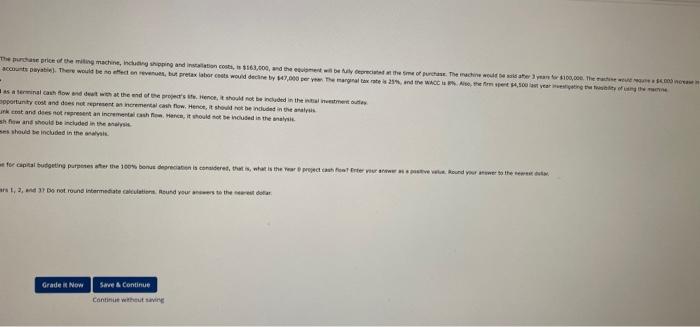

you must evaluate a proposal to buy a new milling machine.

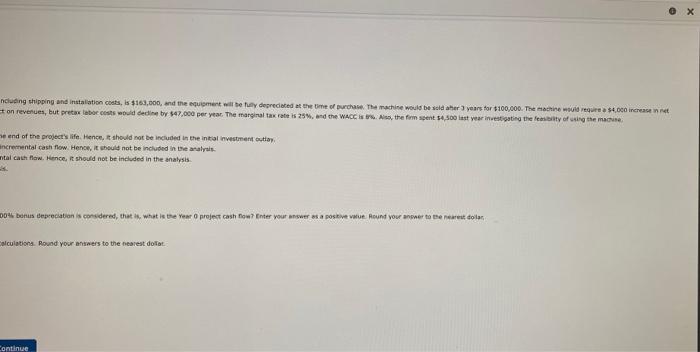

cool You must evaluate a proposal to buy new mong machine. The purchase price of the miling machine, Induling sing and to, 1163.000, and the corrent wieder ein af udom. The main pering working capital story les normas contas). There would be no effect on rebut telahert would dedine by $17,000 per ye The martxan WC, a. How should the spent tast year behandled 1. Last year's expenditure should be treated as a terminal how and chat with at the end of the projects the rest of the cluded in the interventy 1. Last year's expenditure is considered an oportunity cost and control represent an increment cash flow me serbe cured in the m. Last year's expenditure is considered s sunkins and does not representa incremental cost to Heard not be cluded in the 1 The cost of research is an incremental cow and should be included in the analysis Only tweetfect of the research expenses should be induced in the Wat is the trainvestment way to the machine for at udgeting purposer men depreciation is cord that we project for your own you What are the projeto com during re 1, 2 and 3? De not reunditermediate caktont Round your newers to the nearesto Yeni . Should the machine be purchased Grade it Now Save & Continue Continue without ing machine, including shopping and intuition costs, is $163.000, and the quipment will created at the time of purchase. The would be so here for $106.000. The main wou ould be no afect on revenues, but preta labor costs would decine by $47.000 per year. The marginal tax rate la 25, and the CC. As the trent 1.setas y tratto sing the dealt with at the end of the projecte. Hence, it should not be included in the investment represent an incremental cash flow. Hence, it should not be included in the analysis at an incremental cash w. Hence, I should not be included in the way ed in the analysis analysis er the 100% bonus dominis concidered, that is what is the wropecten we voor . Round you to the intermediate calculations, Mount your answers to the nearest ootan 7. Problem 12.09 (New Project Analysis) ebook You must evaluate a proposal to buy a new milling machine. The purchase price of the miling machine, including shipping and installation costs, is $163,000, and the equipment will be fully depreciate operating working capital (increased Inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $47,000 per year. The marginal tax rate a. How should the $4,500 spent last year be handled? 1. Last year's expenditure should be treated as a terminal cash flow and dealt with at the end of the project's life. Hence, it should not be included in the initial investment outlay 11. Last year's expenditure is considered an opportunity cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis III. Last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. IV. The cost of research is an incremental cash flow and should be included in the analysis V Only the tax effect of the research expenses should be included in the analysis. b. What is the initial investment outlay for the machine for capital budgeting purposes after the 100% bonus depreciation is considered, that is, what is the Year O project cash flow? Enter your and $ c. What are the project's annual cash flows during Years 1, 2, and 3Do not round Intermediate calculations. Round your answers to the nearest dollar Yes 15 Year 2:5 Year 3 d. Should the machine be purchased? The purchase price of the iting machine, indutining and code come of the water. The accurate. There would be done, but pretax borus would be pere. There were 1.300 - sa terminal can down twent the end of the projects. Hence, it should not be included in the interes opportunity cost and does not represents retalcan flow. Hence, it should not be induced in the analysis nk and does not represent an incremental, it should be used in the wall show and should be included in the es should be included in the for capital budgetine prestar the 100% bonus dans certats, what is the Year interest Round your mother out Do not round record. Round You were there Grade i Now Save Continue Continue without ncluding shipping and installation costs, is $169,000, and the equipment will be deprecated at the time of purchase. The machine would be sold her 3 years for $100,000. The machine would require 4.0 increased on revenues, but pretax labor costs would dedine by 47,000 per year. The marginal tax rate is 25%, and the WACC Ass, the firm spent $4.500 last year investigating the fastity of using the me e end of the project's life. Hence, should not be included in the initial investment to incremental cash flow. Hence, it should not be included in the analysis tal cash flow. Hence, it should not be included in the analysis 004 bertus deprecation is considered, that w, what be the Year o projet cash nou? Inter your answer sta poskwestue Round your answer to the parent collar, Calculations. Round your answers to the nearest dotat Continue