Question

You observe 3 securities currently available in the market. These securities behave very similarly to the savings bond discussed in class. In exchange for the

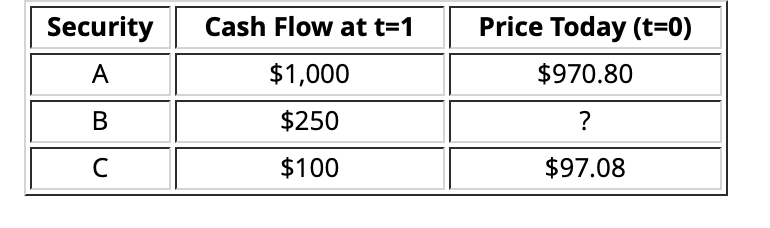

You observe 3 securities currently available in the market. These securities behave very similarly to the savings bond discussed in class. In exchange for the price of the security today, it promises to pay its face value to the holder of the security at maturity. Each of these securities has a maturity date one year from today. Security A promises to pay $1,000 in one year. Security B promises to pay $250 in one year. Security C promises to pay $100 in one year. The prices of these securities are shown below.

What is the Zero-Arbitrage Price of Security B? In other words, at what price must Security B be available such that no arbitrage opportunities exist? (do not place any extra symbols, such as $, in your response)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started