Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You need to choose between making a public offering and arranging a private placement. In each case, the issue involves $9.6 million face value of

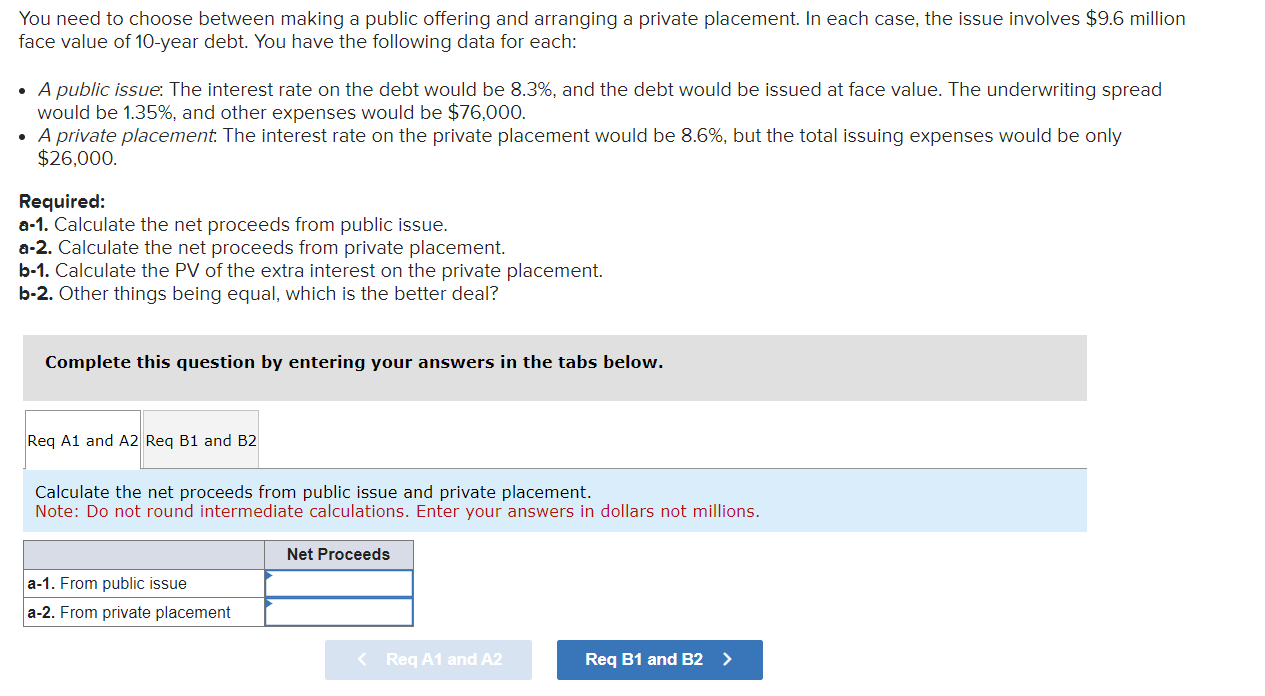

You need to choose between making a public offering and arranging a private placement. In each case, the issue involves $9.6 million face value of 10-year debt. You have the following data for each: - A public issue: The interest rate on the debt would be 8.3%, and the debt would be issued at face value. The underwriting spread would be 1.35%, and other expenses would be $76,000. - A private placement. The interest rate on the private placement would be 8.6%, but the total issuing expenses would be only $26,000. Required: a-1. Calculate the net proceeds from public issue. a-2. Calculate the net proceeds from private placement. b-1. Calculate the PV of the extra interest on the private placement. b2. Other things being equal, which is the better deal? Complete this question by entering your answers in the tabs below. Calculate the net proceeds from public issue and private placement. Note: Do not round intermediate calculations. Enter your answers in dollars not millions

You need to choose between making a public offering and arranging a private placement. In each case, the issue involves $9.6 million face value of 10-year debt. You have the following data for each: - A public issue: The interest rate on the debt would be 8.3%, and the debt would be issued at face value. The underwriting spread would be 1.35%, and other expenses would be $76,000. - A private placement. The interest rate on the private placement would be 8.6%, but the total issuing expenses would be only $26,000. Required: a-1. Calculate the net proceeds from public issue. a-2. Calculate the net proceeds from private placement. b-1. Calculate the PV of the extra interest on the private placement. b2. Other things being equal, which is the better deal? Complete this question by entering your answers in the tabs below. Calculate the net proceeds from public issue and private placement. Note: Do not round intermediate calculations. Enter your answers in dollars not millions Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started