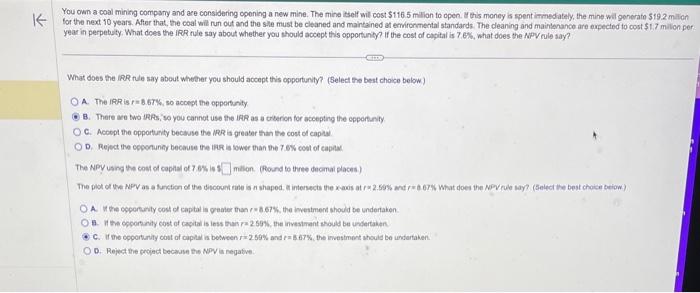

You own a coal mining compsmy and ace considering coening a new mine. The mine itself will cost 5116.5mili ion to open. y this money is spent immedately, the mine wil generato 519.2millon for the next 10 years. After that, the coal will run out and the sle must be cleaned and maintained at ervironmental standards. The deaning and mainlenance are expected to cost \$1.7 milon per year in perpebyty. What does the IRR rule say about whether you thould accept this opportunty? if the cost of coppital is 7,6%, what does the NpVrule say? What does the iRR tule say abeut whether you should accept this opporturify? (Select the best choice below) A. The IRR is r=8.6T$, so acoept the opperfanity B. There ace two IRRs, so you cannet use the IRR as a creerion for accepting the oppertinty C. Acoept the opportunity becasse the MRR is greater than the cost of capial. The NPY using the cost of ceptal of 7.6% is 1 milion. (foosd to three demal places) A. It the coperturity cost of captal is grater than r=8 ber h. the ivestment should be undertaken. a. It the opponsiny cost of capitai is iess basi r=259%, the invesimant should be undertaiden. D. Reject the croject because the Nov ia negative. You own a coal mining compsmy and ace considering coening a new mine. The mine itself will cost 5116.5mili ion to open. y this money is spent immedately, the mine wil generato 519.2millon for the next 10 years. After that, the coal will run out and the sle must be cleaned and maintained at ervironmental standards. The deaning and mainlenance are expected to cost \$1.7 milon per year in perpebyty. What does the IRR rule say about whether you thould accept this opportunty? if the cost of coppital is 7,6%, what does the NpVrule say? What does the iRR tule say abeut whether you should accept this opporturify? (Select the best choice below) A. The IRR is r=8.6T$, so acoept the opperfanity B. There ace two IRRs, so you cannet use the IRR as a creerion for accepting the oppertinty C. Acoept the opportunity becasse the MRR is greater than the cost of capial. The NPY using the cost of ceptal of 7.6% is 1 milion. (foosd to three demal places) A. It the coperturity cost of captal is grater than r=8 ber h. the ivestment should be undertaken. a. It the opponsiny cost of capitai is iess basi r=259%, the invesimant should be undertaiden. D. Reject the croject because the Nov ia negative