Question

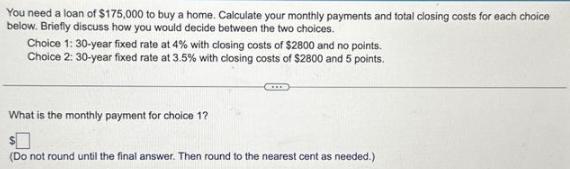

You need a loan of $175,000 to buy a home. Calculate your monthly payments and total closing costs for each choice below. Briefly discuss

You need a loan of $175,000 to buy a home. Calculate your monthly payments and total closing costs for each choice below. Briefly discuss how you would decide between the two choices. Choice 1: 30-year fixed rate at 4% with closing costs of $2800 and no points. Choice 2: 30-year fixed rate at 3.5% with closing costs of $2800 and 5 points. What is the monthly payment for choice 1? (Do not round until the final answer. Then round to the nearest cent as needed.)

Step by Step Solution

3.51 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Computation of Monthly Payment Given The loan amoun...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Calculus Early Transcendentals

Authors: William L. Briggs, Lyle Cochran, Bernard Gillett

2nd edition

321954428, 321954424, 978-0321947345

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App