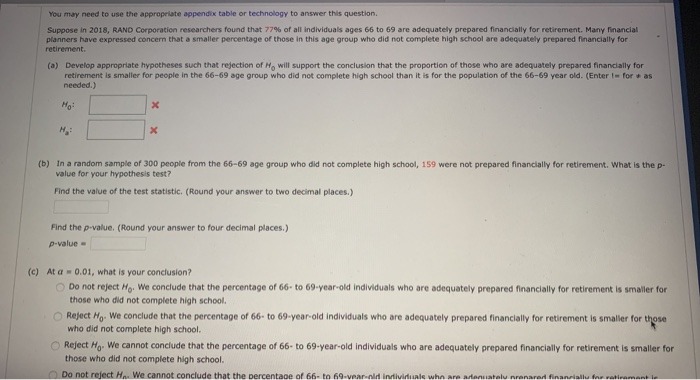

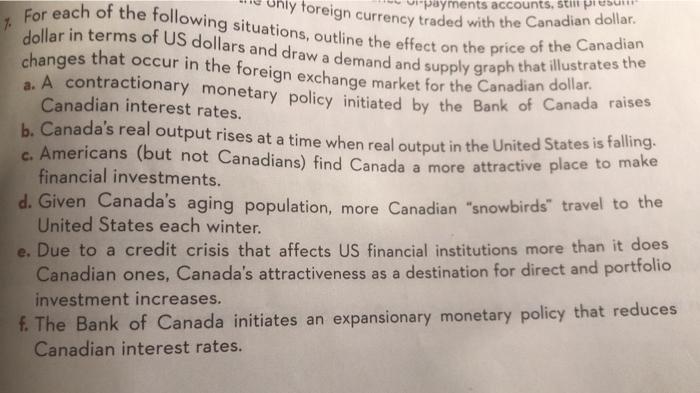

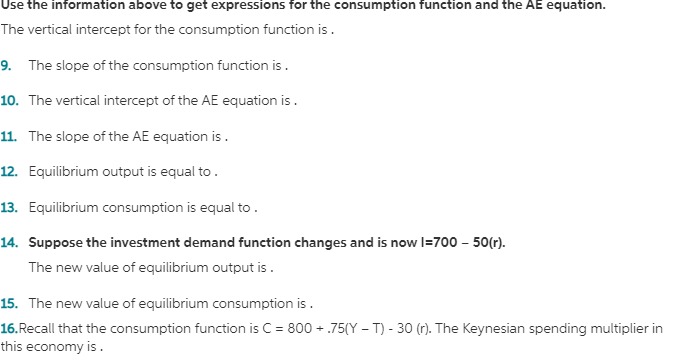

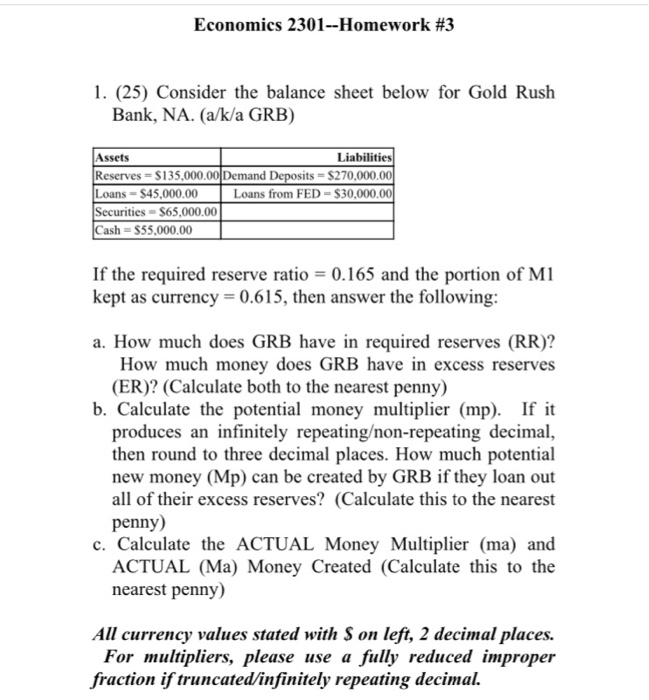

You may need to use the appropriate appendix table or technology to answer this question. Suppose In 2018, RAND Corporation researchers found that 77% of all individuals ages 66 to 65 are adequately prepared financially for retirement, Many financial planners have expressed concern that a smaller percentage of those in this age group who did not complete high school are adequately prepared financially for retirement. (a) Develop appropriate hypotheses such that rejection of N, will support the conclusion that the proportion of those who are adequately prepared financially for retirement is smaller for people in the 66-69 age group who did not complete high school than it is for the population of the 66-69 year old. (Enter In for a as needed.} (b) In a random sample of 300 people from the 65-69 age group who did not complete high school, 159 were not prepared financially for retirement. What is the p- value for your hypothesis test? Find the value of the test statistic. (Round your answer to two decimal places.) Find the p-value. (Round your answer to four decimal places.) p-value = (c] At a = 0.01, what is your conclusion? Do not reject He. We conclude that the percentage of 66- to 69-year-old individuals who are adequately prepared financially for retirement is smaller for those who did not complete high school. Reject Ho. We conclude that the percentage of 66- to 69-year-old individuals who are adequately prepared financially for retirement is smaller for those who did not complete high school. Reject Ho. We cannot conclude that the percentage of 66- to 69-year-old individuals who are adequately prepared financially for retirement is smaller for those who did not complete high school. Do not reject H,. We cannot conclude that the percentage of 66- to 69-vear-old individuals who are adequately pranarad financially far vaticanvi payments accounts, still PLEsuit IsOnly foreign currency traded with the Canadian dollar. 7. For each of the following situations, outline the effect on the price of the Canadian dollar in terms of US dollars and draw a demand and supply graph that illustrates the changes that occur in the foreign exchange market for the Canadian dollar. . A contractionary monetary policy initiated by the Bank of Canada raises Canadian interest rates. b. Canada's real output rises at a time when real output in the United States is falling. c. Americans (but not Canadians) find Canada a more attractive place to make financial investments. d. Given Canada's aging population, more Canadian "snowbirds" travel to the United States each winter. e. Due to a credit crisis that affects US financial institutions more than it does Canadian ones, Canada's attractiveness as a destination for direct and portfolio investment increases. f. The Bank of Canada initiates an expansionary monetary policy that reduces Canadian interest rates.Use the information above to get expressions for the consumption function and the AE equation. The vertical intercept for the consumption function is . 9. The slope of the consumption function is . 10. The vertical intercept of the AE equation is . 11. The slope of the AE equation is . 12. Equilibrium output is equal to . 13. Equilibrium consumption is equal to . 14. Suppose the investment demand function changes and is now |=700 - 50(r). The new value of equilibrium output is . 15. The new value of equilibrium consumption is . 16.Recall that the consumption function is C = 800 +.75(Y - T) - 30 (r). The Keynesian spending multiplier in this economy is .Economics 2301--Homework #3 1. (25) Consider the balance sheet below for Gold Rush Bank, NA. (a/k/a GRB) Assets Liabilities Reserves = $135,000.00 Demand Deposits = $270,000.00 Loans = $45.000.00 Loans from FED = $30,000.00 Securities = $65,000.00 Cash = $55,000.00 If the required reserve ratio = 0.165 and the portion of MI kept as currency = 0.615, then answer the following: a. How much does GRB have in required reserves (RR)? How much money does GRB have in excess reserves (ER)? (Calculate both to the nearest penny) b. Calculate the potential money multiplier (mp). If it produces an infinitely repeatingon-repeating decimal, then round to three decimal places. How much potential new money (Mp) can be created by GRB if they loan out all of their excess reserves? (Calculate this to the nearest penny) c. Calculate the ACTUAL Money Multiplier (ma) and ACTUAL (Ma) Money Created (Calculate this to the nearest penny) All currency values stated with S on left, 2 decimal places. For multipliers, please use a fully reduced improper fraction if truncated/infinitely repeating decimal