Answered step by step

Verified Expert Solution

Question

1 Approved Answer

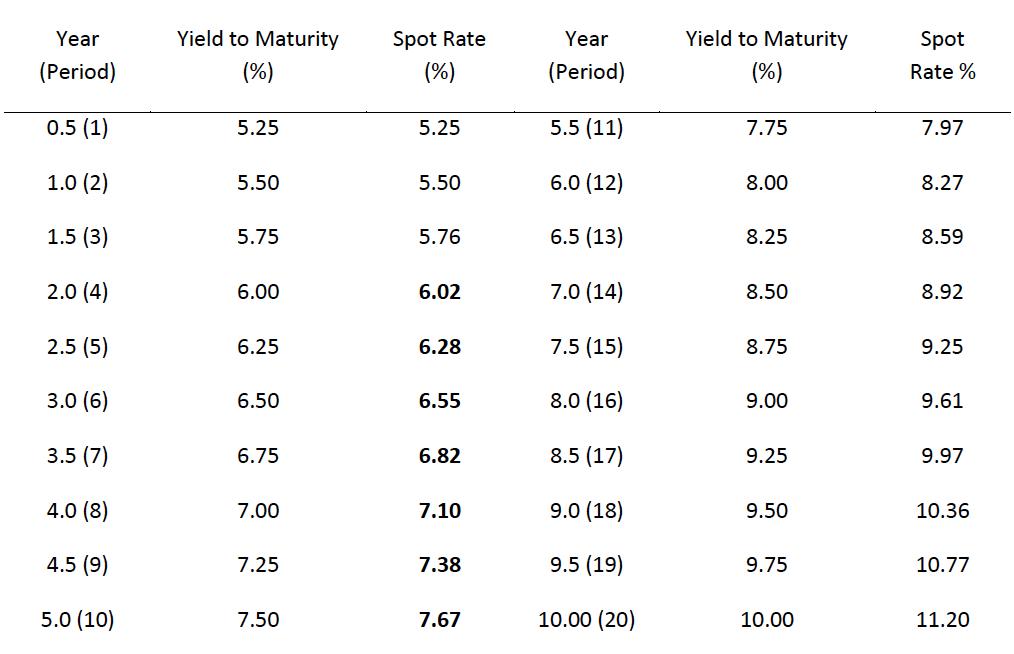

You observe the yields of the following Treasury securities at below (all yields are shown on a bond-equivalent basis). All the securities maturing from 1.5

You observe the yields of the following Treasury securities at below (all yields are shown on a bond-equivalent basis). All the securities maturing from 1.5 years on are selling at par. The 0.5 and 1.0-year securities are zero-coupon instruments.

(a) What should the price of a 6% 5.5-year Treasury security be?

(b) What is the six-month forward rate starting in the seventh year?

Year (Period) 0.5 (1) 1.0 (2) 1.5 (3) 2.0 (4) 2.5 (5) 3.0 (6) 3.5 (7) 4.0 (8) 4.5 (9) 5.0 (10) Yield to Maturity (%) 5.25 5.50 5.75 6.00 6.25 6.50 6.75 7.00 7.25 7.50 Spot Rate (%) 5.25 5.50 5.76 6.02 6.28 6.55 6.82 7.10 7.38 7.67 Year (Period) 5.5 (11) 6.0 (12) 6.5 (13) 7.0 (14) 7.5 (15) 8.0 (16) 8.5 (17) 9.0 (18) 9.5 (19) 10.00 (20) Yield to Maturity (%) 7.75 8.00 8.25 8.50 8.75 9.00 9.25 9.50 9.75 10.00 Spot Rate % 7.97 8.27 8.59 8.92 9.25 9.61 9.97 10.36 10.77 11.20

Step by Step Solution

★★★★★

3.43 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the price of a 6 55year Treasury security we need to discount the semiannual coupons ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started