Answered step by step

Verified Expert Solution

Question

1 Approved Answer

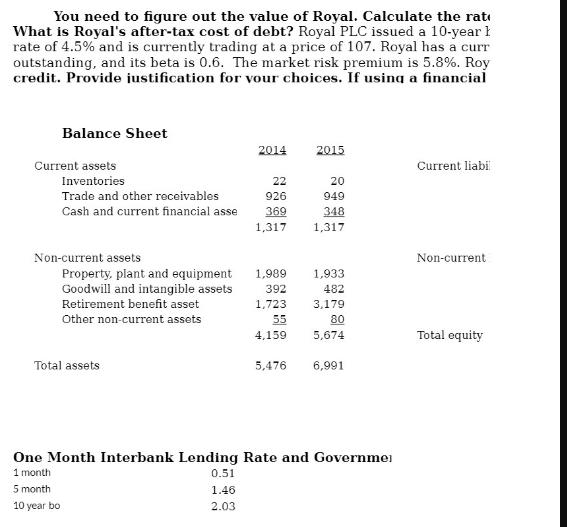

You need to figure out the value of Royal. Calculate the rat What is Royal's after-tax cost of debt? Royal PLC issued a 10-year

You need to figure out the value of Royal. Calculate the rat What is Royal's after-tax cost of debt? Royal PLC issued a 10-year I rate of 4.5% and is currently trading at a price of 107. Royal has a curr outstanding, and its beta is 0.6. The market risk premium is 5.8%. Roy credit. Provide justification for your choices. If using a financial Balance Sheet 2014 2015 Current assets Current liabil Inventories 22 20 Trade and other receivables 926 949 Cash and current financial asse 369 348 1,317 1,317 Non-current Non-current assets Property, plant and equipment 1,989 1,933 Goodwill and intangible assets 392 482 Retirement benefit asset 1,723 3,179 Other non-current assets 55 80 4,159 5,674 Total equity Total assets 5,476 6,991 One Month Interbank Lending Rate and Governme 1 month 5 month 10 year bo 0.51 1.46 2.03

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Royals AfterTax Cost of Debt and WACC Estimation We cant definitively determine Royals value or weighted average cost of capital WACC with the provide...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started