Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You own a fleet of offshore fishing boats and you need to determine how many fishing poles you need to buy to maximize profits.

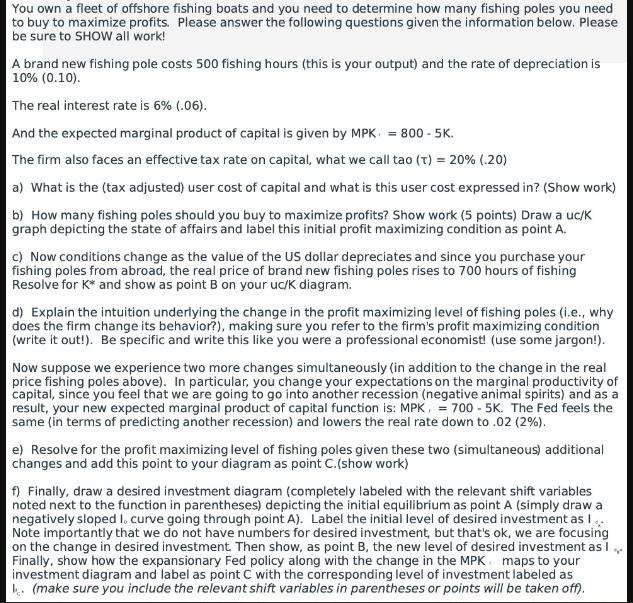

You own a fleet of offshore fishing boats and you need to determine how many fishing poles you need to buy to maximize profits. Please answer the following questions given the information below. Please be sure to SHOW all work! A brand new fishing pole costs 500 fishing hours (this is your output) and the rate of depreciation is 10% (0.10). The real interest rate is 6% (.06). And the expected marginal product of capital is given by MPK = 800 - 5K. The firm also faces an effective tax rate on capital, what we call tao (t) = 20% (.20) a) What is the (tax adjusted) user cost of capital and what is this user cost expressed in? (Show work) b) How many fishing poles should you buy to maximize profits? Show work (5 points) Draw a uc/K graph depicting the state of affairs and label this initial profit maximizing condition as point A. c) Now conditions change as the value of the US dollar depreciates and since you purchase your fishing poles from abroad, the real price of brand new fishing poles rises to 700 hours of fishing Resolve for K* and show as point B on your uc/k diagram. d) Explain the intuition underlying the change in the profit maximizing level of fishing poles (i.e., why does the firm change its behavior?), making sure you refer to the firm's profit maximizing condition (write it out!). Be specific and write this like you were a professional economist! (use some jargon!). Now suppose we experience two more changes simultaneously (in addition to the change in the real price fishing poles above). In particular, you change your expectations on the marginal productivity of capital, since you feel that we are going to go into another recession (negative animal spirits) and as a result, your new expected marginal product of capital function is: MPK, = 700 - 5K. The Fed feels the same (in terms of predicting another recession) and lowers the real rate down to .02 (2%). e) Resolve for the profit maximizing level of fishing poles given these two (simultaneous) additional changes and add this point to your diagram as point C.(show work) f) Finally, draw a desired investment diagram (completely labeled with the relevant shift variables noted next to the function in parentheses) depicting the initial equilibrium as point A (simply draw a negatively sloped I. curve going through point A). Label the initial level of desired investment as I Note importantly that we do not have numbers for desired investment, but that's ok, we are focusing on the change in desired investment. Then show, as point B, the new level of desired investment as I Finally, show how the expansionary Fed policy along with the change in the MPK maps to your investment diagram and label as point C with the corresponding level of investment labeled as (make sure you include the relevant shift variables in parentheses or points will be taken off). V

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the taxadjusted user cost of capital we need to first calculate the user cost of capital using the formula User Cost of Capital 06 MPK ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started