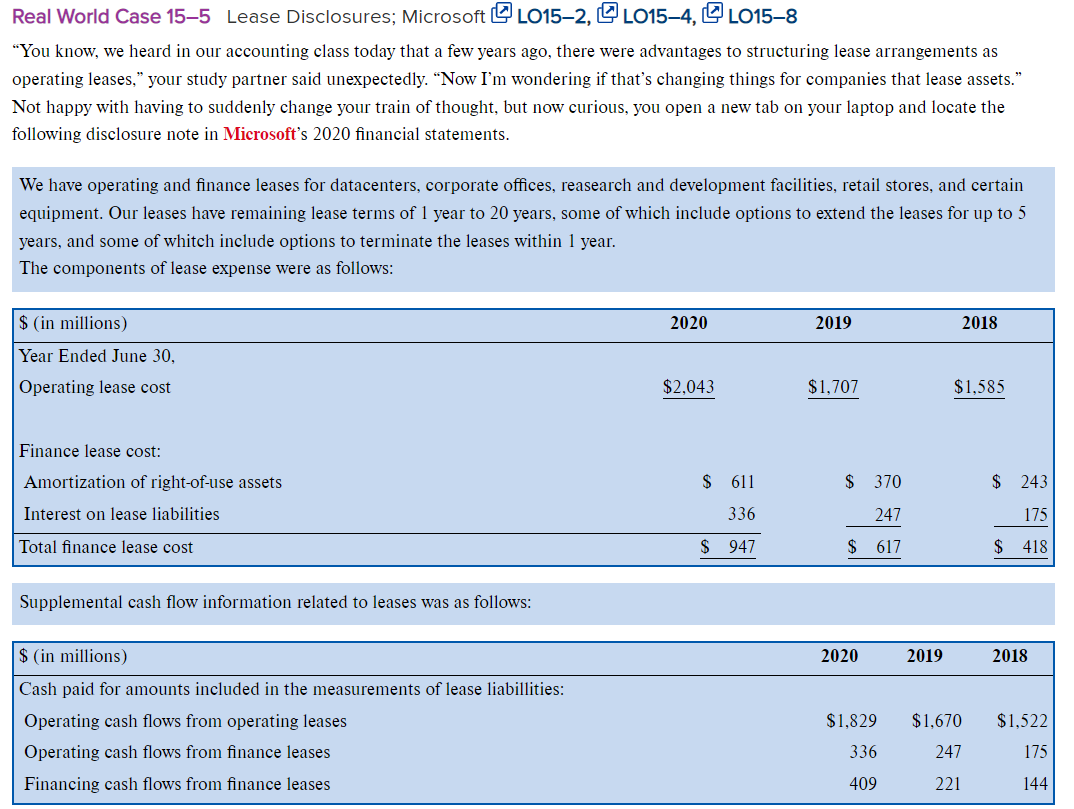

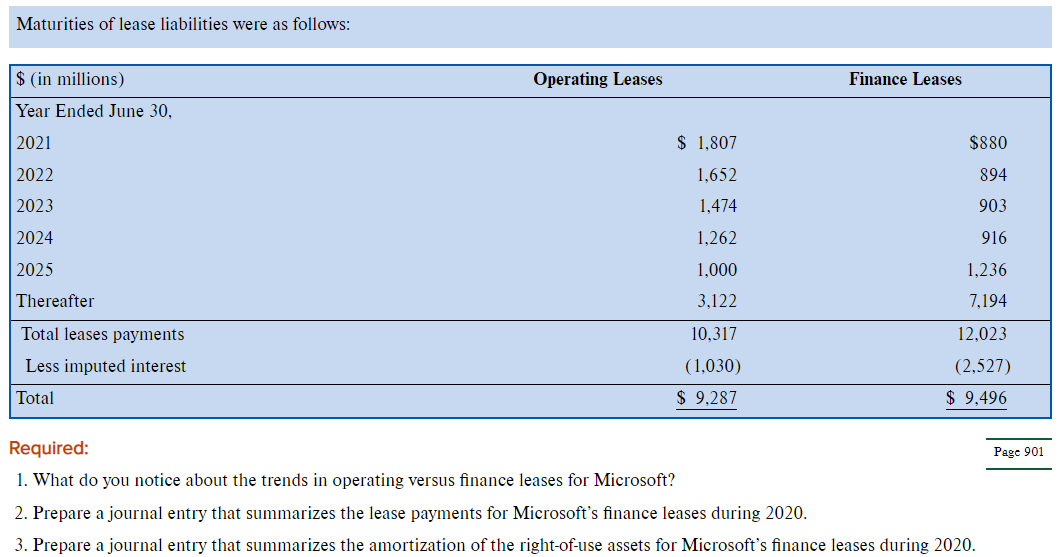

"You know, we heard in our accounting class today that a few years ago, there were advantages to structuring lease arrangements as operating leases," your study partner said unexpectedly. "Now I'm wondering if that's changing things for companies that lease assets." Not happy with having to suddenly change your train of thought, but now curious, you open a new tab on your laptop and locate the following disclosure note in Microsoft's 2020 financial statements. We have operating and finance leases for datacenters, corporate offices, reasearch and development facilities, retail stores, and certain equipment. Our leases have remaining lease terms of 1 year to 20 years, some of which include options to extend the leases for up to 5 years, and some of whitch include options to terminate the leases within 1 year. The components of lease expense were as follows: Maturities of lease liabilities were as follows: Required: 1. What do you notice about the trends in operating versus finance leases for Microsoft? 2. Prepare a journal entry that summarizes the lease payments for Microsoft's finance leases during 2020. 3. Prepare a journal entry that summarizes the amortization of the right-of-use assets for Microsoft's finance leases during 2020 . "You know, we heard in our accounting class today that a few years ago, there were advantages to structuring lease arrangements as operating leases," your study partner said unexpectedly. "Now I'm wondering if that's changing things for companies that lease assets." Not happy with having to suddenly change your train of thought, but now curious, you open a new tab on your laptop and locate the following disclosure note in Microsoft's 2020 financial statements. We have operating and finance leases for datacenters, corporate offices, reasearch and development facilities, retail stores, and certain equipment. Our leases have remaining lease terms of 1 year to 20 years, some of which include options to extend the leases for up to 5 years, and some of whitch include options to terminate the leases within 1 year. The components of lease expense were as follows: Maturities of lease liabilities were as follows: Required: 1. What do you notice about the trends in operating versus finance leases for Microsoft? 2. Prepare a journal entry that summarizes the lease payments for Microsoft's finance leases during 2020. 3. Prepare a journal entry that summarizes the amortization of the right-of-use assets for Microsoft's finance leases during 2020