Answered step by step

Verified Expert Solution

Question

1 Approved Answer

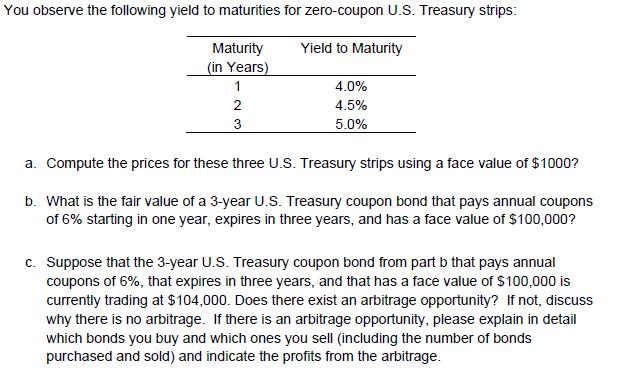

You observe the following yield to maturities for zero-coupon U.S. Treasury strips: Yield to Maturity Maturity (in Years) 1 2 3 4.0% 4.5% 5.0%

You observe the following yield to maturities for zero-coupon U.S. Treasury strips: Yield to Maturity Maturity (in Years) 1 2 3 4.0% 4.5% 5.0% a. Compute the prices for these three U.S. Treasury strips using a face value of $1000? b. What is the fair value of a 3-year U.S. Treasury coupon bond that pays annual coupons of 6% starting in one year, expires in three years, and has a face value of $100,000? c. Suppose that the 3-year U.S. Treasury coupon bond from part b that pays annual coupons of 6%, that expires in three years, and that has a face value of $100,000 is currently trading at $104,000. Does there exist an arbitrage opportunity? If not, discuss why there is no arbitrage. If there is an arbitrage opportunity, please explain in detail which bonds you buy and which ones you sell (including the number of bonds purchased and sold) and indicate the profits from the arbitrage.

Step by Step Solution

★★★★★

3.34 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To compute the prices for the US Treasury strips with different maturities we can use the formula for calculating the present value of a single cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started