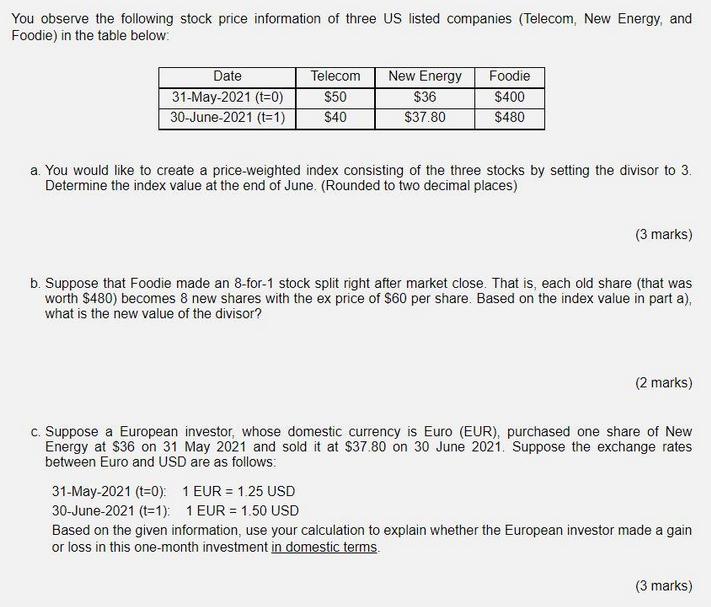

You observe the following stock price information of three US listed companies (Telecom, New Energy, and Foodie) in the table below: Date 31-May-2021 (t=0)

You observe the following stock price information of three US listed companies (Telecom, New Energy, and Foodie) in the table below: Date 31-May-2021 (t=0) 30-June-2021 (t=1) Telecom New Energy Foodie $50 $36 $400 $40 $37.80 $480 a. You would like to create a price-weighted index consisting of the three stocks by setting the divisor to 3. Determine the index value at the end of June. (Rounded to two decimal places) (3 marks) b. Suppose that Foodie made an 8-for-1 stock split right after market close. That is, each old share (that was worth $480) becomes 8 new shares with the ex price of $60 per share. Based on the index value in part a), what is the new value of the divisor? (2 marks) c. Suppose a European investor, whose domestic currency is Euro (EUR), purchased one share of New Energy at $36 on 31 May 2021 and sold it at $37.80 on 30 June 2021. Suppose the exchange rates between Euro and USD are as follows: 31-May-2021 (t=0): 1 EUR = 1.25 USD 30-June-2021 (t=1): 1 EUR = 1.50 USD Based on the given information, use your calculation to explain whether the European investor made a gain or loss in this one-month investment in domestic terms. (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Solution a PriceWeighted Index Value t1 Calculate the weight of each stock Telecom weight 480 Total ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started