Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You observed the forward price in the market is 28000 for a contract with 1 year to maturity. The 1-year risk-free interest rate is

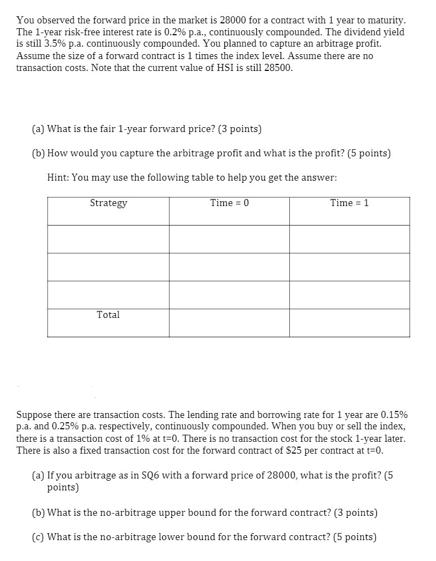

You observed the forward price in the market is 28000 for a contract with 1 year to maturity. The 1-year risk-free interest rate is 0.2% p.a., continuously compounded. The dividend yield is still 3.5% p.a. continuously compounded. You planned to capture an arbitrage profit. Assume the size of a forward contract is 1 times the index level. Assume there are no transaction costs. Note that the current value of HSI is still 28500. (a) What is the fair 1-year forward price? (3 points) (b) How would you capture the arbitrage profit and what is the profit? (5 points) Hint: You may use the following table to help you get the answer: Strategy Time 0 Total Time 1 Suppose there are transaction costs. The lending rate and borrowing rate for 1 year are 0.15% p.a. and 0.25% p.a. respectively, continuously compounded. When you buy or sell the index, there is a transaction cost of 1% at t-0. There is no transaction cost for the stock 1-year later. There is also a fixed transaction cost for the forward contract of $25 per contract at t=0. (a) If you arbitrage as in SQ6 with a forward price of 28000, what is the profit? (5 points) (b) What is the no-arbitrage upper bound for the forward contract? (3 points) (c) What is the no-arbitrage lower bound for the forward contract? (5 points)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Answer So the fair 1year forward price is 2757750 To capture the arbitrage profit we can use the fol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started