Answered step by step

Verified Expert Solution

Question

1 Approved Answer

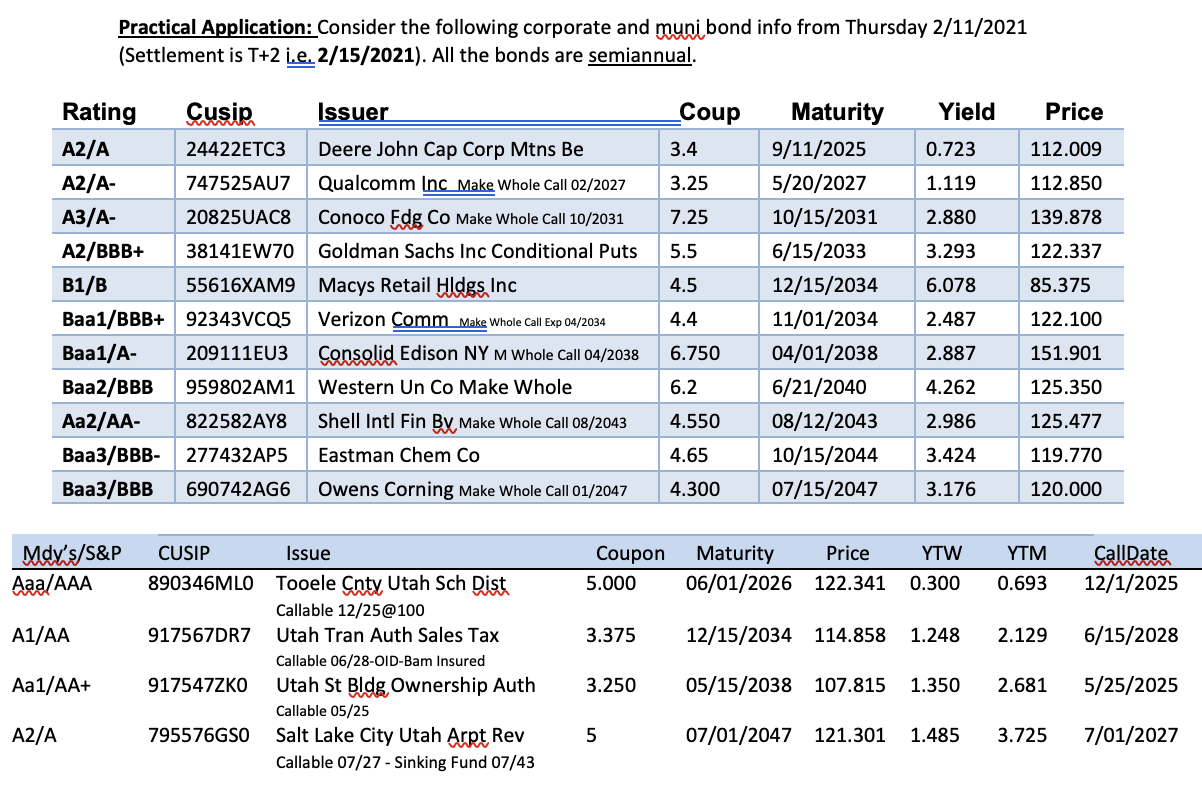

you may disregard Exercise #6. please just help me with exercise #7 Practical Application: Consider the following corporate and muni bond info from Thursday 2/11/2021

you may disregard Exercise #6. please just help me with exercise #7

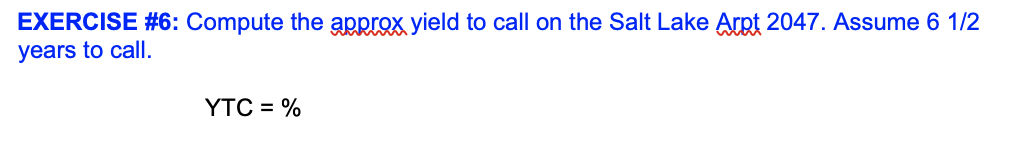

Practical Application: Consider the following corporate and muni bond info from Thursday 2/11/2021 (Settlement is T+2 i.e. 2/15/2021). All the bonds are semiannual. EXERCISE #6: Compute the approx yield to call on the Salt Lake Arpt 2047. Assume 61/2 years to call. YTC=% EXERCISE #7: Compute the Mod Duration of the EastmanChem 2044 bond by "blipping". [23 1/2 years to maturity] That is, compute three prices: at the current ytm, and by changing the ytm by 0.05% up and down. Then follow the ModR definition. Rescale correctly. ModD=%/y(P+5P5)/P/(y+5y5) Practical Application: Consider the following corporate and muni bond info from Thursday 2/11/2021 (Settlement is T+2 i.e. 2/15/2021). All the bonds are semiannual. EXERCISE #6: Compute the approx yield to call on the Salt Lake Arpt 2047. Assume 61/2 years to call. YTC=% EXERCISE #7: Compute the Mod Duration of the EastmanChem 2044 bond by "blipping". [23 1/2 years to maturity] That is, compute three prices: at the current ytm, and by changing the ytm by 0.05% up and down. Then follow the ModR definition. Rescale correctly. ModD=%/y(P+5P5)/P/(y+5y5) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started