Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You must show timelines, formulas with the values (numbers) included, and the final answer and you should NEVER ROUND INTERMEDIATE CALCULATIONS. Final dollar answers should

You must show timelines, formulas with the values (numbers) included, and the final answer and you should NEVER ROUND INTERMEDIATE CALCULATIONS. Final dollar answers should be rounded to two decimal places. Unless otherwise indicated, final interest rate answers should be rounded to 6 decimal places if expressed as a decimal or 4 decimal places if expressed as a percent. You do not need to show trailing zeros (i.e., if no non-zero digits remain, 2.5% will do instead of 2.500000%) but make certain there are none.

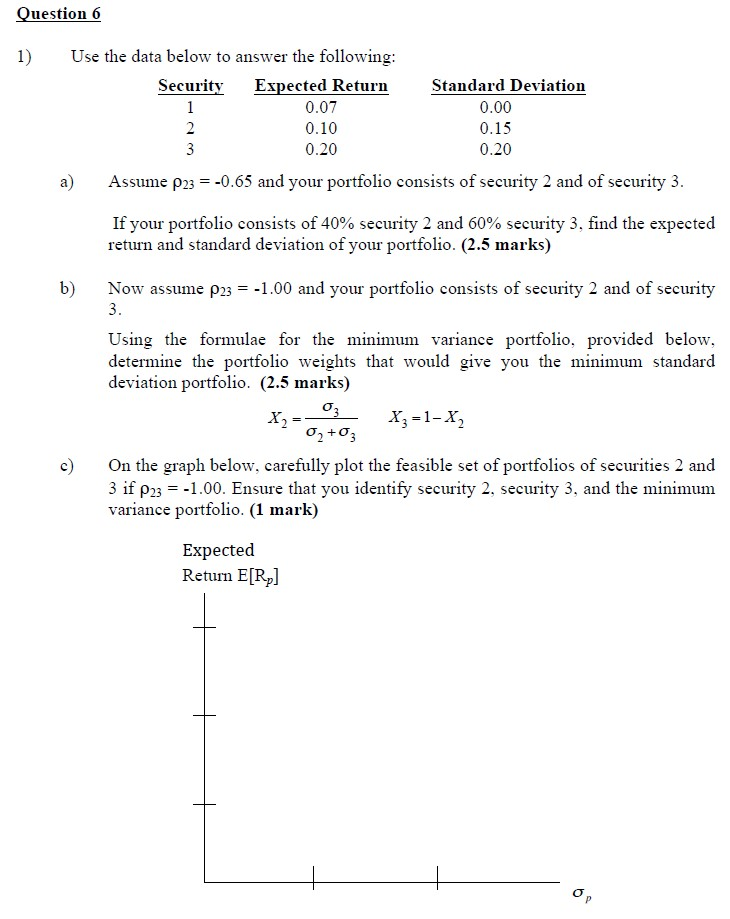

Question 6 1) Use the data below to answer the following: Security Expected Return Standard Deviation 0.07 0.00 2 0.10 0.15 0.20 0.20 a) Assume P23 = -0.65 and your portfolio consists of security 2 and of security 3. 3 If your portfolio consists of 40% security 2 and 60% security 3, find the expected return and standard deviation of your portfolio. (2.5 marks) b) Now assume P23 = -1.00 and your portfolio consists of security 2 and of security 3. Using the formulae for the minimum variance portfolio, provided below, determine the portfolio weights that would give you the minimum standard deviation portfolio. (2.5 marks) X2 = X; -1-X2 02 +03 On the graph below, carefully plot the feasible set of portfolios of securities 2 and 3 if P23 = -1.00. Ensure that you identify security 2, security 3, and the minimum variance portfolio. (1 mark) 03 c) Expected Return E[R]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started