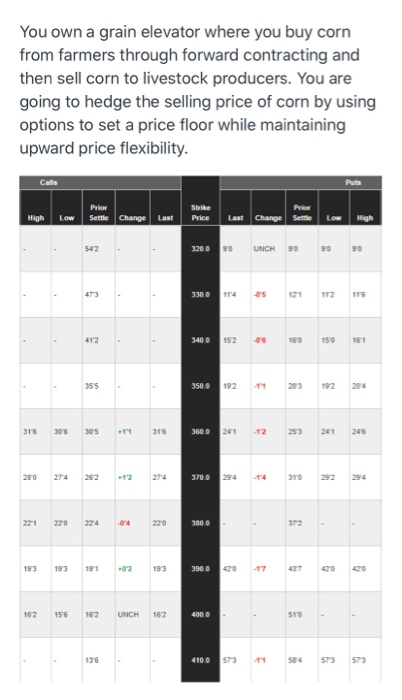

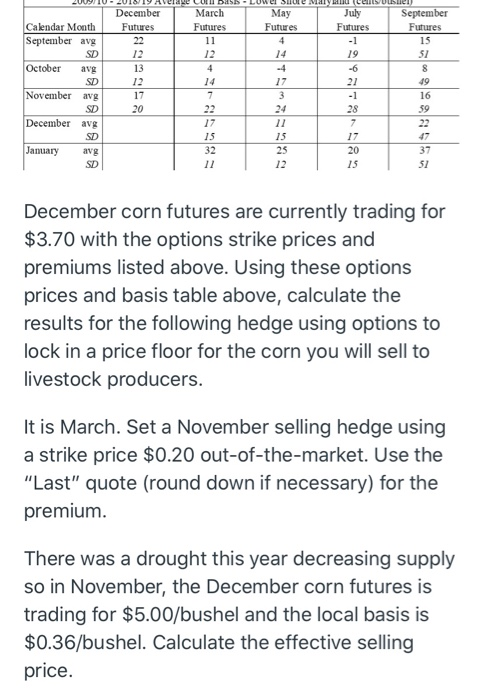

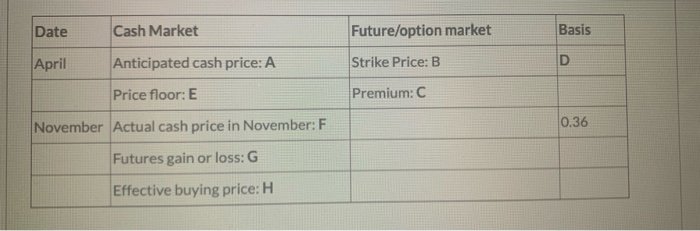

You own a grain elevator where you buy corn from farmers through forward contracting and then sell corn to livestock producers. You are going to hedge the selling price of corn by using options to set a price floor while maintaining upward price flexibility. Last Change Seite 32000 UNCH 9 0 330071128 340.0 152 8015084 350.0 19214203192204 376 306 30 7 378 360.0 241 12 253 241 246 280 274 282 -12274 370.0 24143 222 224 12 158 12 UNCH 152 4000 - - - 410. 0 573 -14 584 573 573 July September Futures SUURUSU LOWEEN UUDb-LUMCI SLUCILIU ICS December March May Calendar Month Futures Futures Futures Futures September avg SD October avg November December avg January December corn futures are currently trading for $3.70 with the options strike prices and premiums listed above. Using these options prices and basis table above, calculate the results for the following hedge using options to lock in a price floor for the corn you will sell to livestock producers. It is March. Set a November selling hedge using a strike price $0.20 out-of-the-market. Use the "Last" quote (round down if necessary) for the premium. There was a drought this year decreasing supply so in November, the December corn futures is trading for $5.00/bushel and the local basis is $0.36/bushel. Calculate the effective selling price. Date Cash Market Basis April Anticipated cash price: A Future/option market Strike Price: B Premium: C 0.36 Price floor: E November Actual cash price in November: F Futures gain or loss: G Effective buying price: H You own a grain elevator where you buy corn from farmers through forward contracting and then sell corn to livestock producers. You are going to hedge the selling price of corn by using options to set a price floor while maintaining upward price flexibility. Last Change Seite 32000 UNCH 9 0 330071128 340.0 152 8015084 350.0 19214203192204 376 306 30 7 378 360.0 241 12 253 241 246 280 274 282 -12274 370.0 24143 222 224 12 158 12 UNCH 152 4000 - - - 410. 0 573 -14 584 573 573 July September Futures SUURUSU LOWEEN UUDb-LUMCI SLUCILIU ICS December March May Calendar Month Futures Futures Futures Futures September avg SD October avg November December avg January December corn futures are currently trading for $3.70 with the options strike prices and premiums listed above. Using these options prices and basis table above, calculate the results for the following hedge using options to lock in a price floor for the corn you will sell to livestock producers. It is March. Set a November selling hedge using a strike price $0.20 out-of-the-market. Use the "Last" quote (round down if necessary) for the premium. There was a drought this year decreasing supply so in November, the December corn futures is trading for $5.00/bushel and the local basis is $0.36/bushel. Calculate the effective selling price. Date Cash Market Basis April Anticipated cash price: A Future/option market Strike Price: B Premium: C 0.36 Price floor: E November Actual cash price in November: F Futures gain or loss: G Effective buying price: H