Answered step by step

Verified Expert Solution

Question

1 Approved Answer

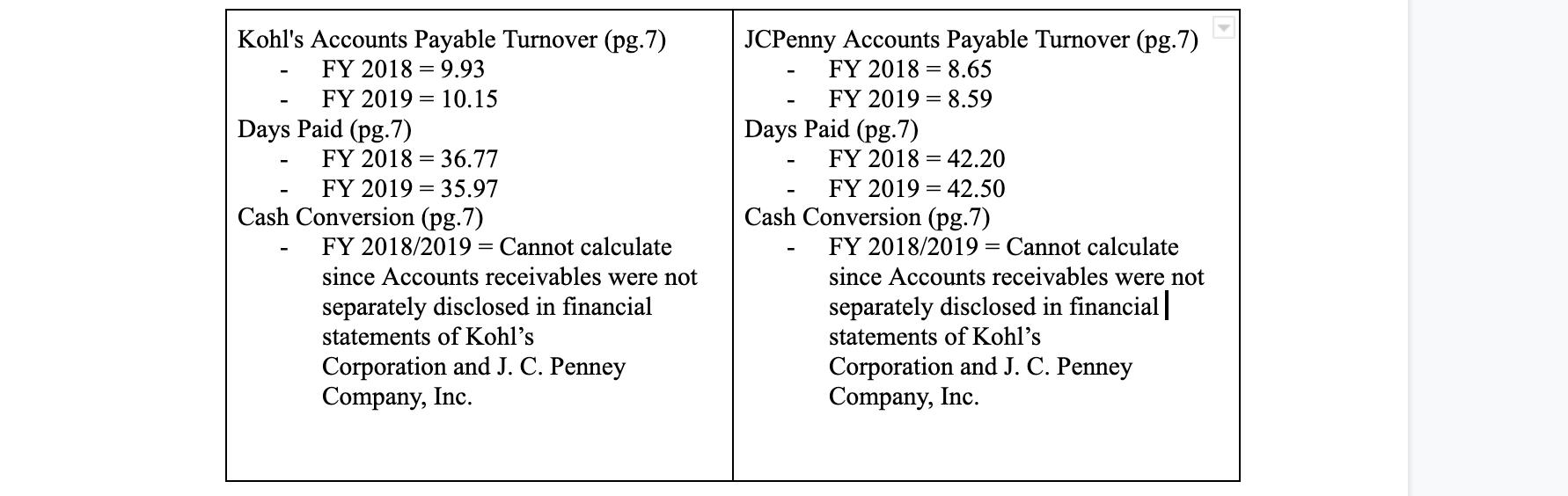

Review the other current assets, accounts payable, accrued liabilities and/or other current asset notes for both companies. Analyze your company's accounts payable turnover, days paid

Review the other current assets, accounts payable, accrued liabilities and/or other current asset notes for both companies. Analyze your company's accounts payable turnover, days paid and cash conversion for both companies. Are there differences between the two companies? Are there any recommendations you would make to improve the cash conversion cycle?

Kohl's Accounts Payable Turnover (pg.7) JCPenny Accounts Payable Turnover (pg.7) FY 2018 = 9.93 FY 2018 = 8.65 FY 2019 = FY 2019 = 8.59 Days Paid (pg.7) Days Paid (pg.7) FY 2018 = 36.77 FY 2018 42.20 FY 2019 = 35.97 FY 2019 = 42.50 Cash Conversion (pg.7) Cash Conversion (pg.7) FY 2018/2019 = Cannot calculate since Accounts receivables were not FY 2018/2019 = Cannot calculate since Accounts receivables were not separately disclosed in financial statements of Kohl's Corporation and J. C. Penney Company, Inc. separately disclosed in financial| statements of Kohl's Corporation and J. C. Penney Company, Inc.

Step by Step Solution

★★★★★

3.55 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Yes I have better Recommendation Observation Kohls Accounts Payable Turnover R...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started