Answered step by step

Verified Expert Solution

Question

1 Approved Answer

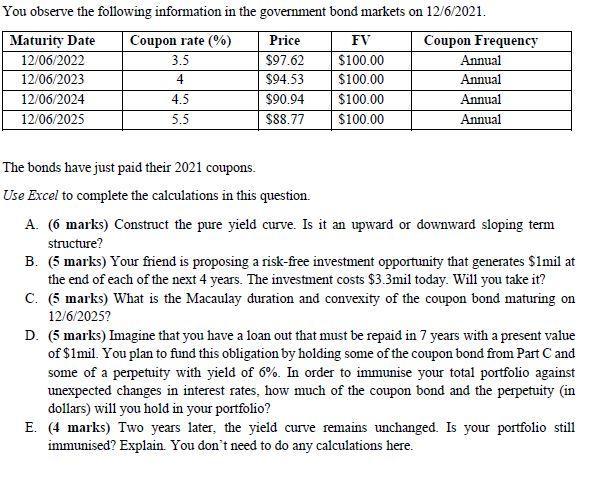

You observe the following information in the government bond markets on 12/6/2021. Maturity Date Coupon rate (%) 3.5 Price FV Coupon Frequency $100.00 S100.00

You observe the following information in the government bond markets on 12/6/2021. Maturity Date Coupon rate (%) 3.5 Price FV Coupon Frequency $100.00 S100.00 $100.00 12/06/2022 $97.62 Annual 12/06/2023 4 $94.53 Annual 12/06/2024 12/06/2025 4.5 $90.94 Annual 5.5 $8.77 $100.00 Annual The bonds have just paid their 2021 coupons. Use Excel to complete the calculations in this question. A. (6 marks) Construct the pure yield curve. Is it an upward or downward sloping term structure? B. (5 marks) Your friend is proposing a risk-free investment opportunity that generates $1mil at the end of each of the next 4 years. The investment costs $3.3mil today. Will you take it? C. (5 marks) What is the Macaulay uration and convexity of the coupon bond maturing on 12/6/2025? D. (5 marks) Imagine that you have a loan out that must be repaid in 7 years with a present value of $1mil. You plan to fund this obligation by holding some of the coupon bond from Part C and some of a perpetuity with yield of 6%. In order to immunise your total portfolio against unexpected changes in interest rates, how much of the coupon bond and the perpetuity (in dollars) will you hold in your portfolio? E. (4 marks) Two years later, the yield curve remains unchanged. Is your portfolio still immunised? Explain. You don't need to do any calculations here.

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answer A Maturity Date Coupon Rate Price FV Coupon Frequency YTM curve 120622 35 9762 10000 Annual 6...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started