Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You need to answer this cash flow question as soon as possible. The data and support ling details are here Answer as soon as possible.

You need to answer this cash flow question as soon as possible.

The data and support ling details are here

Answer as soon as possible.

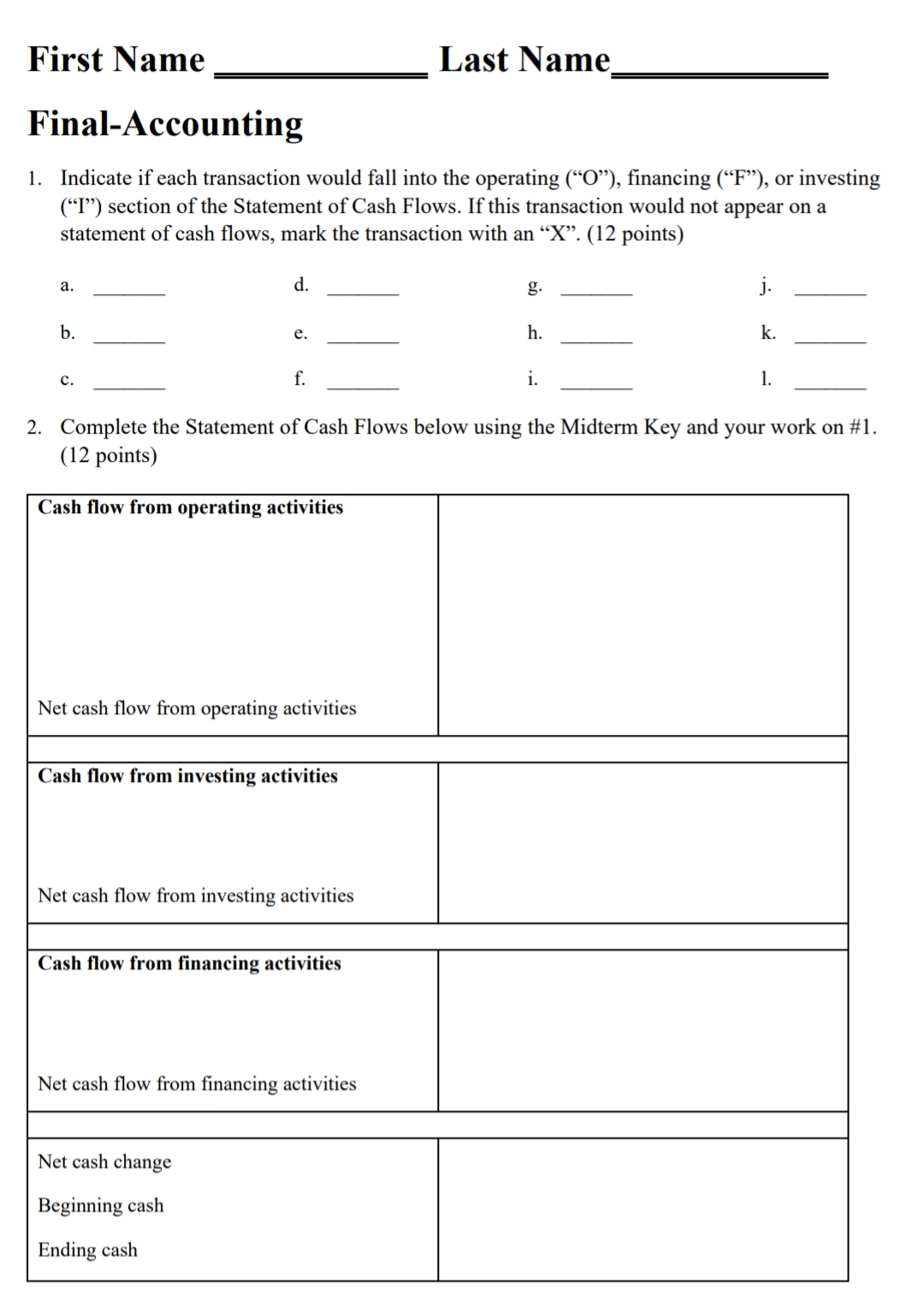

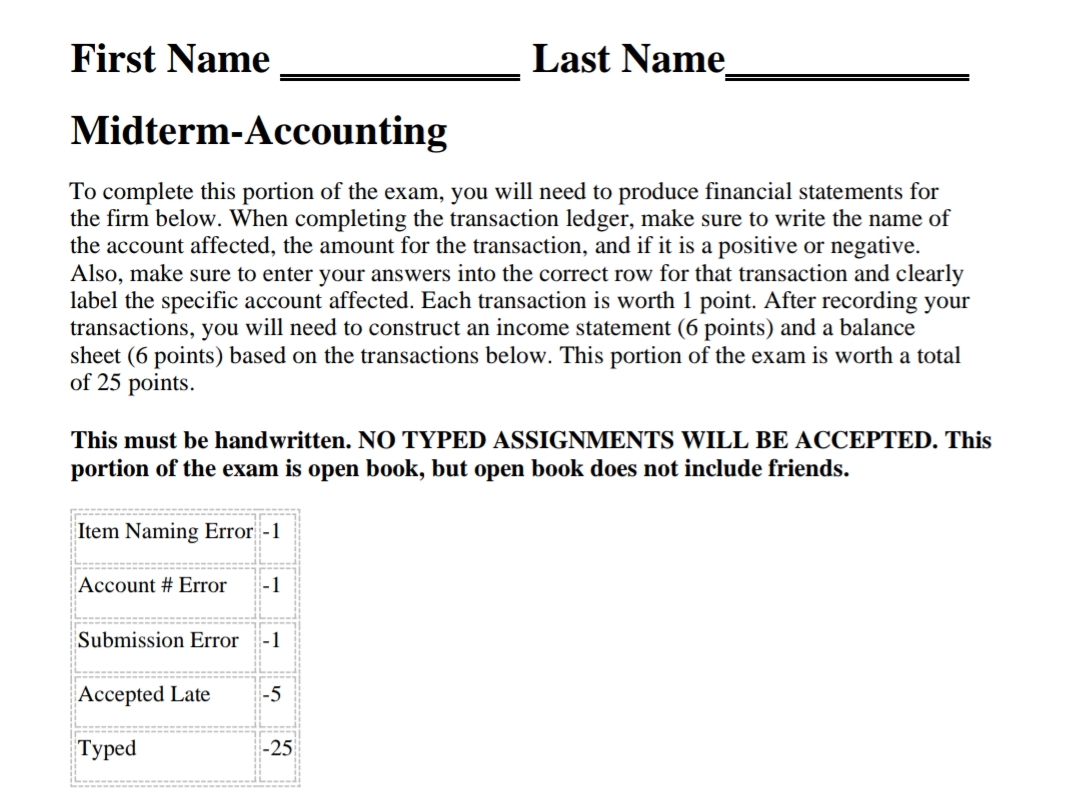

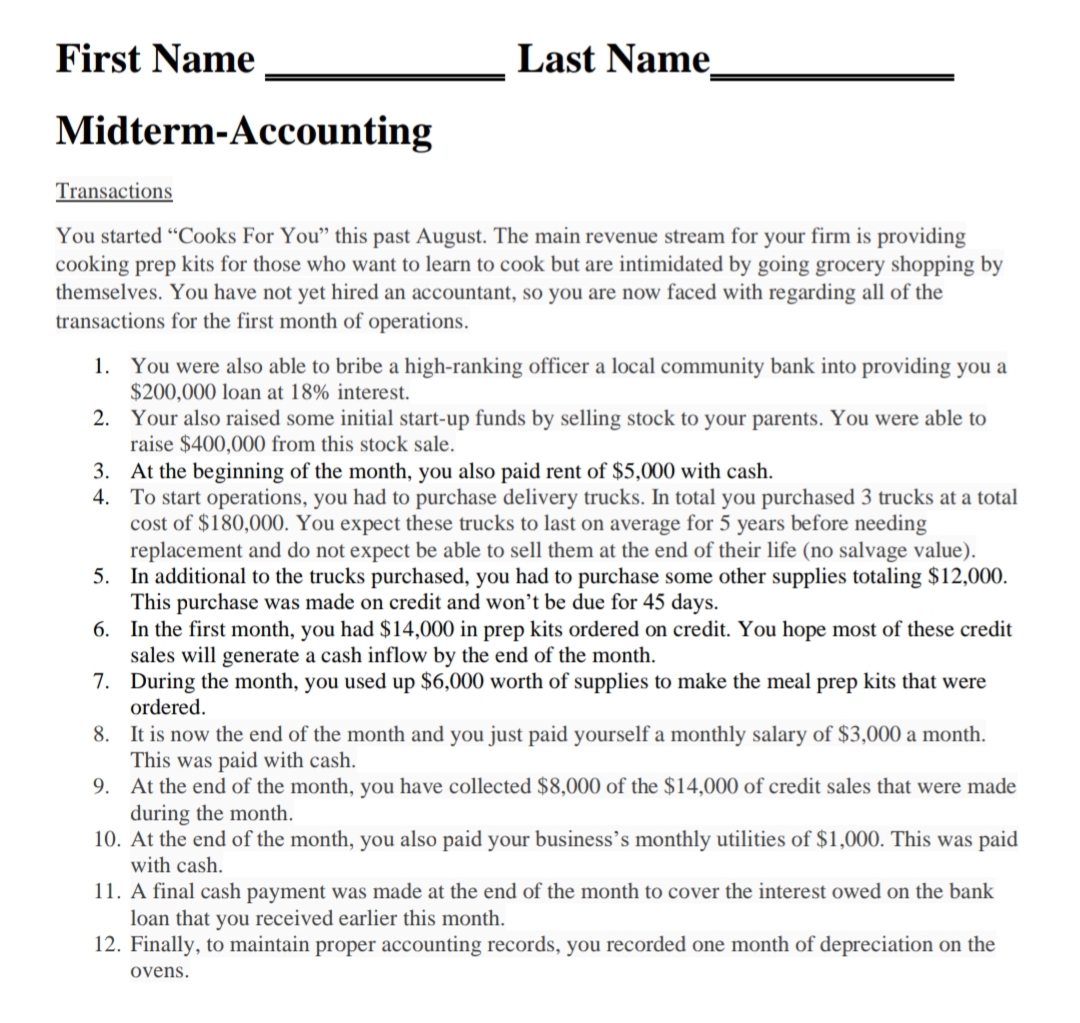

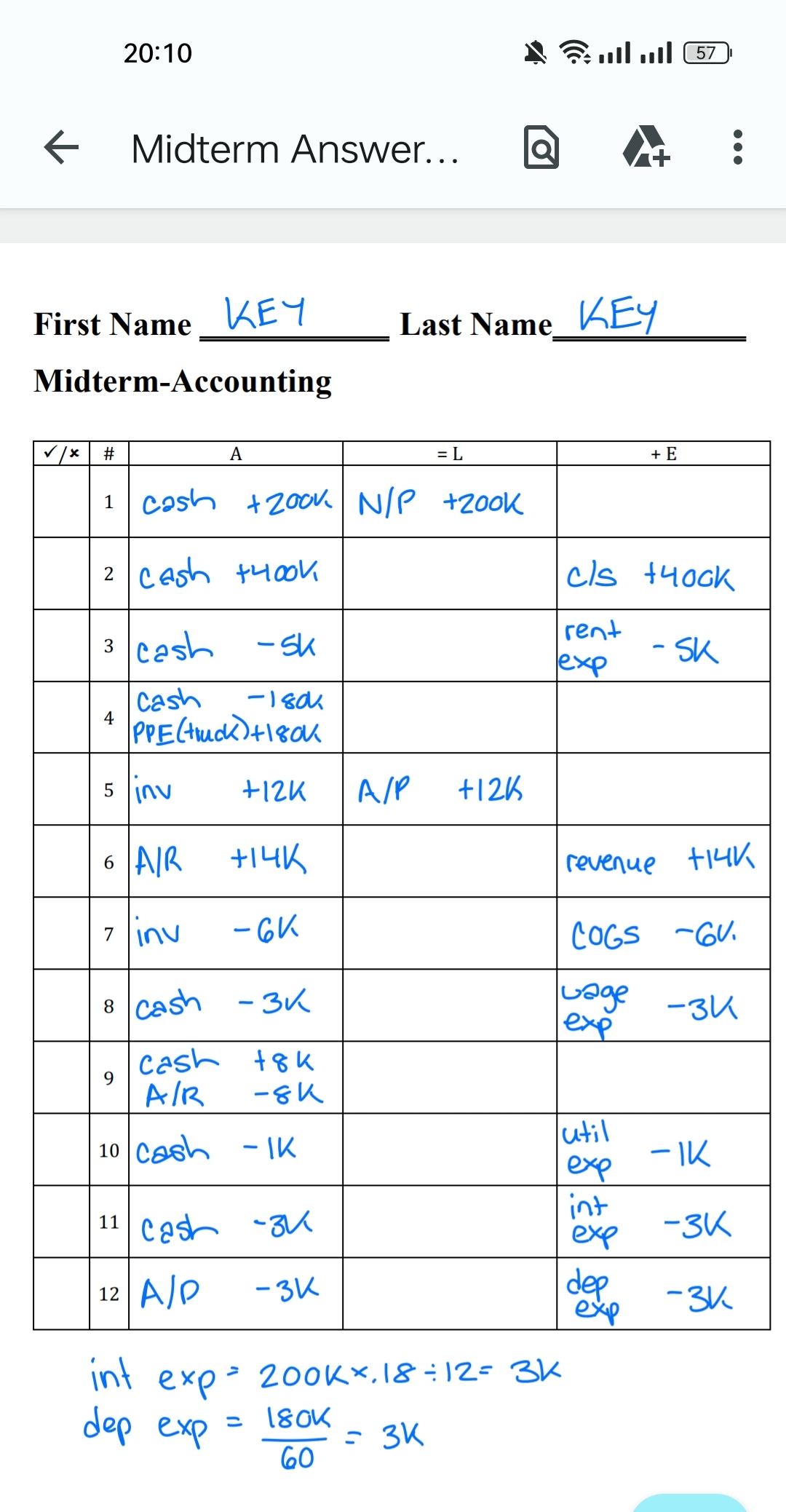

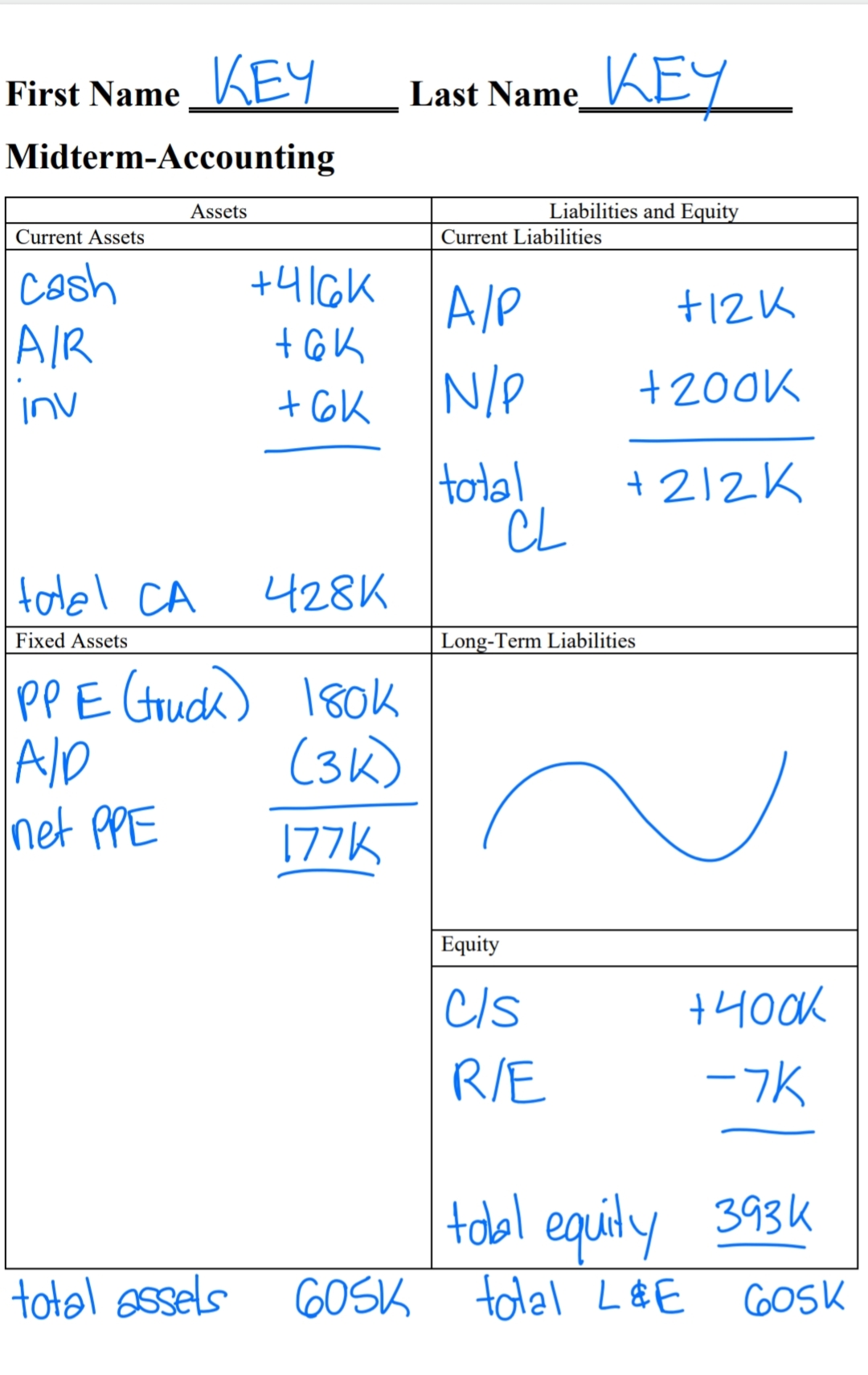

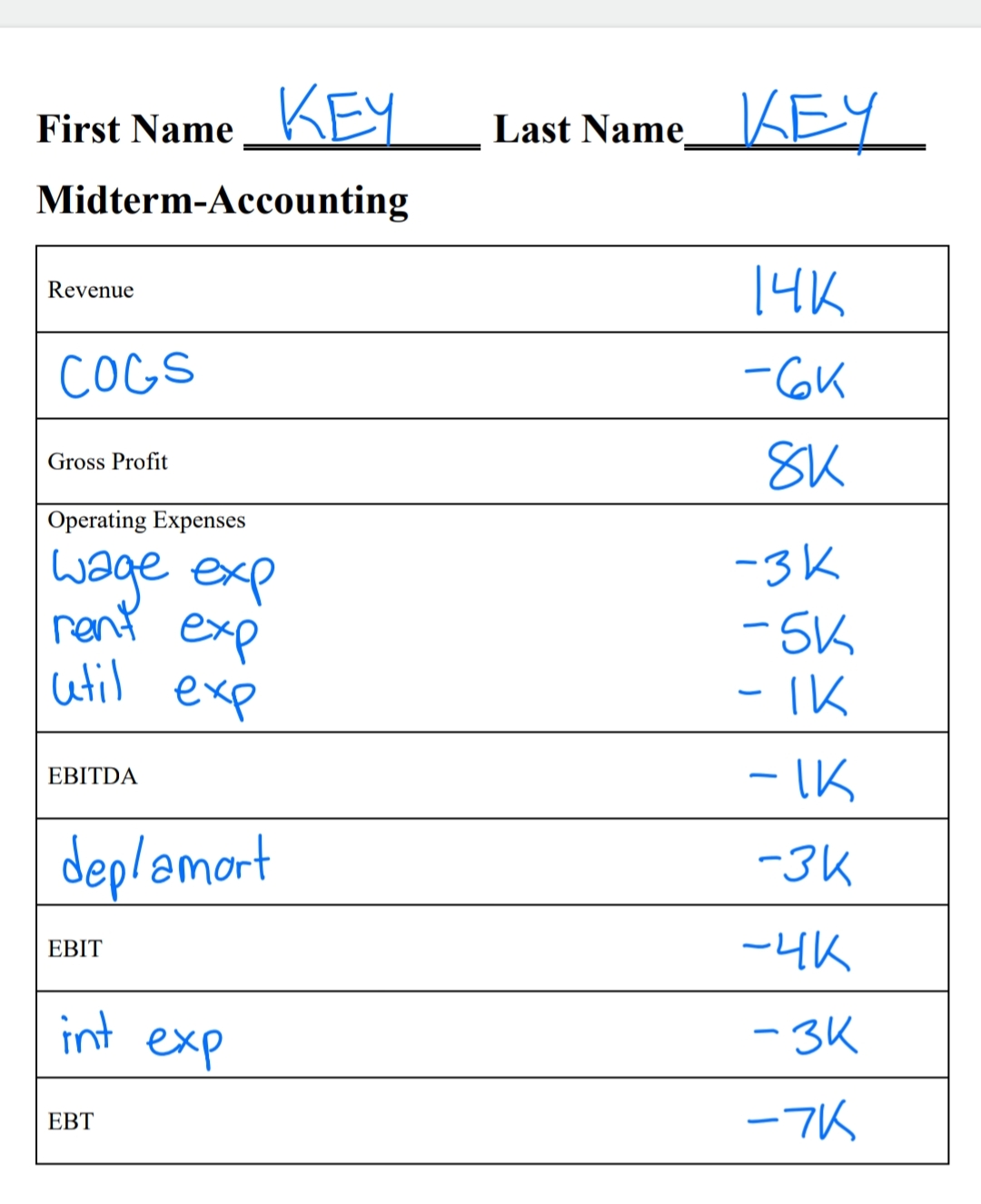

1. Indicate if each transaction would fall into the operating ("O"), financing ("F"), or investing ("I") section of the Statement of Cash Flows. If this transaction would not appear on a statement of cash flows, mark the transaction with an " X ". (12 points) a. d. b. e. h. k. c. f. i. 1. 2. Complete the Statement of Cash Flows below using the Midterm Key and your work on \#1. (12 points) Midterm-Accounting To complete this portion of the exam, you will need to produce financial statements for the firm below. When completing the transaction ledger, make sure to write the name of the account affected, the amount for the transaction, and if it is a positive or negative. Also, make sure to enter your answers into the correct row for that transaction and clearly label the specific account affected. Each transaction is worth 1 point. After recording your transactions, you will need to construct an income statement (6 points) and a balance sheet (6 points) based on the transactions below. This portion of the exam is worth a total of 25 points. This must be handwritten. NO TYPED ASSIGNMENTS WILL BE ACCEPTED. This portion of the exam is open book, but open book does not include friends. You started "Cooks For You" this past August. The main revenue stream for your firm is providing cooking prep kits for those who want to learn to cook but are intimidated by going grocery shopping by themselves. You have not yet hired an accountant, so you are now faced with regarding all of the transactions for the first month of operations. 1. You were also able to bribe a high-ranking officer a local community bank into providing you a $200,000 loan at 18% interest. 2. Your also raised some initial start-up funds by selling stock to your parents. You were able to raise $400,000 from this stock sale. 3. At the beginning of the month, you also paid rent of $5,000 with cash. 4. To start operations, you had to purchase delivery trucks. In total you purchased 3 trucks at a total cost of $180,000. You expect these trucks to last on average for 5 years before needing replacement and do not expect be able to sell them at the end of their life (no salvage value). 5. In additional to the trucks purchased, you had to purchase some other supplies totaling $12,000. This purchase was made on credit and won't be due for 45 days. 6. In the first month, you had $14,000 in prep kits ordered on credit. You hope most of these credit sales will generate a cash inflow by the end of the month. 7. During the month, you used up $6,000 worth of supplies to make the meal prep kits that were ordered. 8. It is now the end of the month and you just paid yourself a monthly salary of $3,000 a month. This was paid with cash. 9. At the end of the month, you have collected $8,000 of the $14,000 of credit sales that were made during the month. 10. At the end of the month, you also paid your business's monthly utilities of $1,000. This was paid with cash. 11. A final cash payment was made at the end of the month to cover the interest owed on the bank loan that you received earlier this month. 12. Finally, to maintain proper accounting records, you recorded one month of depreciation on the ovens. First Name KEY Last Name KEy Midterm-Accounting intexp=200K.18+1=3Kdepexp=60180K=3K First Name KEY Last Name KEY First Name KVY Last Name 1 E E Midterm-AccountingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started