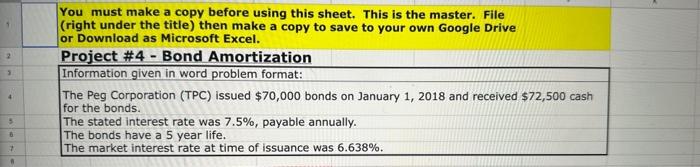

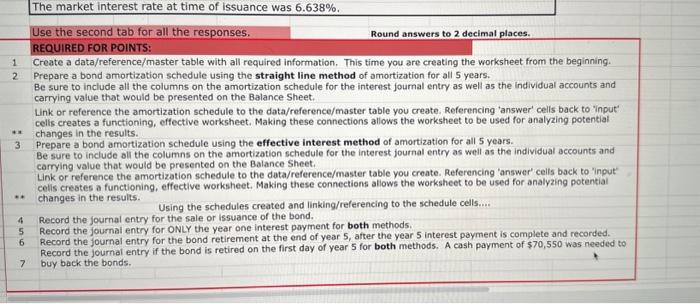

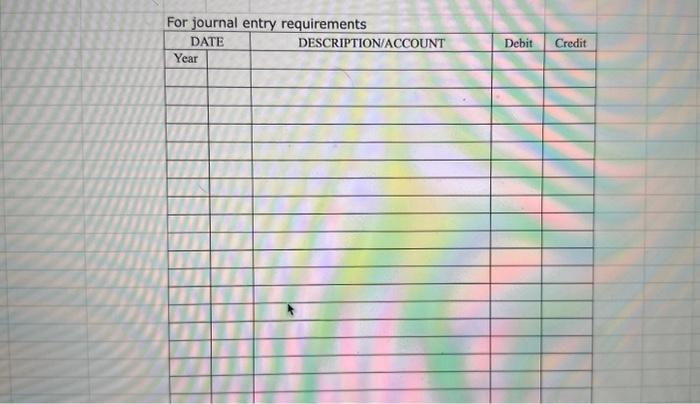

You must make a copy before using this sheet. This is the master. File (right under the title) then make a copy to save to your own Google Drive or Download as Microsoft Excel. Project \#4 - Bond Amortization Information given in word problem format: The Peg Corporation (TPC) issued $70,000 bonds on January 1,2018 and received $72,500 cash for the bonds. The stated interest rate was 7.5%, payable annually. The bonds have a 5 year life. The market interest rate at time of issuance was 6.638%. Use the second tab for all the responses. Round answers to 2 decimal places. REQUIRED FOR POINTS: 1 Create a data/reference/master table with all required information. This time you are creating the worksheet from the beginning. 2 Prepare a bond amortization schedule using the straight line method of amortization for all 5 years. Be sure to include all the columns on the amortization schedule for the interest fournal entry as well as the individual accounts and carrying value that would be presented on the Balance Sheet. Link or reference the amortization schedule to the data/reference/master table you create. Referencing 'answer' cells back to 'input' cells creates a functioning, effective worksheet. Making these connections allows the worksheet to be used for analyzing potential changes in the results. 3 Prepare a bond amortization schedule using the effective interest method of amortization for all 5 years. Be sure to include all the columns on the amortization schedule for the interest journal entry as well as the individual accounts and carrying value that would be presented on the Balance Sheet. Link or reference the amortization schedule to the data/reference/master table you create. Referencing 'answer' cells back to "input' celis creates a functioning, effective worksheet. Making these connections allows the worksheet to be used for analyzing potential changes in the results. Using the schedules created and linking/referencing to the schedule cells.... 4 Record the journal entry for the sale or issuance of the bond. Record the journal entry for ONLY the year one interest payment for both methods. Record the journal entry for the bond retirement at the end of year 5 , after the year 5 interest payment is complete and recorded. Record the journal entry if the bond is retired on the first day of year 5 for both methods. A cash payment of $70,550 was needed to 7 buy back the bonds. Chapter \& Course Outcomes: (demonstrated in this project) A Complete amortization calculations using both the straight line and effective interest methodologies. B Analyze and record journal entries for bond liability transactions including sale, interest payment and amortization of discount or premium. Determine the impact on the financial statements. C Use Microsoft Excel proficiently to record and summarize information used in business analysis and decision making. For journal entry requirements \begin{tabular}{|l|l|l|l|l|} \hline \multicolumn{2}{|c|}{ DATE } & DESCRIPTION/ACCOUNT & Debit & Credit \\ \hline Year & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular}