Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You observe the following exchange rates and interest rates: Spot rate = $0.67/NZS, one-year forward exchange rate = $0.64/NZS, one-year interest in the United States

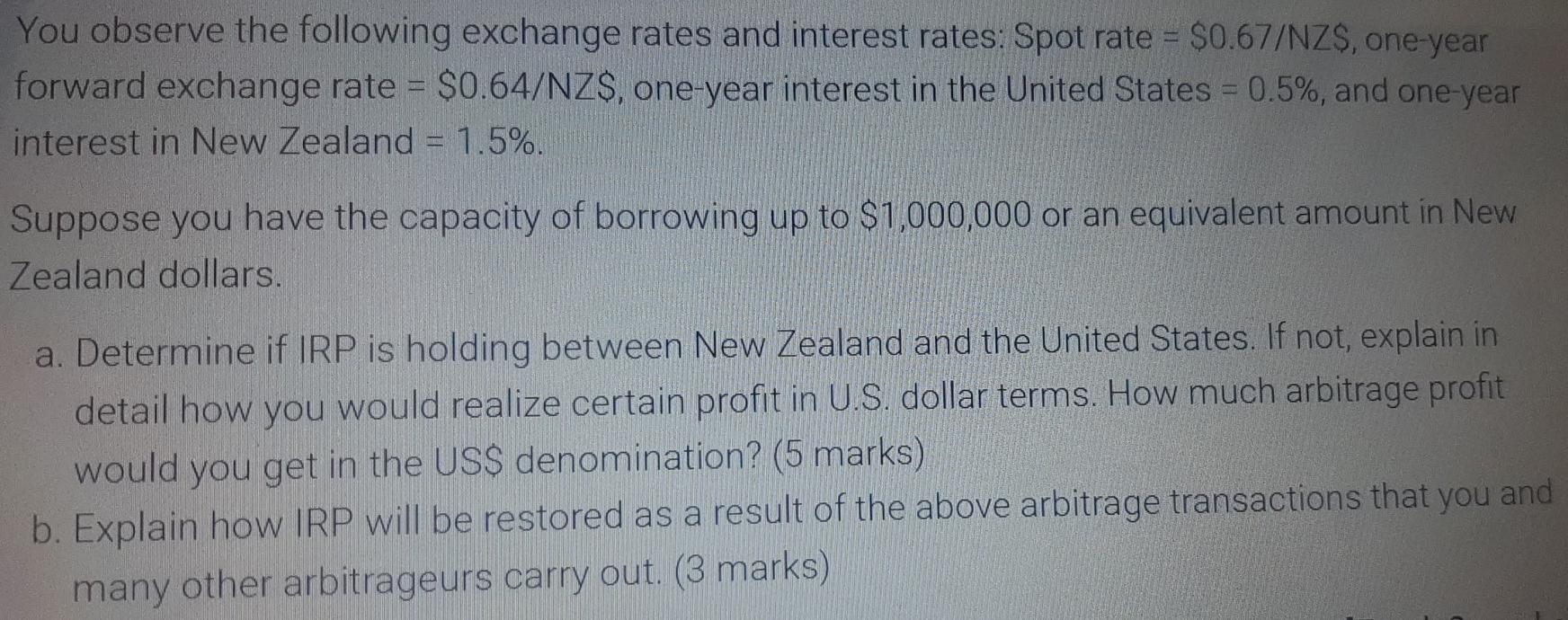

You observe the following exchange rates and interest rates: Spot rate = $0.67/NZS, one-year forward exchange rate = $0.64/NZS, one-year interest in the United States = 0.5%, and one-year interest in New Zealand = 1.5%. Suppose you have the capacity of borrowing up to $1,000,000 or an equivalent amount in New Zealand dollars. a. Determine if IRP is holding between New Zealand and the United States. If not, explain in detail how you would realize certain profit in U.S. dollar terms. How much arbitrage profit would you get in the US$ denomination? (5 marks) b. Explain how IRP will be restored as a result of the above arbitrage transactions that you and many other arbitrageurs carry out

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started