Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You must show equations, all calculator inputs, and outcomes to receive full or partial credit. 1. A company buys $1 million in equipment for

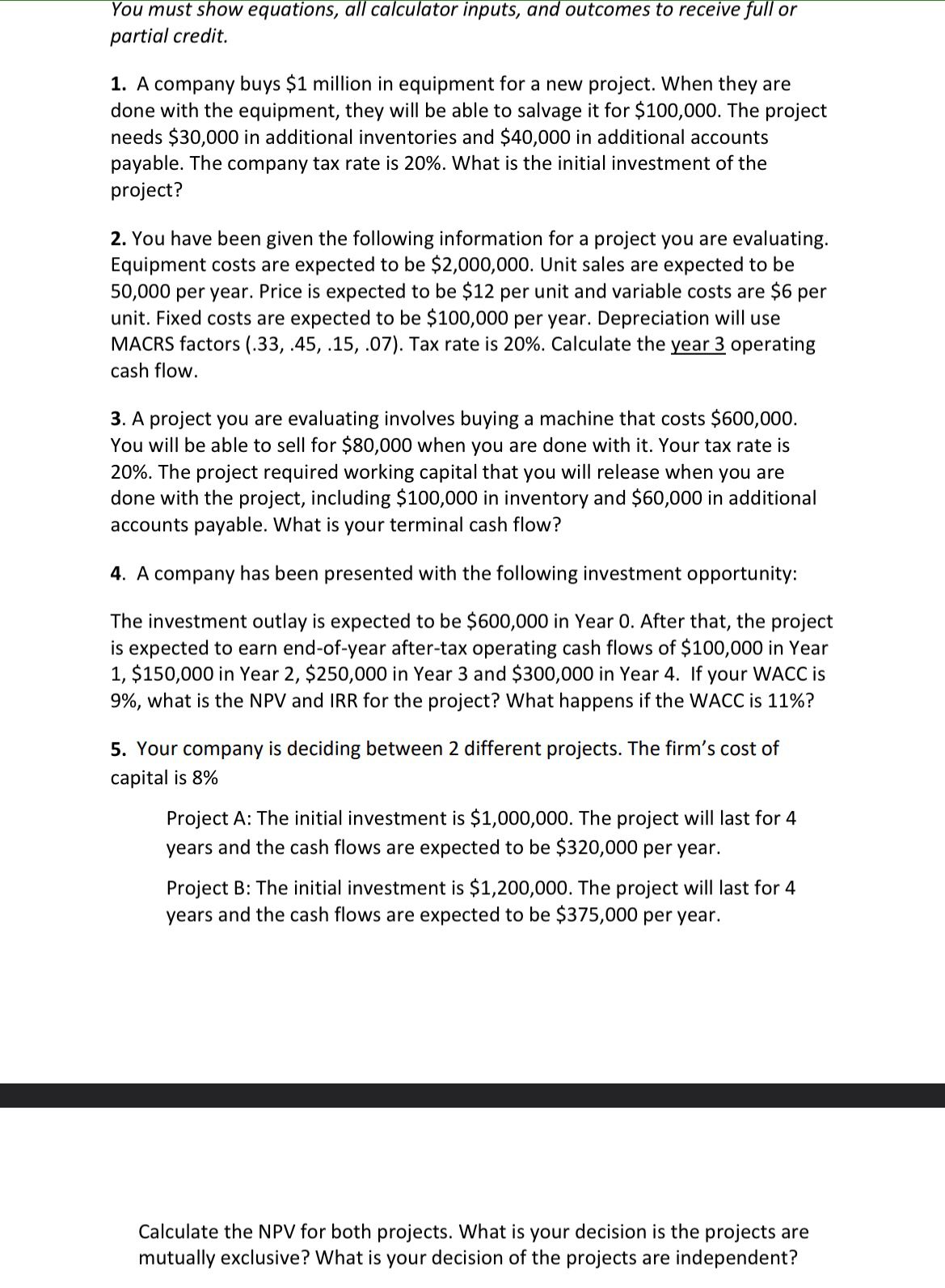

You must show equations, all calculator inputs, and outcomes to receive full or partial credit. 1. A company buys $1 million in equipment for a new project. When they are done with the equipment, they will be able to salvage it for $100,000. The project needs $30,000 in additional inventories and $40,000 in additional accounts payable. The company tax rate is 20%. What is the initial investment of the project? 2. You have been given the following information for a project you are evaluating. Equipment costs are expected to be $2,000,000. Unit sales are expected to be 50,000 per year. Price is expected to be $12 per unit and variable costs are $6 per unit. Fixed costs are expected to be $100,000 per year. Depreciation will use MACRS factors (.33, .45, .15, .07). Tax rate is 20%. Calculate the year 3 operating cash flow. 3. A project you are evaluating involves buying a machine that costs $600,000. You will be able to sell for $80,000 when you are done with it. Your tax rate is 20%. The project required working capital that you will release when you are done with the project, including $100,000 in inventory and $60,000 in additional accounts payable. What is your terminal cash flow? 4. A company has been presented with the following investment opportunity: The investment outlay is expected to be $600,000 in Year O. After that, the project is expected to earn end-of-year after-tax operating cash flows of $100,000 in Year 1, $150,000 in Year 2, $250,000 in Year 3 and $300,000 in Year 4. If your WACC is 9%, what is the NPV and IRR for the project? What happens if the WACC is 11%? 5. Your company is deciding between 2 different projects. The firm's cost of capital is 8% Project A: The initial investment is $1,000,000. The project will last for 4 years and the cash flows are expected to be $320,000 per year. Project B: The initial investment is $1,200,000. The project will last for 4 years and the cash flows are expected to be $375,000 per year. Calculate the NPV for both projects. What is your decision is the projects are mutually exclusive? What is your decision of the projects are independent?

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 To calculate the initial investment of the project we need to consider the cost of equipment salvage value additional inventories and additional accounts payable The formula for the initial investme...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started