Answered step by step

Verified Expert Solution

Question

1 Approved Answer

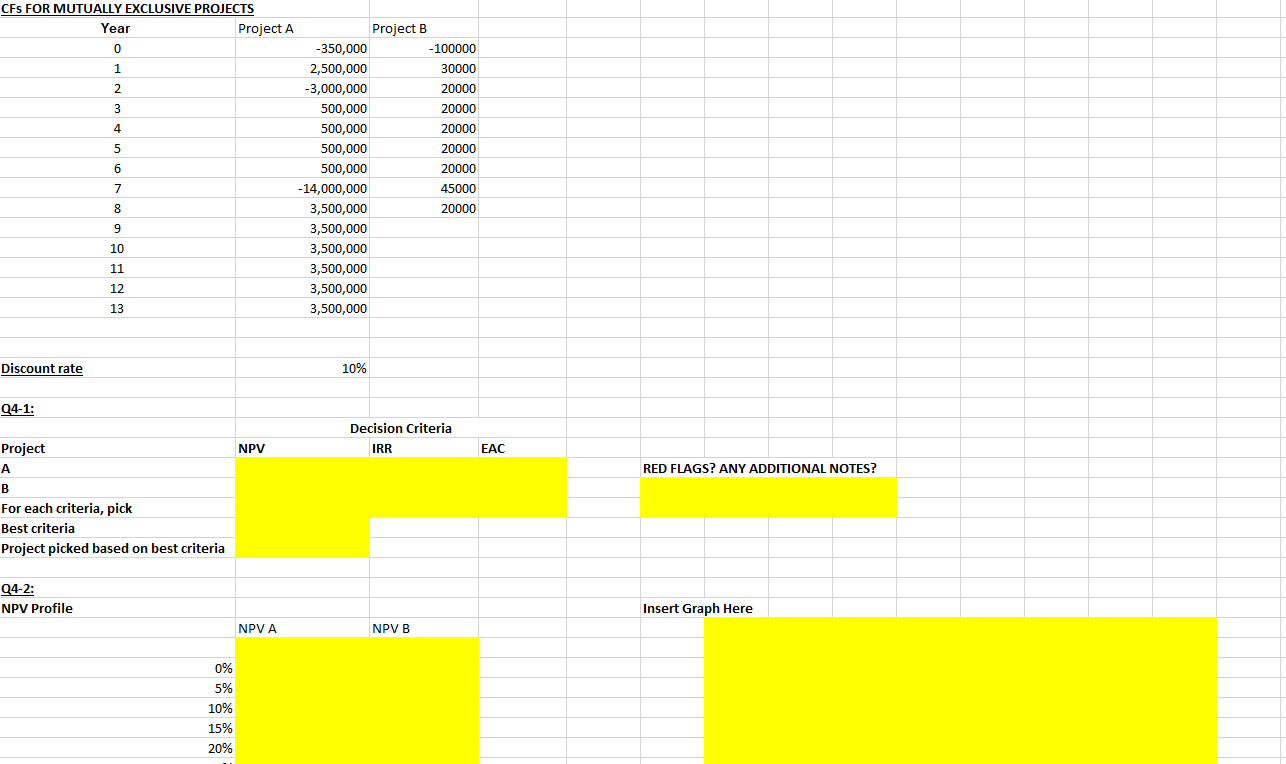

You must pick between two mutually exclusive projects (A and B), with the cash flows and discount rate provided to you on tab M1.Q2. Compute

You must pick between two mutually exclusive projects (A and B), with the cash flows and discount rate provided to you on tab M1.Q2.

- Compute NPV, IRR and EAC for each project and identify which project would be picked under each criterion. Pick the best decision rule and identify what project would you pick between A and B.

- Using a data table, analyze how the NPV of each project changes in response to changes in the discount rate. Draw the NPV profiles of the two projects on the same graph (make sure your graph has a title, your axis are titled, and identify your data series as Project A and Project B).

- Figure out for what discount rate you would be indifferent between the two projects (i.e., the discount rate for which the two projects have the same NPV).

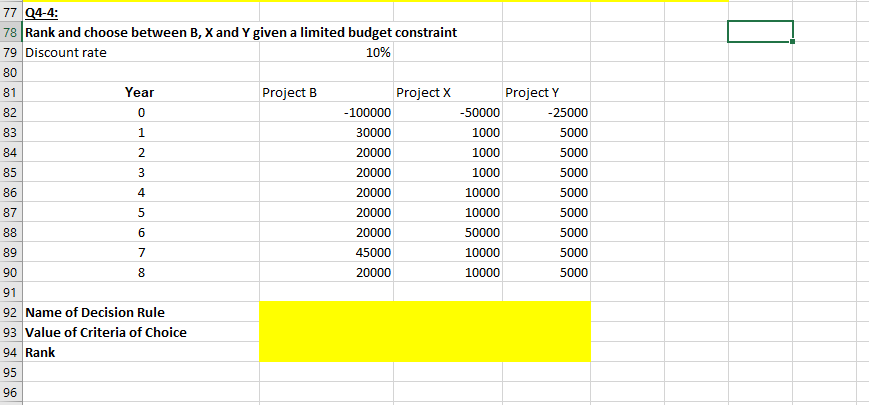

- Assume that you decided to pick Project B, but you are dealing with a limited budget. You now are comparing project B with two other projects (X and Y) rank this projects in order of preference based on a decision rule that takes into account your limited budget (make sure that the project you would pick gets rank 1).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started