Question

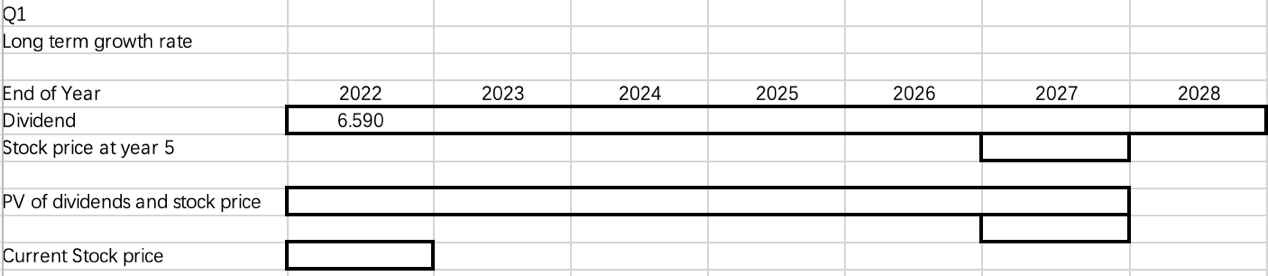

You now need to assess Company X's stock.Your department's advice is to price using the dividend discount model and discounted free cash flow valuation approach.

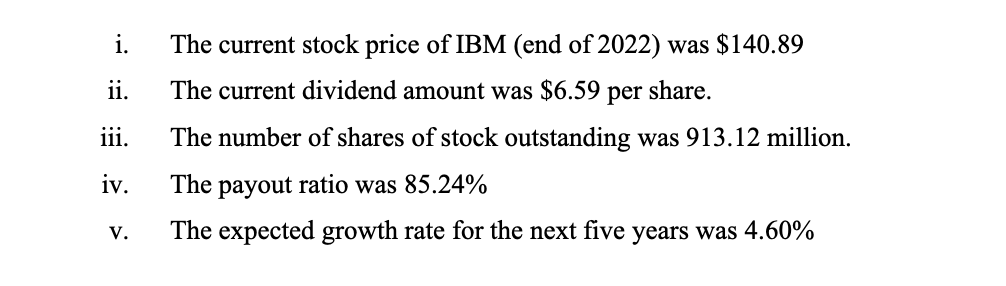

You now need to assess Company X's stock.Your department's advice is to price using the dividend discount model and discounted free cash flow valuation approach. This company's cost of equity is 13.5%, with an after-tax WACC of 12.65%. The estimated return on the new investment is 14% (return on retained profits divided by return on equity). When these two methodologies are applied to actual data, the results might be significantly different. You're hoping that the two ways will provide similar costs.

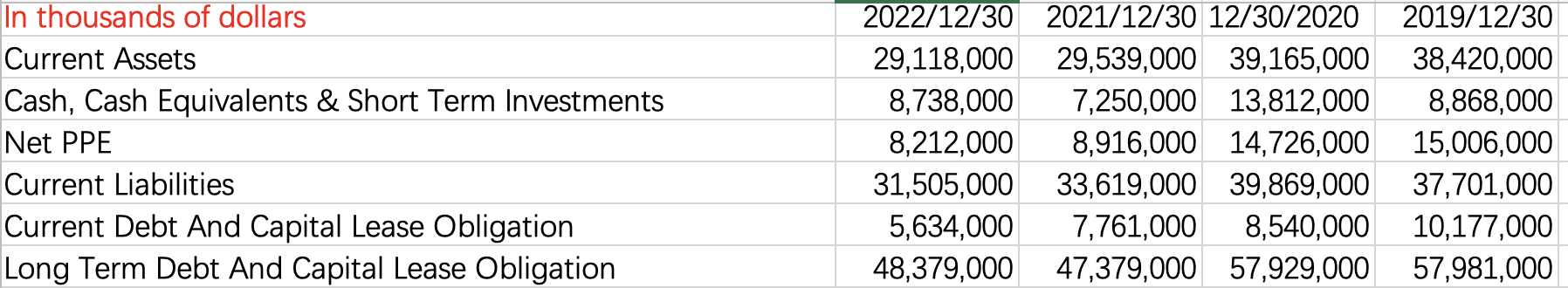

Currently you have the following information

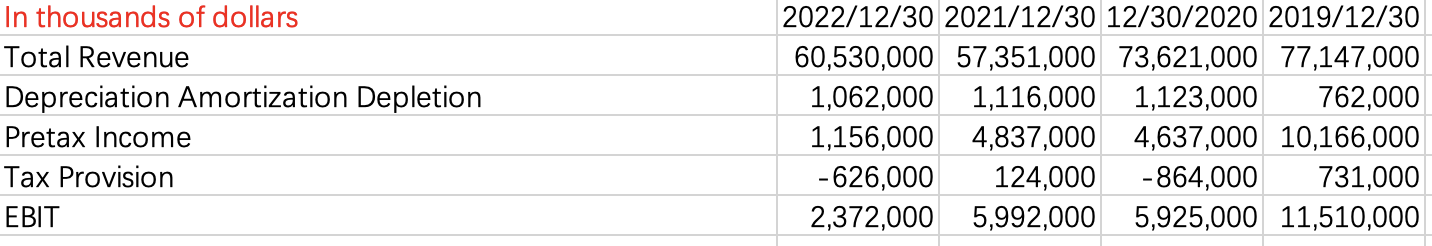

Income Statement

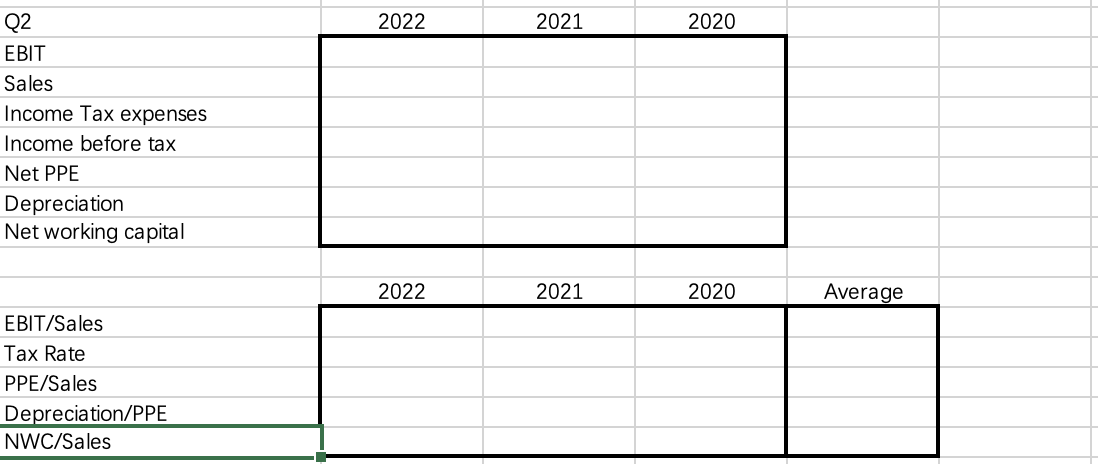

Q2 EBIT Sales Income Tax expenses Income before tax Net PPE Depreciation Net working capital EBIT/Sales Tax Rate PPE/Sales Depreciation/PPE NWC/Sales 2022 2022 2021 2021 2020 2020 Average

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the stock price using the dividend discount model DDM we need to determine the present value of expected dividends and the stock price at ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started