You manage a portfolio of equity and fixed-income securities worth $80,000,000. You've identified four sources of risk for your portfolio equity, interest rate, currency,

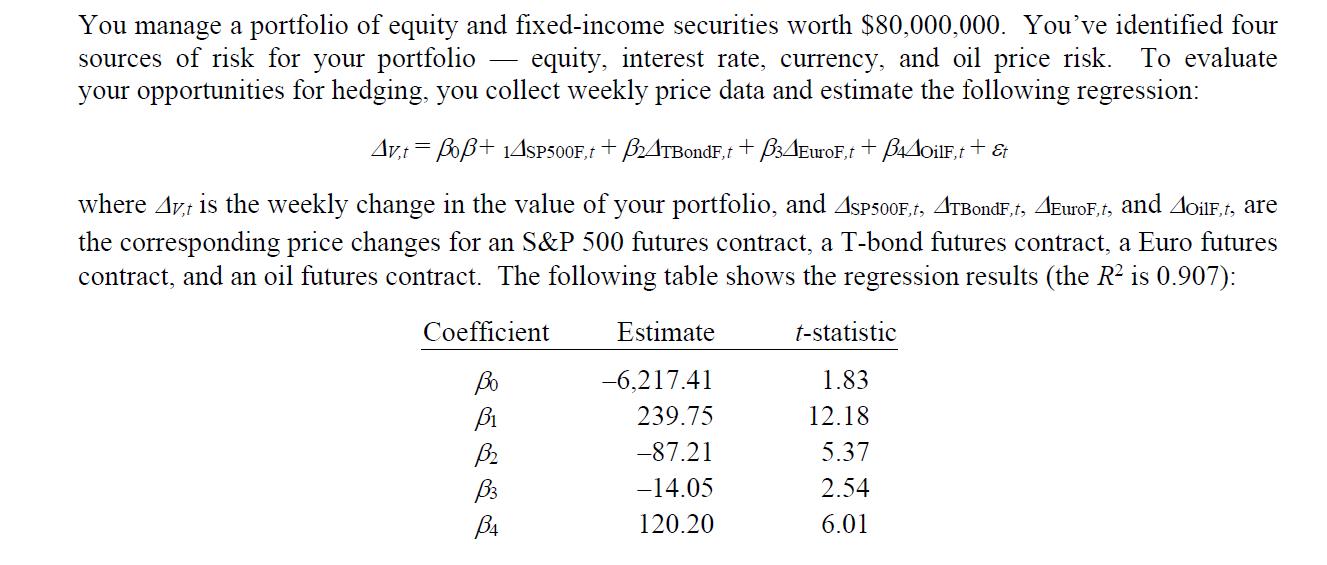

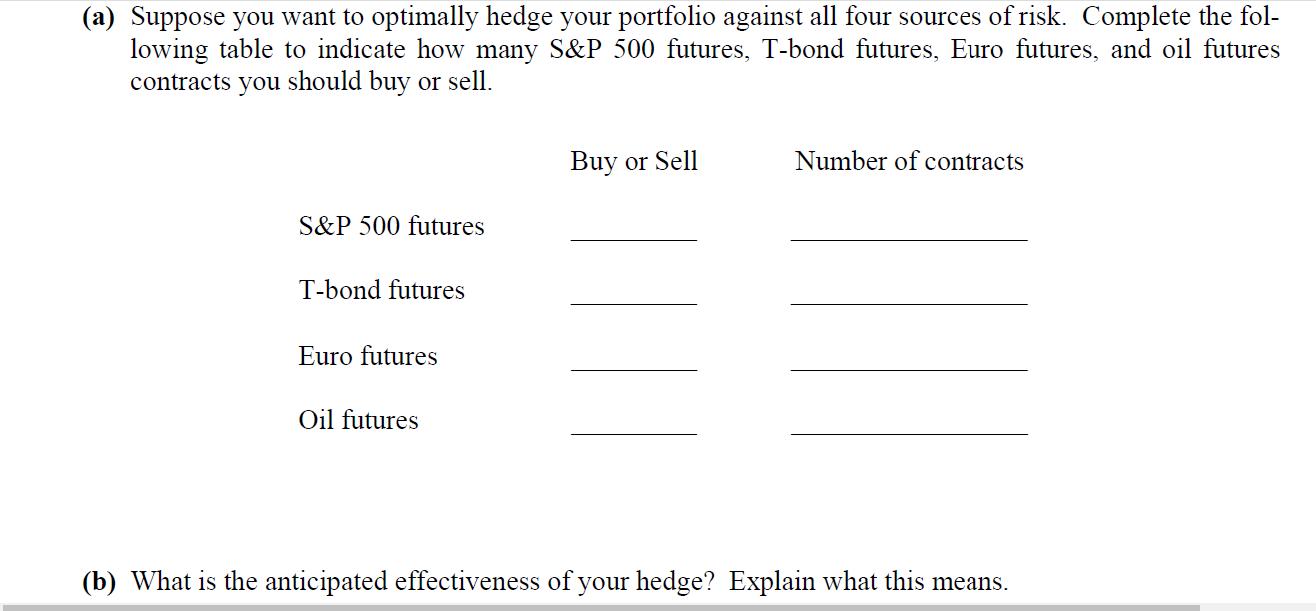

You manage a portfolio of equity and fixed-income securities worth $80,000,000. You've identified four sources of risk for your portfolio equity, interest rate, currency, and oil price risk. To evaluate your opportunities for hedging, you collect weekly price data and estimate the following regression: Avto+ 14SP500Ft + B24TBondF,t + B34EuroFt + B44oilF,t + & where Art is the weekly change in the value of your portfolio, and ASP500F,t, ATBondF,t, EuroF,t, and oilF,t, are the corresponding price changes for an S&P 500 futures contract, a T-bond futures contract, a Euro futures contract, and an oil futures contract. The following table shows the regression results (the R is 0.907): - Coefficient B B B3 B4 Estimate -6,217.41 239.75 -87.21 -14.05 120.20 t-statistic 1.83 12.18 5.37 2.54 6.01 (a) Suppose you want to optimally hedge your portfolio against all four sources of risk. Complete the fol- lowing table to indicate how many S&P 500 futures, T-bond futures, Euro futures, and oil futures contracts you should buy or sell. S&P 500 futures T-bond futures Euro futures Oil futures Buy or Sell Number of contracts (b) What is the anticipated effectiveness of your hedge? Explain what this means.

Step by Step Solution

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To optimally hedge your portfolio against all four sources of risk we need to determine how many con...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started