Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You own a bond with a face value of $10 000. The bond offers a coupon rate of 4% payable annually, and the bond matures

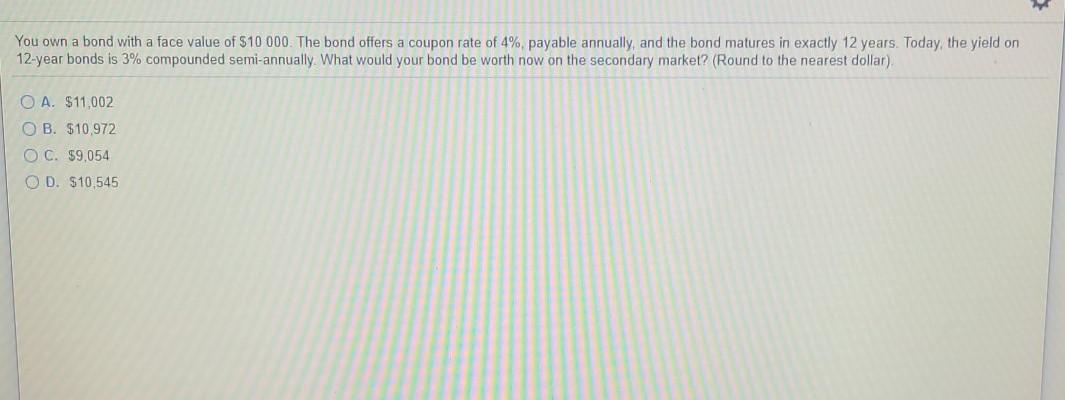

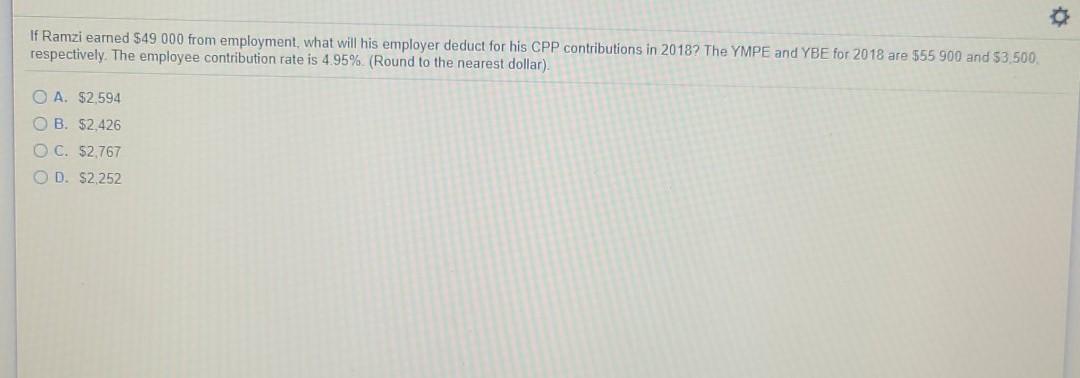

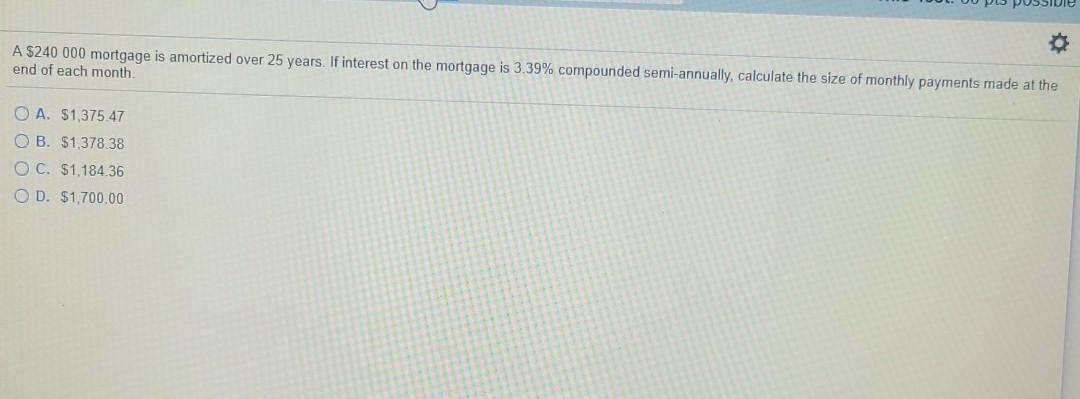

You own a bond with a face value of $10 000. The bond offers a coupon rate of 4% payable annually, and the bond matures in exactly 12 years. Today, the yield on 12-year bonds is 3% compounded semi-annually. What would your bond be worth now on the secondary market? (Round to the nearest dollar). O A. $11,002 OB. $10,972 O C. $9.054 OD. $10 545 If Ramzi earned $49 000 from employment, what will his employer deduct for his CPP contributions in 2018? The YMPE and YBE for 2018 are 555 900 and 53,500. respectively. The employee contribution rate is 4.95% (Round to the nearest dollar). OA. $2,594 OB. $2,426 C. $2,767 OD. $2,252 A $240 000 mortgage is amortized over 25 years. If interest on the mortgage is 3.39% compounded semi-annually, calculate the size of monthly payments made at the end of each month O A. $1,375.47 OB. $1,378.38 OC. $1,184.36 OD. $1,700.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started