Question

You own a copper mine. The price of copper is currently $1.50 per pound. The mine produces 1 million pounds of copper per year and

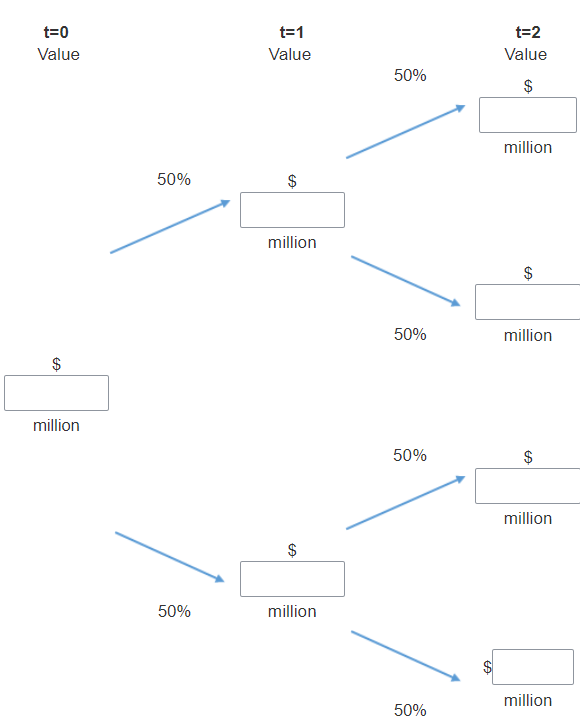

You own a copper mine. The price of copper is currently $1.50 per pound. The mine produces 1 million pounds of copper per year and costs $2 million per year to operate. It has enough copper to operate for 100 years. Shutting the mine down would entail bringing the land up to EPA standards and is expected to cost $5 million. You have the option to shut down the mine for two years. If you decide to continue to operate, after 100 years you will shut down the mine. Reopening the mine once it is shut down would be an impossibility given current environmental standards. The price of copper has an equal (and independent) probability of going up or down by 25% each year for the next two years and then will stay at that level forever. Assume the cost of capital is fixed at 15.5%. Calculate the value of the mine for years 0,1, and 2 under different scenarios for the copper price (Hint: In any scenario, if the value is smaller than the cost of shutting down, you decide to shut down and not to bear higher losses). Fill in the missing fields in the following table. For this question, first, calculate all parts without rounding the solutions. Then, when inserting your solutions in the fields, round to two decimals. Also, use a dot as the decimal separator. If you have a negative value, also include the minus sign. If there is a million, express your answer in million (for example, insert 1.52 instead of 1 520 000).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started