Answered step by step

Verified Expert Solution

Question

1 Approved Answer

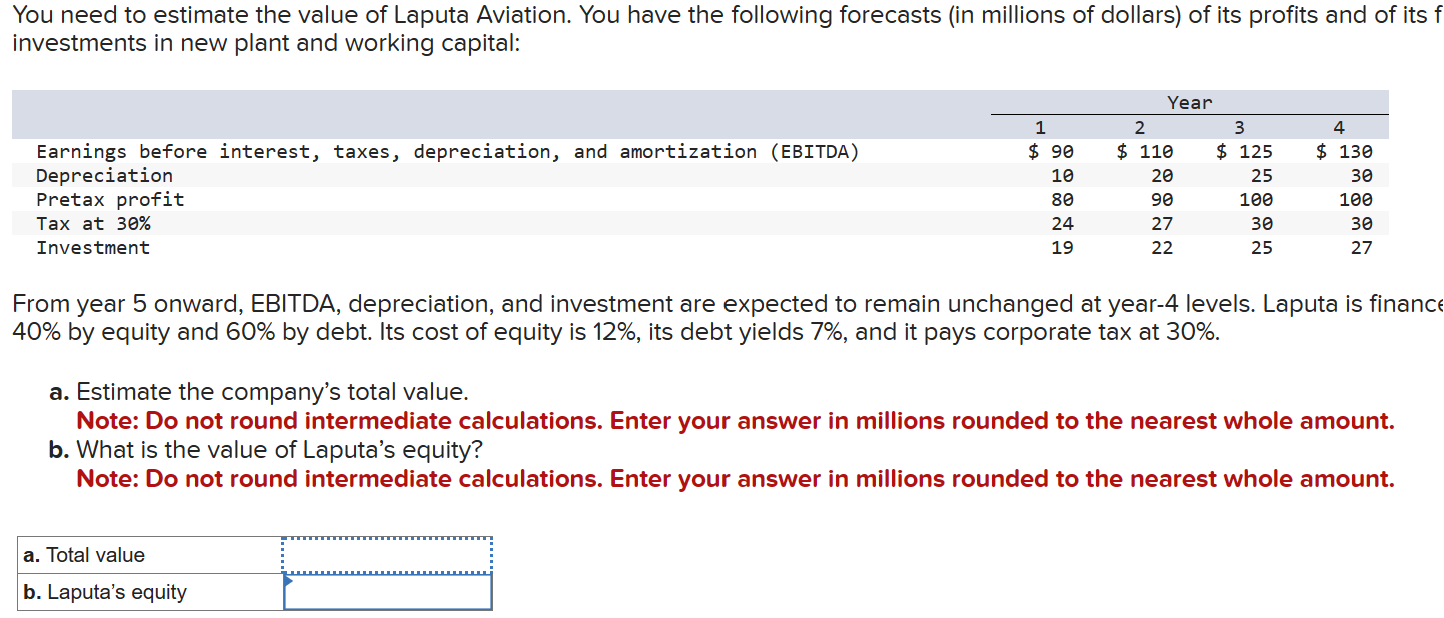

You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its

You need to estimate the value of Laputa Aviation. You have the following forecasts (in millions of dollars) of its profits and of its f investments in new plant and working capital: Year 1 2 3 4 Earnings before interest, taxes, depreciation, and amortization (EBITDA) Depreciation $ 90 $ 110 $ 125 $ 130 10 20 25 30 Pretax profit 80 90 100 100 Tax at 30% 24 27 30 30 Investment 19 22 25 27 From year 5 onward, EBITDA, depreciation, and investment are expected to remain unchanged at year-4 levels. Laputa is finance 40% by equity and 60% by debt. Its cost of equity is 12%, its debt yields 7%, and it pays corporate tax at 30%. a. Estimate the company's total value. Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. b. What is the value of Laputa's equity? Note: Do not round intermediate calculations. Enter your answer in millions rounded to the nearest whole amount. a. Total value b. Laputa's equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To estimate the total value of Laputa Aviation and the value of Laputas equity we need to calculate ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started